Where do you start with a 6X founder who launched a SaaS product in 1999 before the term existed and whose 2012 IPO exit at Bazaarvoice was described by Y Combinator as one of the top 5 most capital-efficient SaaS businesses of all time, with the second most generous ESOP pools of the year? The GetLatka team easily managed that tall order, conducting a lengthy interview (by Latka standards) with Brett Hurt, current Co-founder of data.world. The B2B SaaS B Corp is an enterprise data catalog for the modern data stack.

Aside from launching 6 companies over his career, data.world Co-Founder and CEO Hurt co-founded Hurt Family Investments, is a Henry Crown Fellow, and authored The Entrepreneur’s Essentials based on his esteemed entrepreneurial journey. In this interview, Hurt revealed why he left Coremetrics when he did to start Bazaarvoice, what he would have done differently at Coremetrics had he stayed, and why, after his journey from founder to successful IPO at Bazaarvoice, he’s even more excited about data.world.

- Founded in 2015

- Raised $50m before making $1 in revenue in 2018

- Team of 150, with 50 engineers

- 2.1m free users, 31,000 paid seats from just one client

First $1 in revenue in 2018 after data.world launches on “Slurpee Day” 2016

According to the capital-efficient CEO, data.world raised $50m before earning their first dollar of revenue in 2018. “We launched on July 11, 2016. It was (7/11’s) National Slurpee Day,” chuckled the Co-founder. Explaining the need for funding, the CEO noted, “data.world is a library for all your internal data assets,” adding, “We have over 90 integrations; the surface area of what we are doing is very wide and must be incredibly secure.” He further added that data.world sits atop everything from Snowflake, Databricks, and Oracle to Microsoft Power BI, Tableau, Looker, and Domo, to name a few.

Competing with on-prem solutions, 1000 product releases annually

Alation and Collibra, both on-premise solutions, are data. world’s biggest competitors. “They come out with a couple of releases a day. We come out with 2-3 product releases daily, or 1000 per year. That’s the pace of innovation,” quipped the Co-founder. Hurt likens the disruptive nature of data.world to his first SaaS, Coremetrics, adding, “We are becoming the world’s largest collaborative data community for datasets. We have a for-profit division focused on the data catalog industry.”

Raised over $132m for data.world to date, 50/50 with investors

According to Co-founder Hurt, data.world closely managed dilution while scaling. “We are currently about 50/50 investors vs. internal,” adding, “We did a $50m Series C round with Goldman Sachs in 2022; they put in $40m, and we were oversubscribed on the other $10m.” Hurt confirmed that they closed “after the crazing multiples, which is a huge blessing. Companies that raised at crushing 100x multiples are getting recapped. We’re not in that situation.” Although Latka pressed hard for a specific multiple, the tight-lipped CEO would only say, “It was way south of 100x.”

2.1M free users, the most deployed data tool of all time

Although Hurt refused to share specifics on the number of paid users, he revealed that data.world has 2.1m free users. “We offer a free utility to leverage open data sets and collaborate so people can contribute to the public body of knowledge about cancer, climate change, poverty, and all these important things. Then that part has trained the data catalog part of the business,” he explained. Hurt did reveal that one customer, one of the largest service firms in the world, has 85% of their employees using data.world. “They failed with Collibra and never got over 12 users. With us, they’re at 31,000 users,” he proudly shared. Customers pay for platform access plus users. He added that data.world has become the world’s largest collaborative data community for datasets.

B Corporation with a focus on culture

Hurt proudly proclaimed that data.world is one of the top 3 companies to work for in his market. And he proudly shared their position as a B Corp. “I know of 6 companies that moved to becoming a B corporation after we made that move. I think B corps are the next stage of capitalism. It’s capitalism 2.0,” raved the CEO.

Launched Coremetrics in 1999 as an original SaaS, raised $80m total

“When I was raising for Coremetrics in 1999, the term SaaS didn’t exist,” chuckled the CEO. “I got to see Mark Benioff present when Salesforce was 80 people; he spoke at Stanford about the end of software, and I thought he was brilliant,” the CEO reminisced. Hurt shared that their two competitors were multi-billion dollar on-prem software companies, “I’m going to be able to release software so much faster than them. They deployed in 12–18 months. You could deploy Coremetrics in weeks. The rest is history. Coremetrics blew past those companies and disrupted the industry.” He raised a total of $80m for Coremetrics.

Exited in 2005 to launch Bazaarvoice, Coremetrics sells “early” for $300m

“I got Coremetrics to the point where I knew it would be successful (after coming back from losing 97% of their customers in the dot com crash) at $30m ARR. The timing for Bazaarvoice was too compelling, and I wanted to move on to my next project.” Coremetrics sold to IBM for $300m in 2010. On that move, Hurt reflected, “I wish the CEO who took it forward didn’t sell it so early. It could’ve been an IPO just a couple of years later, but he and the board felt they got a compelling offer. They missed the hockey stick that was coming in SaaS a couple of years later, so the multiple wasn’t that great. The Co-founder lamented, “It really changed IBM. It became IBM’s core analytics stack, but it could’ve been so much more.”

