On the day they launched next-generation DynamicNLP™, Yellow.ai CEO and founder Ragu Ravinutala sat down with the GetLatka team to discuss the state of their enterprise-centric conversational AI business. According to Ravinutala, Yellow.ai is an enterprise-grade conversational AI platform that allows enterprises to deliver human-like interactions that boost customer satisfaction and employee engagement at scale.

Ravinutala shared how and why they bootstrapped to $1m and got profitable before getting VC funding; how they opened the lucrative US market after launching in APAC; and how they’re maintaining a 2.5X growth rate. Also, discover why Latka likens Ravinutala to Snowflake CEO Frank Slootman and whose Yellow.ai SaaS metric he called “world-class.”

- Team of 850, 300 engineers in Bangalore

- 1000+ customers in APAC and US

- Raised $104m in Series A, B, C funding

- Valuation almost $700m

US companies pay $130,000 in ARR for access to 100% dynamic AI agents

In what Ravinutala calls “a machine learning 2.0 breakthrough”, Yellow.ai’s DynamicNLP™ continues to evolve and adapt to the metadata fed from billions of daily conversations. Ravinutala bootstrapped the launch of the company in 2016 by using humans to manually train the AI. Over time, the system began to rely on the metadata from customer interactions to uplift, upgrade, and train the dynamic AI agents to where they are today. According to the CEO, the average US company pays $130,000 in ARR for access to the tool.

Use case from a $750,000 enterprise power user

To put the use of Yellow.ai into context, founder Ravinutala shared how a leading US utility company uses the product. According to Ravinutala, the company pays between $500-750,000 per year to have the tool handle voice calls and digital interactions. While the price varies by country, the US pricing averages $4-5 dollars per minute for voice call handling. More minutes linearly increase revenue for the company.

Cannibalization concerns? Not with 400 billion calls at 1% automation

When Ravinutala noted that his company recommends that clients automate all available transactions with digital interaction choices as well as voice, Latka questioned the CEO on whether that recommendation would cannibalize his business, given the much lower cost of digital engagement. The founder confirmed that while digital interaction drives less revenue, Ravinutala clarified, “400 billion calls are made annually, and only 1% use automation. It would be thinking too narrow to worry about cannibalization.”

Largest customer pays over $1m in ARR

Ravinutala revealed that the largest Yellow.ai customer pays over $1m in ARR. As Latka asked how they upsell to drive revenue: seat, features, or utility-based, the founder indicated that higher revenue comes from utility-based increases.

APAC sweet spot at $30-40,000 ARR

By operating in two different global market geographies, Ravinutala disclosed that the sweet spots are quite different. APAC’s ideal customer spends $30-40,000 annually vs. the US customers who spend $130,000. As a result of this disparity, 90% of the 1000+ customers are in APAC, but 70-80% of the revenue comes from the US.

Launched in US in 2021: biggest market, fastest growth

Ravinutala’s first US customer came from an inbound call based on a press release. The deal was closed by a sales rep in India. The Indian team closed several US customers worth about $500,000 in ARR before opening an office with one person, a VP of sales, in the US 2 years ago.

Some US customers quickly grew from $30,000 to $600,000 in ARR

“The US is the largest market out there for us,” explained Ravinutala. The CEO noted that there are faster expansion and growth rates in the US market, citing an example of one customer who grew from $30,000 to $600,000 in ARR.

US Team scales in a year from 1 to 30

The Yellow.ai US-based VP of Sales made quick work of the opportunity to expand its presence in the US. According to Ravinutala, they spent the early months creating demand generation, first making a marketing hire, then adding an SDR, and hiring sales reps. Within a year, the North American team grew from 1 to 30.

$25-35m run rate targeting $40-60m this year

While keeping the exact numbers close to the vest, Ravinutala revealed that last year’s growth rate hit 2.5X, and the company expects to do the same this year. When Latka asked for clarity on the origin of the growth, new or existing customers, Ravinutala indicated it was a split.

