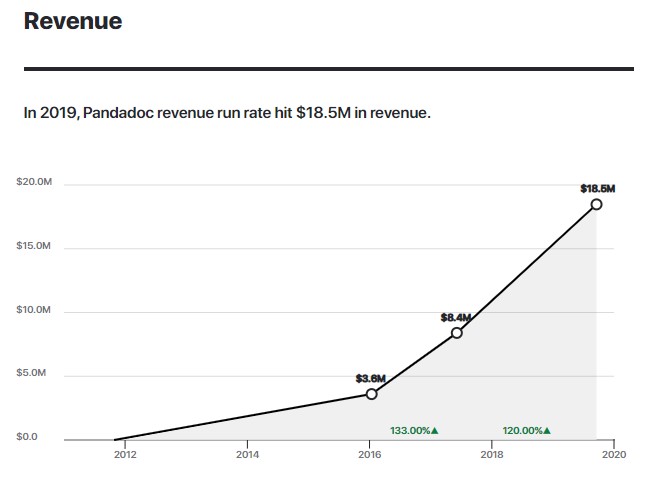

With 70% year-over-year growth, sales document SaaS company PandaDoc nearly doubled its MRR from about $500,000 to almost $1 million in a year and a half.

Founded in 2011, the company helps streamline sales documents, marketing to small and medium-sized businesses through a subscription-based model. Clients’ subscription costs vary on a per-user, per-month basis.

PandaDoc’s ARPU has stayed consistent at about $100 per customer. But the company boosted its revenue by building a quickly-growing customer base, according to CEO and co-founder Mikita Mikado in a 2018 discussion with Nathan Latka.

From early 2017 to mid-2018, PandaDoc increased its customer base from 7,000 to 10,000 clients. Much of that growth has come from an integration with HubSpot’s app exchange and the natural virality that comes from companies sharing documents with one another.

PandaDoc’s team has expanded in that same time period as well, increasing from 106 to about 170. About 90 employees work in Belarus — Mikado’s home country — and focus on the product. The U.S. team, based in San Francisco and St. Petersburg, Florida, works on marketing, support, sales, and operations.

The company raised $20 million in capital as of 2018. This allowed PandaDoc to become more aggressive with courting customers, increasing CAC from $1,200 to $1,600 for a 16-month payback period.

Source: GetLatka

PandaDoc’s gross monthly logo churn dipped from 5%in early 2017 to “much lower than 5%” churn in 2018, Mikado says. Mikado attributes this increase in customers and decrease in churn to three reasons:

- Introducing professional services for their customers. Although professional services only make up about 5% of PandaDoc’s monthly revenue, offerings like training sessions on how to use PandaDoc and design services for clients made a difference, Mikado says.

- Quadrupling the customer success team from 2 to 8 employees.

- Improving the product quality: “Quarter over quarter, we were fixing bugs and adding features and polishing UX and onboarding,” Mikado says.

As of 2018, PandaDoc was less focused on selling and more invested in building itself up “because what we can be 100 times bigger,” Mikado says. With that said, mergers aren’t totally out of the question.

“If a certain merger is going to help us to learn, make an impact, and have a lot of fun, then sure, why not?” Mikado says.

What is PandaDoc’s annual revenue?

In 2018, PandaDoc generated almost $18.5 million in revenue.

What is PandaDoc’s monthly revenue?

In 2018, PandaDoc generated almost $1 million in MRR.

Who is the CEO of PandaDoc?

Mikita Mikado, age 32, is the CEO of PandaDoc.

Transcript Excerpts

Why PandaDoc raised $20 million in capital instead of bootstrapping

“Prior to PandaDoc, we had a different product [QuoteRoller] that we took to profitability …

By self-funding the whole thing for more than a year, and once we became profitable with the software in the company, we just weren’t able to help ourselves but notice that the opportunity is so much bigger, and so when we decided to raise money and sort of say, ‘Go big.'”

The biggest factor in reaching potential new clients: Virality

“The biggest thing for PandaDoc is that, when I send you a PandaDoc, it looks pretty cool, it’s going to be a nice document and it’s electronic, we can collaborate on it, go back and forth instead of exchanging multiple emails with attachments, and you can sign on it with a legally binding electronic signature. So in many cases, recipients of the documents get curious about, “Hey, what just happened? What’s that software?” so they sign up, so that natural virality is what helps us to drive the business quite a bit.

