Mobile engagement company Localytics serves about 600 customers — a number it intentionally cut in half — with an average ACV hovering somewhere between $50,000 and $100,000.

Localytics offers analytics for companies’ mobile platforms, interpreting user behavior to deliver personalized messages and targeted messages to users. Localystics pricing is based on the number of active app users per company. With customers like ESPN and The Weather Channel, some of the biggest customers pay $1 million in annual subscriptions.

The company had hit at least $30 million ARR and around $2.5 million MRR when Nathan Latka spoke to founder and former CEO Raj Aggarwal in early 2018.

Although Localytics bootstrapped for two years after its initial founding in 2009, the company raised $60 million in equity — a figure Aggarwal now believes was too much: “To some extent we jumped onto that bandwagon and probably raised a little more than we should have,” he says.

But Localytics managed to overcorrect and break even by 2017. The company reexamined its focus and strategy, which ultimately meant it dropped about half of its paying customer base from about 1,200 to 600.

“We were hitting maybe too-wide a part of the market, from … mid-market into enterprise. And we had to get really focused in on what our core was … For us, that was really always in the enterprise,” Aggarwal says.

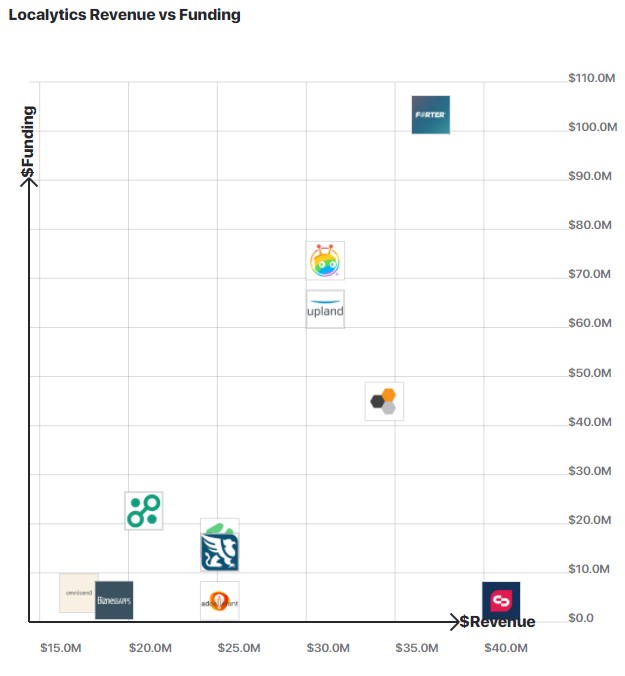

Source: GetLatka

That meant getting rid of the lower-tier subscriptions, which began at $1,200 per month; now the least expensive subscriptions begin at $10,000 a year. To narrow their focus on enterprise, Localytics told its lower-paying customers: You can stick with us and upgrade your plans, or you can cancel our services.

Customers had about a year to decide, and about 25% upgraded. Because their subscriptions tripled or quadrupled in price, Localytics did not lose money during this transition period.

Localytics now has a team of about 150 people, with eight to 10 people working in customer support and even more working as what Aggarwal calls “post-sales solutions consultants” who hold customers’ hands as they make sense of Localytics’ tools. These consultants are an important factor in retaining customers year after year, Aggarwal says.

The company spends somewhere between $50,000 and $100,000 to acquire customers, and the payback period for acquiring customers is typically around 12 months. “[For] a typical customer … we may start with them at $50,000. The next year we’re at $200,000. Next year we’re at $500,000. So we’re well over 100% on net retention,” Aggarwal says.

What is Localytics’s annual revenue?

In 2017, Localytics generated $30 million in ARR.

What is Localytics’s monthly revenue?

In 0217, Localytics generated $2.5 million in MRR.

Who is the CEO of Localytics?

Raj Aggarwal, age 42, was the CEO of Localytics in 2017. Jude McColgan is the current CEO.