World-class NRR at 150-160%

CEO Ravinutala then blew Latka’s mind when revealing that the company’s current NRR is 150-160%. Latka described the metric as “world-class”. A modest Ravinutala attributes the number to the business model. “We try to land right in price and volume. Then, when the client scales, the volume scales.”

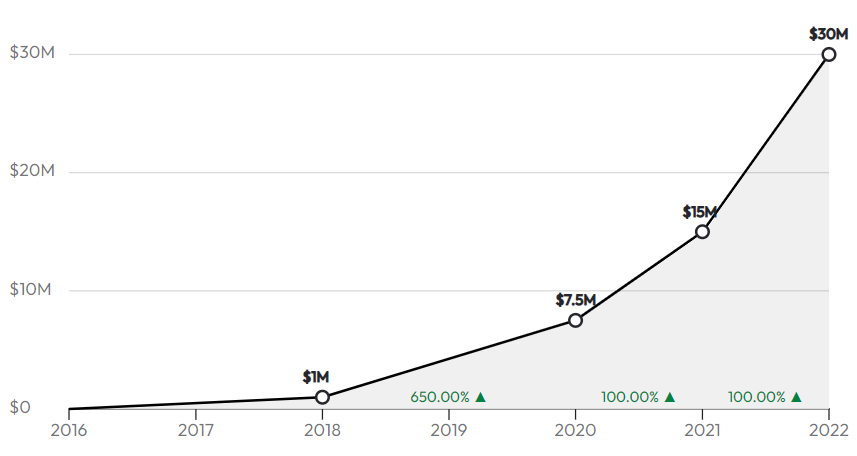

“The toughest part”: hitting the $1m run rate in 2018

When asked if he remembers when the company hit $1m in revenue run rate, Ravinutala recalled the time vividly. “It was the toughest part, hitting $1m run rate. We did it in late 2018,” Ravinutala remembered. He added that the company bootstrapped at the beginning, becoming profitable and hitting $1mm in ARR at roughly the same time.

10X run rate to $10m in 2020 with $104m in VC help

According to Ravinutala, the company finally raised capital in 2018 when it hit $1m in ARR. When Latka asked if the capital represented a pre-seed round, Ravinutala chuckled, noting they started with a Series A round of $4m in early 2019. They added $20m in Series B funding in 2020 and another $78m in Series C in 2021.

$104m question: why so capital intense?

Latka questioned the CEO on why raise so much capital when you’re profitable at $1m. Ravinutala explained that they could have remained profitable at a lower growth rate, but “We are creating the market with fast growth.” When asked where the funds are going, Ravinutala replied, “Most of the capital burn is in sales and marketing. We have to invest upfront in capacity and newer geographies to stay ahead of the curve.”

Typical dilution of 10-20% in each series, nearly $700m valuation

Ravinutala confirmed that each round included a typical dilution rate. While he wouldn’t confirm the exact valuation, he agreed with Latka’s calculations of it being a bit under $700m.

90% of Series C in the bank

Latka asked Ravinutala how he was handling the challenging macroeconomics of today vs. a year ago. The CEO shared that the company still has roughly 90% of the $78m in the bank, estimating that the capital will last them another 2-3 years. “As a company, we know we can’t let up on growth, but we need to do so at a more sustainable rate,” Ravinutala shared. He noted that they’re currently limiting new geographies and focusing on improving the product’s current feature set in lieu of continuing multiple experiments.

Famous 5 with Ragu Ravinutala

Yellow.ai Founder and CEO Ragu Ravinutala shared that his favorite business book is The Hard Thing About Hard Things by Ben Horowitz. His favorite CEO to follow is Frank Slootman of Snowflake. Latka noted that Ragu reminds him of Slootman in his approach to his business model. Ragu’s favorite online tool to build Yellow.ai is Canva. He sleeps 7-8 hours per night. Ragu is 44, married with two children. At 20, he wishes he knew it was OK to start your business and take risks early in life.