Why SaaS metrics like customer numbers matter as much as MRR

“Honestly, the way we think about it, MRR is not the top metric that we care about. What we care about a lot is the number of customers, NPS within our customer cohorts, how happy are customers with our product, are we getting the right types of customers, because we’re not the best product for everyone … So that’s really what we are after, and MRR is the result of doing the right thing on all those fronts.”

The advantages of splitting a team between Belarus and the U.S.

“We started in Belarus and then I exported myself here [to the U.S.], that’s where our core is at. … We try to blend teams, but for obvious reasons, the team in Belarus is heavier on the product side. I mean, Belarus is fantastic for hiring engineers, hundreds of outsourcing companies that you can pull from, and we’ve been fortunate to have our product organization in Minsk that works extremely well. And on the contrary, it’s very hard to hire for sales in Belarus … the marketing and sales were illegal in the Soviet Union, and therefore that domain had a real hard time developing.”

Nathan Latka: Hello everyone, my guest today is Mikita Mikado, he was born in a place called Minsk, Belarus around the time USSR started to collapse, severe infection with the entrepreneurship bug got him doing things like wash cars when he was seven years old and sell berries when he was 10. Eventually, it got so bad he had to jump on a plane to the United States where this type of disease not only treated, but also rewarded. He started multiple software companies, raised many millions of dollars in financing, built amazing teams, and helped dozens of thousands of businesses be more efficient, his project today, pandadoc.com. Mikita, are you ready to take us to The Top? Mikita Mikado: Absolutely. Are you, Nathan? Nathan Latka: You secretly miss those berry picking days, don’t you? Mikita Mikado: I do, I do miss those a lot. It’s a lot healthier than sitting in front of your computer- Nathan Latka: That is true. Mikita Mikado: … in case you’re considering something like that. Nathan Latka: So tell us about the berries you’re picking today, PandaDoc. What do you guys do, and what’s your revenue model? How do you make money? Mikita Mikado: Yeah. We’re a software company that helps to streamline sales documents, anything from quotes to proposals, contracts, getting those documents generated, delivered, signed, tracked, and so on and so forth. That’s our business, we charge on a per user per month basis, it is a subscription-based software that you can use out of your browser. Nathan Latka: No professional services or big setup fees yet, nothing like that? Mikita Mikado: No. We typically work with small to medium-sized businesses and, while we do have professional services, it’s not like a software application that would take you years to deploy and yada, yada, yada. A lot of our customers just sign up for an account, figure it out themselves, and start using it. Nathan Latka: And we were just chatting pre-call, the last time you were on the show was almost two years ago, so it’s been a second. Back then, you shared your ARPU, it was around a hundred bucks per customer, have you actively tried to increase that or have you stayed there and just tried to drive volume? Mikita Mikado: Yeah, we’re staying within the same range, and we did drive quite a bit of volume. So we talked, I think, about a year and a half ago and, since then, we raised more money, we grew- Nathan Latka: How much have you raised to date? Mikita Mikado: Close to $20 million. Nathan Latka: Close to 20. Okay. Yeah, I’m going back, so that was your Series-A or Series-B? Mikita Mikado: It was Series-B. Nathan Latka: Series-B, which was how much? Nine? Mikita Mikado: Series-B was, no, no, no, it was 15. Yeah, prior to that raised five, so that makes a total of close to 20, but you know how it works in the venture world- Nathan Latka: High [crosstalk 00:02:43]- Mikita Mikado: Nathan Latka: Yeah. When did you kind of make the strategic decision that, “We’re going to make this a funded company? It doesn’t make sense to bootstrap this thing?” Mikita Mikado: So prior to PandaDoc, we had a different product that we took to profitability. Nathan Latka: You’re talking about Quote Roller? Mikita Mikado: Yeah. By self-funding the whole thing for more than a year, and once we became profitable with the software in the company, we just weren’t able to help ourselves but notice that the opportunity is so much bigger, and so when we decided to raise money and sort of say, “Go big.” Nathan Latka: And what have you scaled to today, in terms of total