Transcript Excerpts

How starting in the midst of the financial crisis helped Localytics bootstrap and grow

“What went from a ‘Hey, we can raise money easily,’ went to almost two years of bootstrapping the company. But it was the best thing that could’ve happened to us because the companies that did raise money before then, all had to shoot off into the wrong direction, trying to grow fast … For us, we were forced to work closely with our customers, figure out what they really wanted. And at that time it was deep insight about what was working within their mobile apps, how to grow that audience. And it was in 2012 that we expanded from being primarily analytics to adding this engagement layer so that we could use that data to create these more engaging experiences with end users through all these new mobile communication channels.”

Why Localytics jumped onto the capital raising bandwagon, and why they regret it

“Around that time [in 2015], Mixpanel raised 65 million in a single round. Kahuna raised 45 million. Other companies like Urban Airship and Amplitude raised a lot of money around that time. So these are all companies in a similar space to us, so it was a little bit of like the race was on. And really because of the amount of money that went into the space and the amount of money therefore that went into marketing, we oversaturated the space. And pretty much all of us had to do some level of sort of correction, I think.”

The special role of ’post-sales solutions consultants’

“These are folks that have been in the shoes of the practitioner, sometimes they come from our product management organization … They’re taking a proactive approach with the people who are actually using the product to go in there, look at what kind of campaigns are running and what kind of advice that we can give them. How are they analyzing the data and how can they do their job better? Basically doing a good level of handholding to make sure that in this confusing mobile space where everybody feels like they’re in over their head, that they can make sense of these tools.”

How Localytics politely told customers to upgrade or leave

“It’s about giving [customers] a lot of time to make the transition if they’re not able to or willing to sort of pay for the enterprise version of the service … We took up to 12 months to give them a really long window to make their decision. Obviously, you’re going to give to people that have been with you for some time some incentives to make it easier for them to upgrade and stay on an enterprise service, at least for a certain period of time. And so I think at the end of the day, it was just about treating them with respect, right? Giving them [the] ability to download their data and have a smooth transition if we were no longer the right fit for them, which in some cases we weren’t.”

