Russ Hawkins, CEO of Agilence, isn’t a founder. He’s a serial first outside hire—a role he’s embraced at a trio of companies. His track record earned him his pick of three companies from a portfolio before choosing Agilence, where he’s been for the past 15 years. Agilence helps improve margins by reducing preventable loss across grocers, restaurant operators, and retailers. In Hawkins’ conversation with the GetLatka team, the CEO shared the highlights of his journey. Read on to discover what one decision in 2008 changed the trajectory of the business, how he’s managed debt providers as a funding option, and why he’s disappointed in last year’s exit.

- Team of 70 with 28 engineers and 5 quota-carrying salespeople with $1m ARR quotas

- 300 customers with $125,000 ACV

- $35m ARR

- Founded in 2006 as hardware installation, fully pivoted to SaaS in 2013

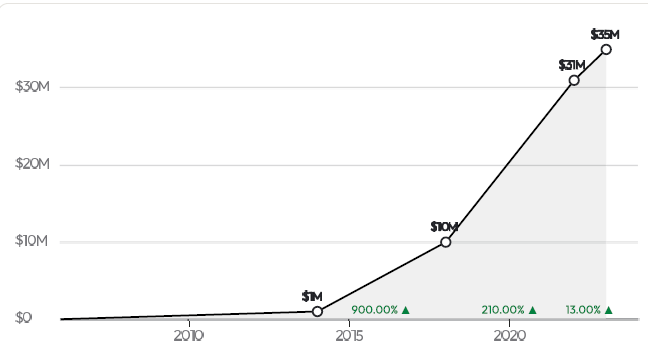

2006 hardware-oriented business pivots to recurring revenue model in 2008, pure SaaS in 2013

“I came in in 2008 and changed to a recurring revenue model. The value was in the software, but it was delivered in a piece of hardware as we put servers out in each grocery store,” explained Hawkins. He added, “In 2013, we made a major pivot to a strictly data analytics SaaS company. We thought we could do a better job than ‘exception-based reporting,’ which was being done at the time at many large retailers. We were right, and now we’ve proven that.”

MVP in 2013 focused on loss prevention, now only 20% of use cases

According to the CEO, “We came out with a SaaS MVP in 2013. Originally, use cases were all around loss prevention,” Hawkins added, “We’ve evolved pretty significantly since then. Now 80% of my customers use it for operational analytics, merchandising, marketing, and even finance.”

The CEO summarized, “Today, it’s all about data management. We pull together the data exhaust from all these systems to create value or give the users the ability to create value out of all that data.”

$125,000 ACV from 300 customers

Although the ACV varies significantly, Hawkins estimates that the ACV for a typical customer sits at $125,000. “It depends on the size, plus there’s a difference between grocers, restaurants, and retailers,” the CEO clarified. Agilence currently boasts nearly 300 customers across 3 business verticals in the US and Canada.

“We have avoided, for now, bringing the platform outside the US and Canada. I’ve done it before, and you need a lot of energy and patience to make that work,” revealed Hawkins.

3 customers close to $1m ARR, will surpass through acquisition add-ons

Hawkins revealed that Agilence has three customers nearing $1m in ARR. He believes each will surpass that threshold next year once the company integrates potential expansion products. The CEO shared that their PE acquisition 18 months ago enabled him to explore acquisition targets to fuel inorganic growth.

Latka then gushed about million-dollar customers as one of his favorite metrics: “I love to read all the S1s from the SaaS companies going public. I go down to the customer section buried on page 60 to see exactly how many $1m+ customers they have.”

17.3% YoY growth to $35m ARR with a team of 70

Capital-efficient Agilence currently does $35m in ARR with a team of 70, 28 of which are engineers. The sales organization is comprised of a group of 10, including 5 quota-carrying salespeople, BDRs, and technical leads. “Originally, we were focused on mid-market. Then, we worked our way up to support larger companies. We learned a lot along the way and are now considered the leader in this space today.”

$1m quotas, segmented targeting

The CEO revealed that the salespeople carry a quota of around $1m. Hawkins explained to Latka, “Territories are account-assigned. Our sales team spends its energy with the largest accounts while the marketing team works to have mid-level prospects self-identify.”