customers? Mikita Mikado: We are close to 10,000 accounts [crosstalk 00:00:03:34]- Nathan Latka: Okay. That’s great growth. Yeah, about a year and a half ago when you were on the show, you said you had you just [inaudible 00:03:38] about 7,000, so about 3,000 new ads over the past year and a half, does that sound about right? Mikita Mikado: Yeah. Nathan Latka: Okay, good. And then, look, 10,000 customers at that ARPU you just articulated, I mean, have you broken a million bucks a month yet? Mikita Mikado: It depends. In bookings, yes. In MRR, we’re a little shy of that. Nathan Latka: But something you’ll probably definitely break the next month or two, right, a couple of months? Mikita Mikado: Nathan Latka: Well, tell me why you talk about those two things differently? Kind of educate us on why bookings would be different than MRR recognition. Mikita Mikado: Well, it’s because bookings involve annual subscriptions and professional services whenever those are present, so the bookings are larger, typically. Nathan Latka: Yeah. But I asked you earlier, though, about professional services, that’s not any… You don’t have more than 5% of your revenues is in professional services, is it? Is it significant? Mikita Mikado: 5%. On the monthly basis, I think we’re actually around 5% [crosstalk 00:00:04:39]- Nathan Latka: Okay. And what is that? If I sign up for PandaDoc and I pay you a little bit of professional services, what am I getting for that? Is it setup fees and stuff? Mikita Mikado: Yeah. Well, we would help you to integrate your CRM system with PandaDoc, we’d provide some design services on top of your existing sales collateral, a lot of people like that. We just help to make your sales proposals look a lot better, and there’s value for a lot of sales teams that want to get that done. From our perspective, we just want to make our customers successful in the best way we can and, if that means that we have to engage our design team to help you out, we’d totally do that. What else would we do? Trainings, we’d take your content and convert it into PandaDoc format if you are busy and don’t have time to do that, so basically those are the types of things that we do as a part of our professional service. Nathan Latka: Tell me about where most of the customer growth is coming from. I know, last time we spoke, you talked in a very nice light about the integration with HubSpot’s app exchange, and that’s been great for you guys. Are you leveraging other app exchanges to continue to drive growth or do you still see most of it coming from HubSpot? Mikita Mikado: Yeah, hopefully we’re going to pop up on Salesforce’s app exchange in the next couple of weeks, HubSpot is great but it’s just one of the channels. The biggest thing for PandaDoc is that, when I send you a PandaDoc, it looks pretty cool, it’s going to be a nice document and it’s electronic, we can collaborate on it, go back and forth instead of exchanging multiple emails with attachments, and you can sign on it with a legally binding electronic signature. So in many cases, recipients of the documents get curious about, “Hey, what just happened? What’s that software?” so they sign up, so that natural virality is what helps us to drive the business quite a bit. Nathan Latka: And what has the growth been over the past 16 or so months? I mean, are we talking 100% year over year growth or more or less? Mikita Mikado: No, it’s less. We’re averaging 70%. Nathan Latka: Okay, that’s pretty healthy, though. I mean, you guys are getting up in the… I mean, if you’re close, if you’ve passed a million bucks a month in bookings, I mean, it’s hard to double 12 million in ARR, right? Mikita Mikado: Well, you can do that, and I think we can do that as well, it’s just a matter of choices that we make strategically, we don’t see that competition-wise. There are a lot of threats and [crosstalk 00:07:23]- Nathan Latka: What do you mean, you don’t see that? You know their growth rates are lower than yours? Mikita Mikado: We know that, from the product perspective and from the, also, growth perspective, we have a little bit of time so we choose not to raise a ton of money and be super aggressive at this time. We might change that, that thinking might change but, for now, that suits us pretty well, and as long as you’re not burning a lot of money and you can become profitable at [inaudible 00:08:02], 70% is good. Nathan Latka: Yep. So again, look, 70% year over year growth, again, if you’re around that million-ish market today in MRR, I mean, is it fair to say about a year and a half ago you were doing somewhere around 500, 600? Is that generally accurate? Mikita Mikado: So I think we were