Full Transcript Raj: Hello, everybody. My guest today is Raj Aggarwal. He co-founded Localytics in 2009, and as CEO until 2017, creating the leading mobile engagement platform that is used by many of the world’s top brands. Before Localytics, Raj spent 12 years building a variety of different technology companies. He was a management consultant focused on mobile with Bain and Company and Adventus. And then Raj worked alongside Steve Jobs at Apple to develop the business framework for the iPhone while he was at Adventus and led the formation of the multi-billion dollar Disney Mobile venture in Japan. Raj, are you ready to take us to the top? Nathan: Let’s do it. Raj: All right. Very good. So tell us first, what does Localytics do? And what’s the business model? How do you make money? Nathan: Sure. So Localytics is a mobile engagement platform. There’s two sort of major parts to it. There’s the analytics part where we’re helping mobile apps collect data on their users. What are the behaviors? What’s working? What’s not? And then we take that data and we use it to deliver personalized and targeted messaging across a variety of mobile channels, including push notifications in-app messages, as well as email and content personalization. Nathan: So the way that we make money, it’s a SAS subscription business that’s based on the volume of the app. So depending on how- Raj: You mean the app downloads? Nathan: Well, specifically, we base it on the number of monthly active users that you have. So basically, as an app grows, forget about downloads because we think that’s a vanity metric, is not a very helpful metric, but how often are you bringing users back to your app? How big is your audience? And based on how big your audience is, the subscription fee for different modules of the product, for example, the analytics, the push notification service, et cetera. Raj: And in general, what’s the customer paying you per month on average, would you say? Nathan: The average tends to be in that 50,000 to a hundred thousand dollars range. Raj: ACV or monthly? Nathan: That’s annual, ACV. Raj: Got it. Nathan: Our biggest customers are well over a million dollars, and that’s increased a lot over the past five or six years as we started probably more SMB mid-market and really moved up market over the past, particularly over the past three or four years. Raj: I want to talk more about that here in a second, but give us more of the history here. When did you launch the company? Nathan: So, yeah. Beginning of 2009. I left my job at Bain on August 31st, 2008. Raj: That’s a cushy salary to give up. Nathan: It was, and it felt like still the right thing to do based on the investor interest we had, but 15 days later, Lehman brothers collapsed. Raj: Yep. Nathan: And so what went from a “Hey, we can raise money easily,” went to almost two years of bootstrapping the company. But it was the best thing that could’ve happened to us because the companies that did raise money before then, all had to shoot off into the wrong direction, trying to grow fast. And most of them tried become ad networks. For us, we were forced to work closely with our customers, figure out what they really wanted. And at that time it was deep insight about what was working within their mobile apps, how to grow that audience. And it was in 2012 that we expanded from being primarily analytics to adding this engagement layer so that we could use that data to create these more engaging experiences with end users through all these new mobile communication channels. Raj: Got it. And just to be clear, if I launch Nathan’s app, it has a 100,000 kind of monthly active users. User X logs on, you are basically going to tell me that user X clicked this button in the app, they watched a video on the app for two minutes, and then they exited on this part of the app experience versus collecting demo data on that user to then sell across some ad network. Nathan: That’s exactly right. Now, in some cases there’ll be demo data that helps us give you a better experience. So if we know something more about you, we might cater a push notification too. As an example, customers include like ESPN and Weather Channel, and we’ll use data like your favorite sports team or your location to give you targeted messaging that you’re going to actually want to receive and that’s going to help you. Raj: Just to be clear, you’re not doing anything else with that demo data in terms of putting it into some big network. Nathan: Correct. We’re not. Raj: Got it. Okay. Good. Fascinating. So 2009 was launch date. Obviously, Lehman collapsed shortly thereafter. You’ve grown the company. Now, have you bootstrapped, or have you raised capital? Nathan: We’ve raised capital. So we raised a couple of angel rounds, 2010, 2011. Our first venture round was in 2012. Total, we’ve raised nearly $60 million in equity. Raj: Raj, about a minute ago I liked you so much