He added that Agilence segments their customers and prospects by categories within categories, “The use cases vary. For us, restaurants are a mix of quick service and table service. On the retail side, segmentation is around grocery, specialty, drug stores, and convenience stores.”

$30m in total equity raised, $5m debt

When asked about their funding history, Hawkins quipped, “We started out with VC funding. Then, we sold the company 18 months ago to Private Equity. I consider that a graduation from the venture world to the capital world.”

He explained that they raised several rounds of VC and put in debt as they went along. The total debt varied as they paid it off and paid it down as they went along, but Hawkins estimated that they had maybe $5m in debt at the height plus $30m total equity raised.

Cap table management strategies, 60:40 equity-to-debt ratio for Agilence

Latka queried Hawkins on how he keeps control of the cap table between the funding, ESOP, founders, etc. The CEO responded, “I’ve always been very conservative. I don’t like to get ahead of my skis even though I’m chasing growth. I try to keep a balance. I never want to be in a desperate situation where I have to raise money, so we take a methodical method. We raise money before we need it on an incremental basis.”

He further admitted, “I’ve made mistakes. Lately, we have had more debt. We are leveraged up with debt because that’s part of the PE playbook, so the equity-to-debt ratio is 60:40 today.”

Debt deals revealed

“How do debt deals work? Many founders don’t even know debt is an option,” asked Latka. CEO Hawkins first reminisced, “I pitched AKKR and did the Silicon Valley Road shuffle. When AKKR decided to enter the debt business, I might have been the first deal they did.”

As for the typical deals, he replied, “They’ve changed over time; there’s a wide census of debt providers from banks to private debt providers,” he started, adding, “Early on, we got hefty rates in low teens and a bit of equity 1-3%. But as revenue became more predictable, we were able to do better on interest rates. Now we have a bank as the lead debt provider, and they subordinate it to the historical debt financing companies.”

He added that Cuadrilla Capital set up their financing with PNC Bank and Hercules, sharing, “They’re very good at that.”

Sale forced by investor, at a disappointing sub-5X multiple

“I didn’t think last year was the right time to sell. We sold because the investors and the business owners decided they wanted to do it for their own reasons, which is a problem,” the straight-shooting Hawkins revealed.

He added, “It’s a problem with the multiple venture investors that have conflicting objectives within their own funds. I think we sold the company short. We sold sub-5X, and I think we should have gotten more like 8X. The early investors, Next Stage and Granite, were patient, good, and supportive. Subsequent rounds brought in additional voices with different perspectives. Arrowroot, the last one to join, was the one who wanted to move more quickly in terms of an exit.”

He concluded, “I misinterpreted what they were and what their hold period was. All I know is they forced our hand, and it’s not what we wanted to do.”

Cuadrilla Capital supporting inorganic acquisitions to continue growth past $35m ARR

Hawkins has provided Cuadrilla with a strategic roadmap of acquisitions, and they are working out the outreach, details, and financing.

The CEO is exploring adjacent technologies, sharing, “We are all about data analytics in the retail space, especially enterprise customers. I’m very interested in incident management, task management, frontline and human capital management in retail environments. We do some good things around ecom, but I’d like to do more in real time. We have some good forensics that can tell you what happened until yesterday.”

The CEO continued, “We are also interested in supply chain management, restaurant add-on tech, and picking up competitors that can give us a foothold in other geographies.”

Famous 5

Favorite Book: CEO Russ Hawkings chose the Pulitzer Prize-winning novel A Confederacy of Dunces by John Kennedy Toole as his favorite book.

CEO he’s following: “None,” replied Hawkings.

Favorite online tool: Hawkings said he had quite a few tools he was not happy with but named Salesforce as his tool of choice. He explained, “It’s our CRM, and we get a lot of value out of it.”

Balance: Hawkings said he sleeps a short 5 hours per night, adding that the time is interrupted by a bathroom break. The 64-year-old is married with 4 children and now has his first grandchild.

What does he wish he had known at 20? “I wish I had known how important the decisions you are making every day are,” shared Hawkings.