Solides CEO and Founder Alessandro Garcia’s story is one of perseverance. From its founding in 2010 to 2015, the Brazilian HR software company failed to gain traction. In 2015, Garcia’s fortunes began to change after revamping his pricing model to a SaaS. It took another 4 years to hit $1m in ARR, but then sales exploded to an expected $60m ARR in 2023.

The CEO recently shared with the GetLatka team his entrepreneurial journey to building the #1 HR tech company for SMBs in Brazil, revealing how he grew from 4X in 2 years, what market conditions have accelerated his growth, and why he’s waiting 2-3 more years to IPO.

- Team of 700, with 200+ engineers and 150 salespeople divided into teams: expansion, medium business, SMBs

- 20,000 customers managing 2m employees

- ARPU of $130 per month

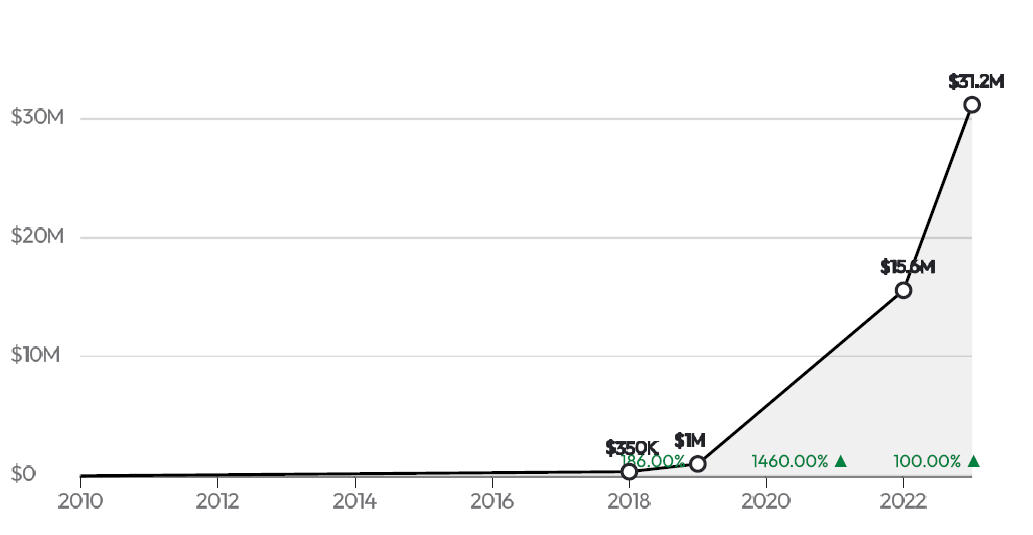

- $31.2m ARR in 2022, up from $15.6 in 2021

Introducing 20,000 SMBs to HR processes

According to Garcia, almost 20,000 small and mid-sized Brazilian companies subscribe to Solides for HR implementation. “We provide holistic talent management, so you can attract, develop, and retain talent using people analytics, AI, and behavioral management,” explained the CEO.

He added, “Most SMBs don’t have HR processes in their company. We help introduce to these companies the ideals of hiring, retaining, and engaging talent to increase productivity and reduce costs.”

Product drives growth with $107,000 annual savings

“Triple, triple, double, double” is how the CEO summarizes Solides’ last 4 years of growth. But how? Garcia points to two significant factors. First, he says, “It’s easy to get customers and generate results for them. Our software saves companies an average of $107K per year.”

Secondly, he noted, “Today, we don’t have other players providing job software for small companies in Brazil. You have companies like BambooHR (and Rippling) in the US, but here we are playing this game alone.” He added, “We must explore this opportunity and run as fast as we can.”

Bootstrapped until $3M Series A at $15m valuation in 2019

Four years after pivoting to a SaaS model, the bootstrapped Solides passed $1m in ARR and secured a $3m Series A funding round from DGF, so the company could continue to grow. That funding launched Garcia’s company into a high growth mode, where they tripled their ARR for two straight years before “slowing down” to 100% growth in 2022.

2022 Series B round of $100m at $800m valuation

CEO Garcia indicated they closed a $100m Series B round last year at a valuation of $800m. He confirmed that they gave up more than the typical 10% to partner with an investor who can help prepare them for an IPO.

On track for 2X in 2023 to $60m ARR

The founder confirmed that Solides is on track to hit $60m ARR by the end of 2023, effectively doubling its ARR again from $31.2m in 2022. Garcia confirmed, “80% of that will come from organic growth. We want to grow the other 20% from an M&A inorganically.” In 2022, the company acquired Tangerino, a time clock tool that doubled Solides’ total customer count from 10,000 to 20,000.

105% Net Dollar Retention with 24% gross churn and 30% expansion

According to Garcia, the company’s current gross churn is 24%, with a 30% expansion that leads to a 105% Net Dollar Retention. However, the CEO believes, “We have many opportunities in growth from 105 to 130%.” He added that their GTM strategy includes inbound marketing and inside sales. He added, “We have a major portal for job professionals searching for content, plus an academy with courses in HR to help inexperienced small and medium companies generate results. We can help them and then introduce ourselves and our services.”

Potential for Acquisitions

Founder Garcia admitted that he was looking for potential acquisitions. “We have an opportunity with very hard-to-build products, and we would lose a lot of time if we developed it ourselves. We are also looking for opportunities with companies in adjacent product categories,” revealed the CEO.

Problems with underwater options after 51X valuation?

Latka queried Garcia about dealing with employee morale after the $800m valuation, noting that US employee morale is down at companies where the valuations have come down, and the options are underwater. “We don’t have this problem. Even with the lower multiples and valuations. We have grown a lot since then, so we don’t have to deal with that,” adding, “We have problems but not that.”

Targeting $200m ARR before IPO in 2–3 years

When asked about a potential IPO, the upfront CEO declared, “We are trying to build a solid business to offer in the public market. We don’t yet know where that would be. We are targeting $200m ARR per year before doing the IPO. If we do it in Brazil, though, we can probably do it at a little less, like $150m.”

Famous 5

Favorite Book: CEO and Founder Alessandro Garcia picked The 48 Laws of Power by Robert Greene as his favorite book. “A great choice,” quipped Nathan.

CEO he’s following: “I am trying to understand Parker Conrad from Rippling; he’s doing an awesome job,” revealed Alessandro.

Favorite online tool: Garciaidentified Google Calendar as his must-have tool.

Balance: Alessandro, 45, “easily” gets 8 hours of sleep nightly. He is married with two children, 10 and 15.

What does he wish he had known at 20? “In terms of business, I wish I had known the power of the subscription model earlier, so I could have explored it better.”