more than I like you now. 60 million. What the hell do you do with 60 million bucks? Nathan: I’ll tell you. There’s pros and cons, obviously, of raising money. For a lot of our early going, we wanted to maintain [inaudible 00:05:02] optionality and stay lean, but this space did start to really take off. And particularly in 2015, a lot of money was going into this space, and to some extent we jumped onto that bandwagon and probably raised a little more than we should have. Raj: Name a few, though. What were some other companies that raised a bunch in 2015? Nathan: Around that time, Mixpanel raised 65 million in a single round. Kahuna raised 45 million. Other companies like Urban Airship and Amplitude raised a lot of money around that time. So these are all companies in a similar space to us, so it was a little bit of like the race was on. And really because of the amount of money that went into the space and the amount of money therefor that went into sales and marketing, we oversaturated the space. And pretty much all of us had to do some level of sort of correction, I think. We were early on that, and we’ve been able to take the business to cashflow breakeven, which we did in last year, in 2017. Raj: And you’re still breakeven today? Nathan: Yes. Raj: Okay. I mean, look, when someone’s at breakeven, unless you had a crazy burn, right, when you raised 60 million, you still have a lot of that cash sitting in the bank. Nathan: That’s right. So look, we spent more than we wanted for a period of time, but we corrected what we were doing quickly enough and focused back in on customers. We were also to the extent… the piece that I talked about, where we sort of moved towards the enterprise, it was a time where we were hitting maybe too wide a part of the market from sort of a mid-market into enterprise. And we had to get really focused in on what our core was, where we were able to see a huge growth within our existing customers, strong retention, as well as good unit economics. And for us, that was really always in the enterprise. Raj: In terms of economics today, what is your churn look like in terms of maybe… Give me a monthly logo and revenue, if you have that. Nathan: Yeah. I don’t know the specific numbers, but I would say that we’re seeing like best in class retention with our enterprise, right? Frankly with the SMB in mid-market, we didn’t see that, but that’s now a very, very small part of our revenue. Raj: Got it. When you say best in… Let’s just talk about your enterprise cohort. When you say best in class, I mean, are we talking sub 1% monthly logo churn and net negative revenue churn? Nathan: Yeah. I mean, we’re talking high eighties into nineties. Raj: Got it. Okay. Fair enough. Walk me through the transition. So let’s do it this way. What was your cheapest price point? When you were kind of going very wide, how cheap could people get in at? Nathan: It was $99. So that was per month, so you could get in a $1,200 per year. We had a free product that went up to 10,000 monthly active users. Now, the first paid tier was $99 a month. Once you got to about $10,000 a year, you were off of the self-service version of the product, and you had to move into the enterprise version of the product. And so that was… It dependent on the timeframe, but usually it’s between a 100,000 monthly active users and 250,000 monthly active users. Since then, we’ve actually sort of basically disbanded those lower tiers so that the starting point today is about $10,000 a year. Raj: Okay. So if you go back to when you had the most customers, even though your revenue is probably lower, how large was your customer base at the peak before you started cutting down? Nathan: Probably about 11 or 1200 paid customers and six to 7,000 total companies using the service, including free customers. Raj: Okay. Got it. And then, what have you cut down to today? And my follow-up question is, how did you get people who were paying… how did you politely tell them you’re not a good fit anymore? Nathan: First of all, a lot of it’s about giving them a lot of time to make the transition if they’re not able to or willing to sort of pay for the enterprise version of the service. So a lot of these things… I mean, we took up to 12 months to give them a really long window to make their decision. Obviously, you’re going to give to people that have been with you for some time some incentives to make it easier for them to upgrade and stay on an enterprise service, at least for a certain period of time. And so I think at the end of the day, it was just about treating them with respect, right? Giving them ability to download their data and have a smooth transition if we were no longer the right fit for them, which in some cases we weren’t. I would say, though, what we did find is that we did not… We were revenue neutral in terms of the revenue we lost from those customers versus the [crosstalk 00:09:46]

