After serving as an investor, board member, advisor, and political strategist in the GovTech space, Rachel Stern decided to level up her leadership skills by getting in the trenches on the operating side. She joined Streamline as the Chief Strategy Officer, tasked with helping the GovTech digital services company target special districts to expand their early niche category dominance. CSO Stern sat down with the GetLatka team to reveal how she’s tackling an underserved and fragmented market with no accurate prospect count. Discover how she’s gathering the data and what she’s learned so far, how she plans to 3X ARPU without adding new customers, and why she’s exploring tech partnerships instead of internal builds.

- $400,000 MRR, up from $140,000 MRR YAG

- Team of 37 with 12 quota-carrying sales reps

- 1,450 customers, 55,000 special district prospects

- $275 ARPU

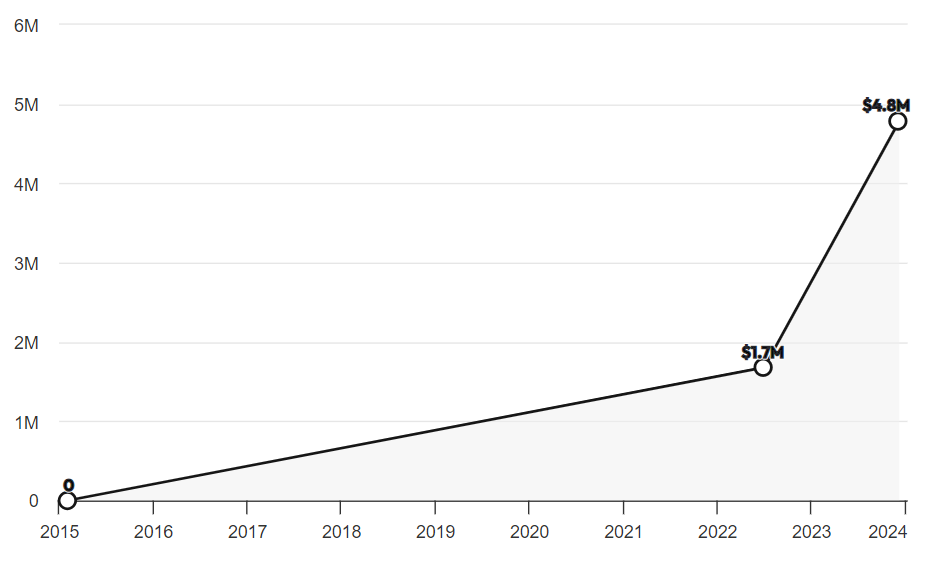

Streamline hits $1m ARR in 2022, Stern joins in 2023 as Employee #35

After its launch in 2015 to cater to special districts across the US, Streamline hit $1m ARR 7 years later in 2022. Meanwhile, Stern founded InState Partners, an evergreen business line inside Private Equity firm Advantage Capital that combined capital investments with government affairs. “Advantage uniquely used a network of state and local lobbyists across the country to create programs where the government incentivized capital to come into vulnerable areas,” revealed the CSO. She joined Streamline as their 35th employee only 4 months ago because they needed someone with legislative, partnership, fundraising, strategy, and data experience. At the same time, she wanted to get in the trenches on the operating side to “be the best leader I can be.”

Still establishing TAM, estimating 55,000 special districts

“Special districts are everywhere!” Stern proclaimed, explaining that they include water, sanitation, and utility districts, as well as cemeteries, libraries, and more. “It’s a really funny corner of the government market that’s wildly underserved, partially because it’s so disparate.” Stern further shared that no one knows the actual count because the districts often supersede city and county boundaries, and many states don’t know how many are even within their borders. “They are managing their own budgets and providing a singular service,” she added. Her team currently estimates 55,000 special districts in the US.

Creating unity of market, with $275 ARPU

According to Stern, Streamline currently provides digital services like a website, social media, and posting tools that comply with state regulations. “Very few of our customers have the tools or tech background to do this themselves. We are getting them online with digital tools that allow them to serve their constituents better,” expounded the CSO. While the average customer pays $275 per month for Streamline’s services, Stern explained that their tiered pricing is based on the special district’s operating budget.

1% net revenue on Stripe payments

When Latka queried Stern about whether Streamline’s model was a “SaaS Plus”, the Chief Strategist replied, “Yes, payments are a part of that. Stripe is a wonderful partner. They’re easy to integrate, and we keep 1% net.” However, the CSO added, “Stripe isn’t a sophisticated enough tool for our target districts’ needs, so we are thinking about other partners in our market to expand our services.” She elaborated, “Having a more sophisticated payment solution would help us close more sophisticated deals. We are losing out on deals like water and utility districts, which are much bigger fish and have consistent GMV.” Stern revealed that they’re considering partnering with her first investment– a plug-and-play payment system built for the government. Why not build your own? “The question is how much tech debt we want to take on vs. acquiring or partnering and focusing on our roadmap,” she revealed.

Increasing ACV is a growth lever, tapping into $275B estimated GMV

“The key to our growth is to increase ACV through offerings to existing customers,” noted Stern. She added that the average special district processes $5m in GMV, but there’s a full spectrum of value. Nevertheless, Latka calculated the total GMV at $275B. The CSO cautioned, however, that 55,000 is still an estimate, as they have completed counts in 37 states, with the other 13 being more challenging to evaluate.

Sales team of 12 carries quota with low ARPU, high volume targets

“Rarely do you see quota with a low ARPU, high volume business. How do you make that work,” Latka asked Stern. She explained that the team works together to get credit for deals, and each level, BDR, Assistant AEs, and AEs work against specific criteria, such as cold calls, demos, and sales. “Each BDR makes 50–65 calls per week; 37% translates into demo calls, and we have a 60% close rate on demos,” shared the CSO. She added that the current system is a necessary motion to get a sense of the market and verify the data set. “The census did an exploration in 2017 and said there were 40,000 special districts. Our BDRs are calling and finding that to be incorrect, so we are calling, collecting data, calling counties, and overlaying all that data to the census data to build that data set,” Stern revealed.

122% growth to $400,000 MRR, since incorporation 18 months ago

Even though she joined 4 months ago, Stern is closely tied to Streamline’s journey, citing their 122% growth over the last 18 months since their incorporation. She confirmed that they did a $2m seed round where they offered common stock and gave up 14% equity and are now looking at raising a Series A round of $6-8m.

$8m Series A offer sheets at 7-8X: venture or growth?

Stern shared that Streamline is currently considering both VC and growth capital offer sheets for their Series A funding: “Growth says we love your potential, but you’re burning too much, you have too many touches, you need to get more efficient and grow at 40-50%. VC says don’t change a thing. Grow at 150%. Think bigger about marketplaces and partnerships. Who cares about efficiency, capture the market!” The CSO revealed, “As a leadership team, we are thinking about what kind of company we want to be and what kind of partners we want to grow with.”

Famous 5

Favorite Book: Chief Strategy Officer Rachel Stern chose the John Steinbeck classic novel East of Eden as her favorite book.

CEO he’s following: “Our current CEO (Mac Clemmens): I love his moves,” proclaimed Stern.

Favorite online tool: Stern chose ChatGPT as her favorite tool today.

Balance: 33-year-old Stern sleeps a full 9 hours nightly. She has two dogs and is currently engaged.

What does he wish he had known at 20? “I wish I had known to buy property,” laughed Stern.