at 500 around that… Wait, January 2016 is the time when we would talk? Nathan Latka: Yes. Mikita Mikado: So January 2017, that’s when we were at- Nathan Latka: 500? Mikita Mikado: Nathan Latka: Okay, great. That’s good. Mikita Mikado: … probably a little less than that. Nathan Latka: That’s great. And then as you execute your growth strategy here, throughout 2018, it sounds like you have other app exchange launches coming down the pipeline. I mean, what do you hope to drive ARR to? What do you hope to drive your growth at? Mikita Mikado: What do we hope to drive our growth at? Honestly, the way we think about it, MRR is not the top metric that we care about. What we care about a lot is the number of customers, NPS within our customer cohorts, how happy are customers with our product, are we getting the right types of customers, because we’re not the best product for everyone, right, so that’s really what we are after, and MRR is the result of doing the right thing on all those fronts. Nathan Latka: How do you know that the things you’re measuring, though, are directly correlated to MRR? That’s always a tricky thing for people to figure out, right? Mikita Mikado: Yeah, so we don’t. We assume. I think, at some point, we’ll get to correlating, let’s say, NPS score and monthly recurring revenue and seeing some dependencies. And as of today, we assume that this is the case, and that’s what I’m hearing more and more from revenue leaders in Silicon Valley, so I tend to believe that. Slack people say that that’s the ultimate metric you have to focus on and I tend to believe that. Nathan Latka: Last time you were on the show, again, just about a year and a half ago, you said your gross logo churn per month was about 5%. How is that panning out? Mikita Mikado: It’s slower than that, at this point. Nathan Latka: Slower, meaning it’s 4%, 3% or 6%,7%? Mikita Mikado: Well, churn is something that I wouldn’t probably be disclosing on a podcast, but it is much lower than 5% and [crosstalk 00:10:52]- Nathan Latka: And you’re talking about gross monthly logo churn? Mikita Mikado: I’m talking about logo churn per month. And over the course of existence of our product, we were able to drive our churn down quarter over quarter. Nathan Latka: Yeah. I was going to say, because you did, I have the quote. I mean, you did say 5% gross logo term per month last time you were on. You’d driven that down, it sounds like, significantly. And can you point to two or three things you’ve done that really helped you drive that down? Mikita Mikado: Yeah. First of all, we introduced professional services, I don’t think we had them at the time we talked, so that helped. The reason we do professional services is, frankly, not to make money but to ensure that our customers get value faster, and that helps tremendously, so that’s number one. Number two, we increased coverage for our customer success team. Nathan Latka: What’s that mean? Mikita Mikado: Well, in the past, we had started with two CSMs that focused only on large accounts- Nathan Latka: So [crosstalk 00:12:07] customer success managers? Mikita Mikado: Yeah, customer success managers. And today we have a team of eight that focus on much smaller accounts, compared to a year and a half ago and then, finally, the product came a long way. Quarter over quarter, we were fixing bugs and adding features and polishing UX and onboarding and so on and so forth, and you can see in the cohort analysis that things could get greener and greener and greener and better and better and better, so that obviously helps. Nathan Latka: Yeah. Those are all great levers to be pulling during churn down. You shared, last time, payback period, you like to keep it at about 12 months, which meant you’d spend up to 1,200 bucks to acquire a customer. Have any of those two metrics changed? Are you more aggressive, less aggressive today? Mikita Mikado: A little more aggressive. Nathan Latka: Okay. So you’re happy [crosstalk 00:13:02]- Mikita Mikado: You raise [crosstalk 00:13:02]. Nathan Latka: Yeah. That’s usually what happens. So just to be clear, you’re happy with a 16th or 18th-month payback period, you have the cash to be more aggressive? Mikita Mikado: Yeah, it’s pretty close to 16. Nathan Latka: Okay, that’s good. That makes a lot of sense. And again, with a monthly ARPU of a hundred bucks, that can take a hundred times at 16 to assume CAC is about 1,600 bucks. Where are you spending that $1,600, typically? Any direct stuff or all inside sales? Mikita Mikado: Well, I’m sure a lot of our competitors are watching your show, so I wouldn’t tell you precisely where the money goes. Nathan Latka: Well, tell me this, tell