Raj: Expansion. Nathan: … upgraded. Raj: Yeah. And I want to hone in on that for a second. If X percent of your customers, you deemed to not be a fit because they were smaller than what you wanted to serve, when you made the shift, what you’re saying is 50% of those not-fit users, you were able to convince to, or expand their revenue into being a fit where you could serve them, and 50% you essentially lost, so it was net neutral. Nathan: Yeah. Now the real numbers are probably closer to 75% we lost, but the 25% that we upgraded, we were able to not just double their price, but more like triple or quadruple [crosstalk 00:00:10:24]. Raj: Smart. And support costs go down, you can provide higher touch, et cetera. Nathan: As 40% of our support volume was coming from the 10% of revenue, the bottom 10% of revenue, so… Raj: I want to talk about your team and the support section of that here in a second, but so finish that story. You were at 1100 customers. What are you down to today? Nathan: It would be in that 600-ish range. Raj: Fair enough. And then, I mean, you quoted earlier an ACV of between 50 and 100. That generally puts you somewhere around two and a half-fish in MRR. Is that generally accurate? Nathan: It’s in the right zone. Raj: Right zone. Okay. Have you broken 30 million in ARR yet? Okay, good. You think you’ll break 50 this year? Nathan: TBD. Raj: Come on, Raj, give me some confidence, man. You still got 11 months. You think you’ll do it? Nathan: I’ve just got to say TBD. Raj: All right. It would be damn good gr… If you’re at 30 now and you go to 50, that’d be damn good growth, obviously. Take me back to the team. What’s the total team size and what percent of those folks are focused on support? Nathan: So it’s about 150 people and support can be broken up into a couple of different ways. But if you talk about customer support itself, we’re probably talking about 8 to 10 people. But then our support organization includes what we call mobile engagement consultants, consider them like post-sales solutions consultants. But our model is a little bit different, right? These are practitioners. Nathan: These are folks that have been in the shoes of the practitioner, sometimes they come from our product management organization, and they’re taking a proactive approach with the people who are actually using the product to go in there, look at what kind of campaigns are running and what kind of advice that we can give them. How are the analyzing the data and how can they do their job better? Basically doing a good level of handholding to make sure that in this confusing mobile space where everybody feels like they’re in over their head, that they can make sense of these tools. Because while we think our tool is relatively simple because there’s a self-serving [inaudible 00:12:34] version, et cetera available, sometimes it does take that extra level of handholding to maximize the full capabilities of this. Raj: Sure. And you can afford it at this price point for what they’re paying you. So, hey, we’re running out of time here. Last few quick questions. Lifetime value, what do you assume it is on the cohort that is a good fit for you, your enterprise cohort? Nathan: If you take an average customer at 50,000, it should be at least a five to six year lifespan. And I think we expect to see that, but what we’re seeing is definitely, our upsells are awesome, right? So a typical customer, a large enterprise customer, we may start with them at 50,000. The next year we’re we’re at 200,000. Next year or 500,000. So we’re well over 100% on net retention. Raj: Yeah. So in terms of lifetime value by dollars, I mean, you can fairly confidently say minimum is 100, 200 grand, pretty easily. Nathan: Absolutely. Raj: Yeah. Last question here on economics, before we wrap up with the famous five, payback period. How quickly do you like to get your money back? Nathan: We want to be in that 12-ish months range. Raj: Got it. So it’s fair to say you’re spending maybe 50 up to 100, in some cases, K to acquire the customer. Yeah. All right. Let’s wrap up here, Raj, with the famous five. Number one, what’s your favorite business book? Nathan: Leadership and Self-Deception. Really had an impact on the way I think about the world. Raj: Number two, is there a CEO you’re following or studying right now? Nathan: Elon Musk, but part of that, partly because I worked with jobs, he was the guy that I took a lot of inspiration from. Raj: Number three, besides your own, what’s your favorite online tool for growing the business? Nathan: I really have to say it Salesforce just because of the number of different things you can use to bring together your world. Raj: How many hours of sleep to get every night? Nathan: Nowadays, since I hired a CEO to take over the harder work, I get like seven. It used to be closer to five. Raj: I’ll have to have you back on and understand that story as well. I’m sure there’s some learnings in there. But wrap us up here with your current situation. Are you married? Single? Do you have kids? Nathan: I’m married. I’ve got a three-year-old daughter, and it’s a lot of fun with her. Get to spend a little more time with her these days. And that’s that’s life right now for me. Raj: And how old are you, Raj? Nathan: I am 42. Raj: All right. Last question. Take us back to your 20 year old self. What do you wish he knew? Nathan: Oh man. I wish I knew that I can and should be more aggressive about everything in life. Raj: That means he wishes he had 20 kids instead of just one right now. I’m just kidding. Be more aggressive about everything in life. You guys heard of here from Raj, founded Localytics back in 2009, helping you understand what your users are doing inside of the mobile apps you’ve built for them. He helps you customize those experience, increased stickiness of those applications, time in-app, things like that. They’ve raised $60 million. They serve about 600 customers paying a minimum of $50,000 ACVs, doing somewhere around 30 million bucks in ARR today. Super-healthy economics. More than 80 or 90% logo retention and net negative retention in many cohorts he’s serving. Payback period healthy at 12 months, spending about 50 to 100 grand to acquire those customers with their team of 150 folks. Raj, thank you so much for taking us to the top. Nathan: Thanks so much, Nathan.