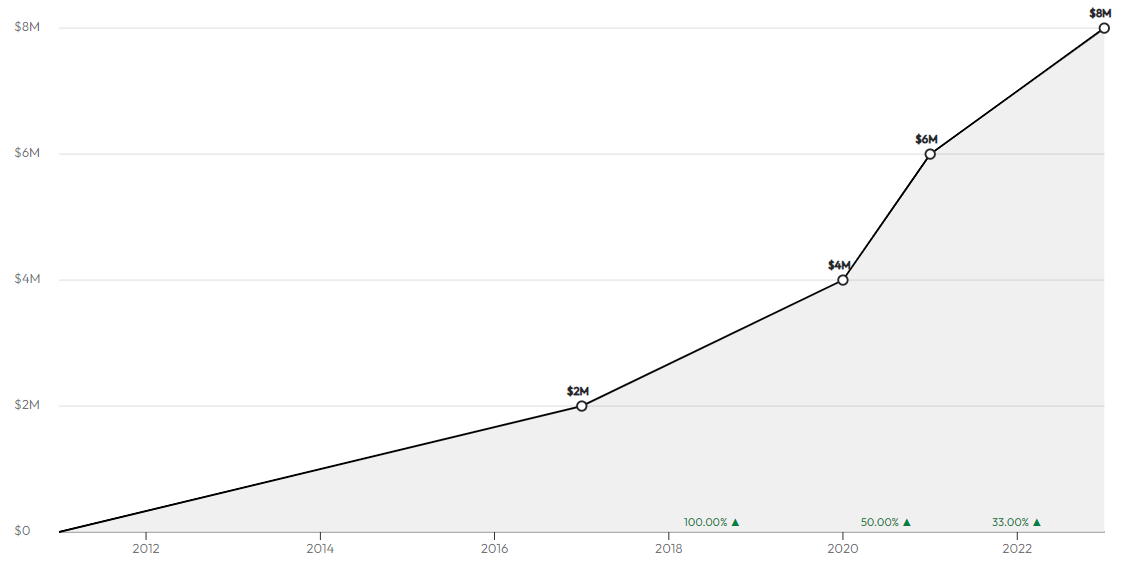

Sometimes, a surprising strategy works wonders, and for some businesses, less might bring in more. Let’s delve into such an exciting journey, where losing customers became a stepping stone for achieving greater heights. Here is an interesting journey of an SAAS company, which pulled in a revenue of $8m over the past year, despite losing customers and successfully managed to double its ARPU.

The company had an impressive run since 2018 with a $2 million primary and 500k in secondary. They also underwent a topping-off in 2020 when crucial changes were adopted. The journey unfolds further.

Regaining Valuation: A Fresh Perspective

When we think of business growth, more customers typically come to mind. However, sales gamification SaaS, SalesScreen, proves otherwise. Its founder, Sindre Holland, has been leading the company to new heights by decreasing customer count and doubling average revenue per user (ARPU).

Launching SalesScreen in 2011 when he was only 22 years old, the Norway-based entrepreneur has a master’s degree in Industrial Economy and Technology, with a specialization in Computer Science from the Norwegian University of Science and Technology. Sindre has since expanded, dividing his time between Europe and the US, constantly driving the growth of his business venture, SalesScreen.

Sales Screen’s Approach

SalesScreen harnesses the power of gamification to keep sales reps engaged in their tasks. As a result, businesses can break down their given target into actions that can be influenced by the individual, encouraging them to perform more of the activities that lead to building a prosperous pipeline.

SalesScreen’s customers typically come from high-transaction B2C sectors such as insurance and real estate. These clients utilize the platform to motivate their sales team and are paying per seat for the service. Among their clients are notable names like SAP, Seismic, and IED. The average customer payment per month, as of the current reporting, is around $2,500, a figure that has conveniently doubled since late 2021.

Fundraising and Pandemic Resilience

Despite the adverse pandemic circumstances, the company managed to raise funds in the form of small bridge capital, intended to keep the business operational and profitable within the next 12 months. However, the primary capital raise which also included some secondary capital fell short due in part to the unpredictable market conditions brought about by the pandemic.

Capitalizing on its recurring revenue and its predictability, SalesScreen chose to secure a credit line, providing a cushion for the business and a more extended runway for future fundraising. An interest rate of seven percent was applied to the credit drawn from this line.

The company earlier was serving 400 customers, but currently, it serves around 350. But the actual highlight is that it has managed to double its ARPU in the process enhancing the overall annual revenue. Because of fluctuations with currency, particularly the US dollar, the revenue took a minor hit, but last reported remains impressive at around $8 million.

Future Plans

As the business stands today, it is not keen on actively raising more capital, but it remains open to prospects at the right price. The focus remains on efficiencies and consolidating the existing user base while focusing on the ones that will propel higher ARPU.

Not without its fair share of challenges and learning experiences, SalesScreen’s strategy is unique. With the belief that losing customers and focusing on those that are left is a part of business realities, SalesScreen has proven how to succeed in transforming obstacles into opportunities.

To improve its product and services further, the team is working on simplifying its product and enhancing visibility and value for its clients. Sales Screen is also investing in a new product-led growth (PLG) motion to further reduce customer acquisition cost.

Famous 5

CEO he’s following: none

Favorite online tool: Visual Studio

Balance: Sindre manages to get around six hours of sleep, despite having two young children.

What does he wish he had known at 20? Sindre emphasizes the importance of a tightly defined Ideal Customer Profile (ICP) for any business.