me the experiments that failed. Mikita Mikado: Oh, experiments that failed. We built Oracle integration and tried to do that but- Nathan Latka: That didn’t work out so well, yeah. Mikita Mikado: Yeah. How about that for a dumb thing to do? I mean, it’s not dumb if you’re not an SMB SaaS company, but it was pretty dumb for PandaDoc. Nathan Latka: Yeah. What do you have today, in terms of team size? You were at 106 people year and a half ago. Mikita Mikado: We are at 160. Nathan Latka: Oh great. Okay, good. Mikita Mikado: Actually wait, 170 at this point. Nathan Latka: You’ve hired about 70 people, were those most additional hires product or sales, or what? Mikita Mikado: Yeah, vastly product. I think our sales headcount did not increase, they increased by a couple CSMs, right? Nathan Latka: And where’s home? Where is everybody based? Mikita Mikado: All over the globe. We’ve got about 90 people in Belarus and we’ve got about 80 people in the U.S. Actually, to be correct, 97 are in Belarus last time I checked Slack, a little over 70 in the U.S. Nathan Latka: And why Belarus? What’s advantageous about that for you? Mikita Mikado: Well, where do you think the accent comes from? Nathan Latka: Well, I’m not sure if that was your hometown or what but, strategically, I mean, is it cheaper cost to capital? Mikita Mikado: Yeah. We started in Belarus and then I exported myself here, right, that’s where our core is at. Product, some support, some marketing, a couple of CSMs, some operations, we try to blend teams, but for obvious reasons, the team in Belarus is heavier on the product side. I mean, Belarus is fantastic for hiring engineers, hundreds of outsourcing companies that you can pull from, and we’ve been fortunate to have our product organization in Minsk that works extremely well. And on the contrary, it’s very hard to hire for sales in Belarus, almost impossible, I mean, the marketing and sales were illegal in the Soviet Union, and therefore that domain had a real hard time developing. Nathan Latka: That’s funny. You had to have a U.S. operation. Mikita Mikado: Yeah. Well, that’s why we have offices in San Francisco and St. Pete, Florida. Nathan Latka: Mikita, around the time that you closed your series, around the financing, a gentleman by the name of Brad Coffey who leads M&A at HubSpot had an interesting Twitter check-in, which was location oriented around Belarus, and he doesn’t go to Belarus for random reasons. Why did you strategically decide to raise capital versus sell to somebody like a HubSpot? Mikita Mikado: Because what we do can be a hundred times bigger. Nathan Latka: You cut out right when you started that. You said what to be a hundred times bigger? Mikita Mikado: What we’re working on could be a hundred times bigger. Nathan Latka: Let’s ignore HubSpot for a second. Any founder listening today, when they raise capital, many of them may also have LOIs for acquisition on the table, as well. Whether you had that duality or not, how do you recommend founders think about those two options? Mikita Mikado: Well, I can tell you how we think about it, but I think it’s so personal and private that giving any kind of advice on that front is advice that no one should take. Nathan Latka: Uh-huh (affirmative). Do you have personal advice you can share even though, obviously, it is your own bias? Mikita Mikado: Yeah. So there are three things that my co-founder and I care about. Number one, we want to learn. Learning is something we’re deeply passionate about, wanting to get better. Quarter over quarter, we want to have new challenges and we want to learn. Number two, we want to make an impact. And when we started this company, the impact was, quite frankly, on ourselves. We wanted to build a product and, prior to Quote Roller, we had a service business and it was a super stressful business. You work per hour and then you’re being woken up at night, it just wasn’t great. Mikita Mikado: So first it started with the impact on our own lives, right, we just wanted a zen business, and then people started using our software and they loved it, so then we wanted to make an impact on their business, and we wanted to have a lot of them using our software. And then people joined our company and we noticed that, “Hey, actually, we helped them learn and we helped them make an impact and build careers,” so there is this third dimension for the impact value that we care about, so impact is the number two. Mikita Mikado: And then, finally, we want to have fun, we want to learn, we want to make an impact, we want to have fun while we’re learning and making that impact. So the way we think about M&A is, if a certain merger