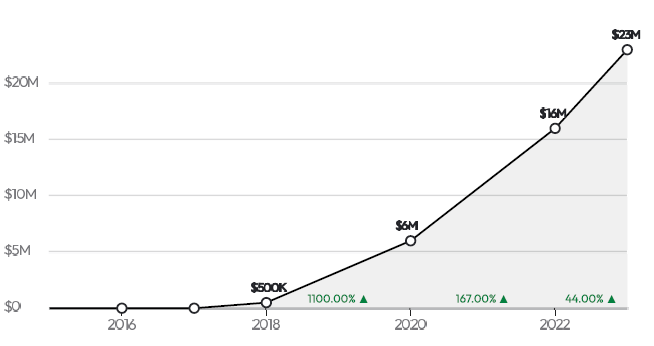

$23m total raised in 7 years at Bazaarvoice

Hurt launched Bazaarvoice in 2005, recalling, “I launched with my friend Brant Barton 2 years before the iPhone. There was this entire social wave that was about to come, and that really accelerated the business. Here we were, at the right time, right place.” The savvy Co-founder added, “Entrepreneurship is a lot of grit and a lot of luck. Anybody who says there’s no luck in it is absolutely wrong.” Before going public, the retail review SaaS raised a total of $23m.

Tough equity conversation ends in uneven split

Hurt revealed that the equity split was the most challenging conversation he had with his Co-founder, “There’s a lot of romance in starting a company together, but I would not do a 50/50 deal. I had a tremendous network and know-how. I negotiated with him and ended up with a much bigger equity stake, but Brant did incredibly well financially.

According to Hurt, “Brant was amazing on the client services team at Coremetrics. He led one of the most difficult parts of the SaaS model: ensuring you’re doing a great job serving your customers. I always say you have to constantly be re-earning their trust because it’s a recurring revenue business; you’ve got to stress that last ‘S’ of Software as a Service and make sure you’re providing great service.”

Successful IPO in 2012, spawns 60 new companies

As described by serial CEO Hurt, “By the time Bazaarvoice went public, we had only raised $23m, and we had over $100m run rate with $13m left in the bank in 2012. Y Combinator said it was one of the top 5 most capital-efficient SaaS businesses ever.”

The CEO added that their generous 20% ESOP pool led to over 60 companies being started by former Bazaarvoice people: “That’s how big of an exit it was and how much wealth it affected. I’m a capitalist, and that ripple effect capitalist impact is very real in terms of what happens with non-profits, with people starting their own businesses, the type of know-how they get to create great cultures.”

He added, “It was an incredible journey. We were rated the #1 company to work for in Austin when we were small, then medium, then large. Many of my book’s insights come from Bazaarvoice, and we’ve applied them at data.world.”

20,000 customers to date in 40 languages, offering customer reviews to retail partners

“Bazaarvoice was my 5th company. It was the best company outcome to date. But I think data.world is much more ambitious, and it’s incredibly exciting the path we’re on,” the CEO shared and continued, “Bazaarvoice popularized customer reviews all over the world. It brought VOC into websites like Walmart, The Home Depot, Best Buy, and many others. Today, they have over 20,000 customers in over 40 international languages. It’s run by a very good friend of mine, Keith Nealon. It’s an amazingly scaled company at this point.”

Taking a company to $100m

Over the years, culture and capital efficiency have been hallmarks of Hurt’s companies. When asked how you take a company to $100m, Hurt replied, “It’s all in my book. Build a sales team in a cap-efficient way. Structure, culture, hire, ultimate right business model—everything about it is in the book.’ He added, “All proceeds from the book go to supporting female entrepreneurs.”

Famous 5

Favorite Book: CEO and Co-founder Hurt chose Enlightenment Now by Stephen Pinker as his favorite book: “It’s so data-driven and optimistic for the future. It takes chapter by chapter issues you’re worried about like inequality or food or energy and shows you the no BS data to show the world progressing beautifully overall vs. the fearmongering that goes on out there pretty constantly,” he espoused.

CEO he’s following: Hurt admitted to being a Ross Buhrdorf fan, revealing, “We’re investors in his company, ZenBusiness. They recently closed a round at $1.7B and are disrupting Legal Zoom. It’s his first time in the CEO seat, and it’s been a joy to mentor him. He’s also a Proud B Corp.”

Favorite online tool: “It’s becoming GitHub Co-pilot because of the way it’s leveraging Open.AI’s codex. It is lifting our productivity on the engineering side, turning our engineers into superpowers,” he shared.

Balance: The 51-year-old sleeps 7–8 hours per night and has been married for 27 years with two kids. He added, “My wife is my investing partner as well. We’ve invested in over 130 startups over the past 12 years. We’re in 40 VC funds as well. We have our own family office.”

What does he wish he had known at 20? “I took this path of being an entrepreneur. I graduated from Wharton. Growing wealth took a long time, so my wife and I waited until we were 32 to have kids. I would have gotten started earlier, all things considered. I would have said to believe in yourself more. Believe in your ability to become successful; don’t worry about the financial security with kids. You will figure it out,” Hurt wistfully lamented.