is going to help us to learn, make an impact, and have a lot of fun, then sure, why not? Nathan Latka: You eliminate, though, a lot of potential M&A after you raise around like you raise because you have to sell for so much… First off, you have to grow into whatever valuation you negotiated, which I bet was good because it sounds like you’re probably a great negotiator, so you have to grow into the valuation and then you have to sell for [inaudible 00:19:43] the liquidation preference, you have to sell for way above that to make it even worth it, so you really, now, are committed to do your own thing for a year and a half, grow, grow, grow, grow, grow. Mikita Mikado: Yeah. Well, the first thing you got to do when you raise money is you shouldn’t have some crazy liquidation preferences. I would rather take clean terms but a higher valuation. Nathan Latka: Well, everyone would like clean terms and a higher valuation, I think what you meant to say is you’d rather have clean terms and a lower valuation. Mikita Mikado: Yeah. I would rather have clean terms than have [crosstalk 00:20:16]- Nathan Latka: Oh, I see. Mikita Mikado: … so that’s for one. And then for two, if you can grow with the money that you’re raising to the expectations of every enrolled party, and if that growth milestone or the time it’s going to take you is something you want to do, then why not do that? Right? So that’s where we were with our Series-B, we knew that we can please 10x our customer base and our annual recurring revenue, so then why not? Nathan Latka: Very good. All right, Mikita, let’s wrap up here with the Famous Five. Number one, what’s your favorite business book? Mikita Mikado: My favorite business book… I gave you one, I’ll give you another one this time. Check out What Doesn’t Kill Us, it’s a great book and it is about sustaining cold, and I got on the program that this book is preaching and, oh my God, I love it. I’m so much fresher- Nathan Latka: Good. Your book last year was Pitch Anything, so Pitch Anything and What Doesn’t Kill Us, both those books. All right. Number two, Mikita, Is there a CEO you’re following or studying? Mikita Mikado: CDO? Nathan Latka: CEO. Mikita Mikado: Oh, CEO. Is there a CEO I’m following or studying? Yeah. So actually, I read a lot of stuff that both founders of HubSpot put out through Think Right, and I think they got awesome pieces there. And I find a lot of similarities between our businesses, the market we go after is very similar, so I find that content very relevant. Nathan Latka: Number three, is there a favorite online tool you have for building your business, besides your own and besides HubSpot? Mikita Mikado: Besides HubSpot, I didn’t name HubSpot. Let’s see- Nathan Latka: Just one that you use every day. Mikita Mikado: Yeah, you got to cut off me being dumb, but what do I use every day? I use my calendar at this point and I use Google Slides, that’s my job. Nathan Latka: Google Slides. Mikita Mikado: Blah, blah, blah, and put slides together, and blah, blah, blah more. That’s really all I do. Nathan Latka: Good. Number four, how many hours of sleep do you get every night? Mikita Mikado: Eight hours of sleep. Nathan Latka: That’s good, because you’re there at your house right now, you got a little one running around, right? Mikita Mikado: I got two. Nathan Latka: Two little ones, and married, right? Mikita Mikado: Yeah. Nathan Latka: And how old are you? Mikita Mikado: I’m 32. Nathan Latka: Mikita Mikado: Nathan Latka: What do you wish your 20-year-old self knew? Mikita Mikado: That I need to learn to work and deal with people, wished I took some, maybe, psychology classes or something along those lines, management classes that would help me to be a better manager because that matters so much after you have more than 20 people on your team- Nathan Latka: Got it. There you have it [crosstalk 00:23:49]- Mikita Mikado: … or in your company. Nathan Latka: He would have sharpened his people skills earlier on, but he seems to be doing something right. Over a 170 people on his team today, launched in 2011, PandaDoc’s helping you send proposals and quotes in minutes. They’re scaling rapidly, a year ago they had about 7,000 customers, now they have over 10,000 customers paying, on average, a hundred bucks a month, so they’re flirting with that $1 million per month mark, 70% year-over-year growth, really healthy. $20 million raised, spending up to 1,600 bucks to acquire a customer, he’s comfortable with a 16-month payback period considering they just raised capital, healthy economics, and his team is split between Belarus and the United States. Mikita, thank you for taking us to The Top.