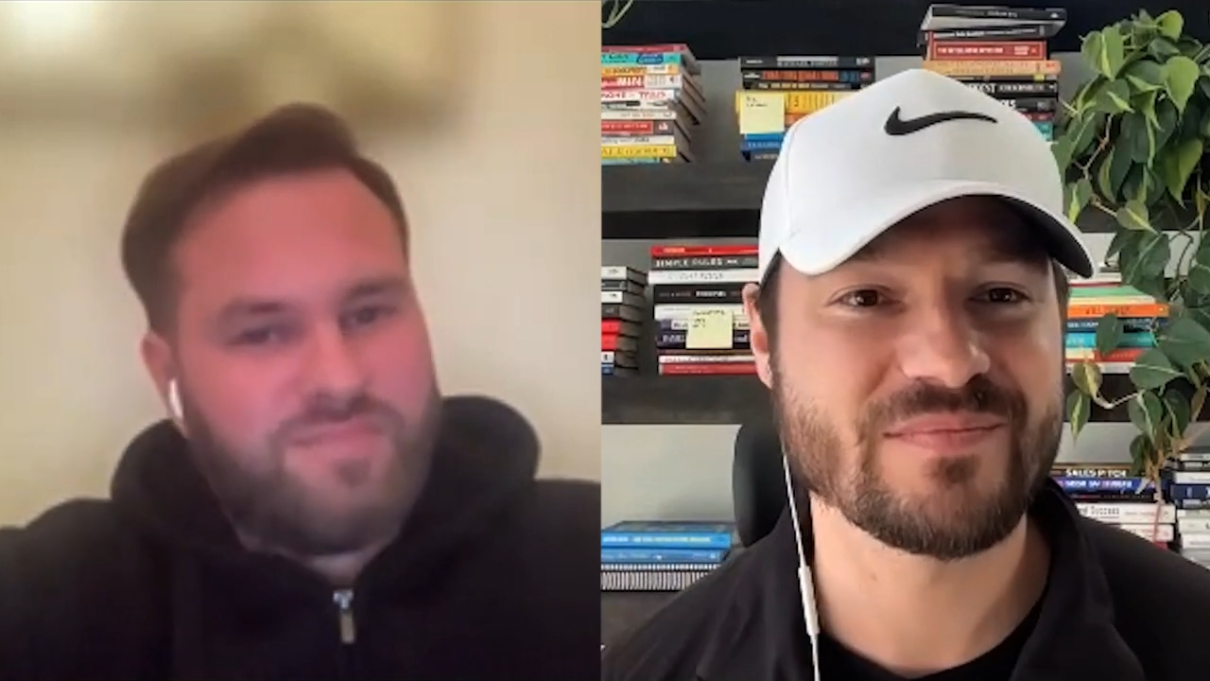

Slack remote team-building tool Karma bot is experiencing phenomenal growth. The company is owned equally by co-founders Stas Kulesh and David Kravitz. Co-founder Stas Kulesh sat down with Latka to discuss the company’s rapid growth.

- Monthly revenues have grown to $35,000 today compared with $14,057 in January 2020.

- The company gets most new customers from Microsoft teams and is now moving upmarket.

- They’ve hit $400k in ARR without raising outside capital

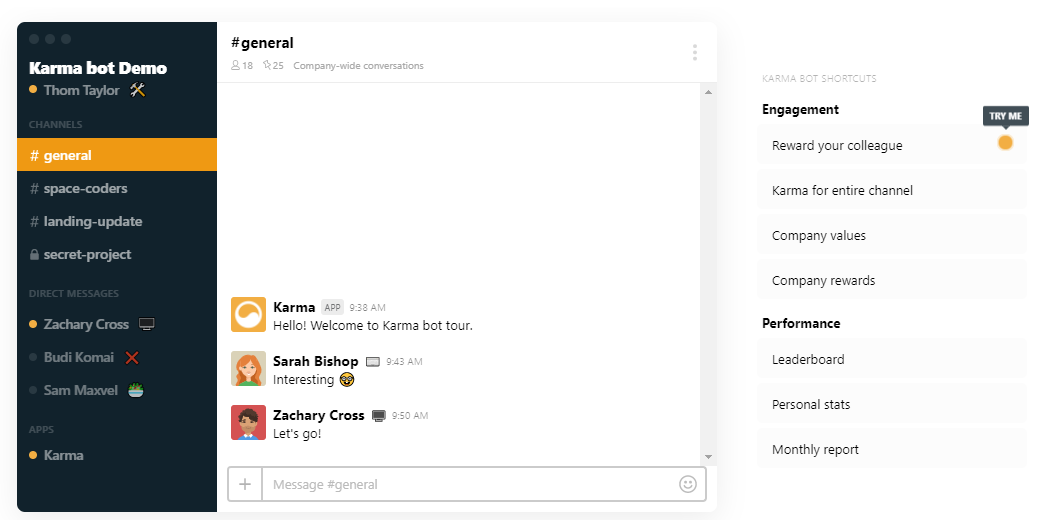

Karma bot allows team members to use Slack actions and inline commands to recognize the achievements of their colleagues. Its purpose is to improve team morale and performance.

According to Kulesh, the SaaS company is growing largely through word of mouth, demonstrations that convert to free trials, and from free trials downloaded from Slack.

Karma bot Gets 500 New Trials Every Month From Microsoft/Slack

Most of Karma bot’s new business comes through customers who download and install it from Slack or Microsoft. In fact, the company gets about 500 new trials a month in this way. Customers can access onboarding materials on Slack, as well, and can try Karma for 30 days for free.

The company considers those who send Karma every other day during the trial period to be prime targets to sign up for the service long term. From there, the company can upsell customers by encouraging them to buy gifts for the team, and Karma receives a portion of the revenue from the gifts.

Karma also can sell extra features. The best-selling feature is an automated one-on-one Karma Connect, he says.

Seven to 10 Demos A Week Grow the Customer Base

Kulesh demos Karma bot at least seven to 10 times each week. Out of that, about 10 percent, or almost one new customer a week, converts to a free trial.

Karma bot Now Serves 350 Teams

As of September 2021, Karma bot serves 3,000 individual customers across350 teams. That’s up from about 240 teams one year ago. The company’s ARPU (average revenue per unit) is $100 per month, which adds up to $35,000 monthly or $420,000 per year.

Monthly Profits Are $25,000

Kulesh and Kravitz operate Karma bot as a side business and do not need to take large amounts of cash out of business for living expenses. Kulesh, for example, also owns and runs Sliday.com, a design and development studio, and does consulting work.

Kulesh and Kravitz each own 50 percent of the business and take dividends as needed. According to Kulesh, they put most of the profits back into the business while taking some money out for travel and to live a good life. Out of the $35,000 in revenues each month, profits are about $25,000.

“We’re playing a long game,” says Kulesh, who grew up in Siberia, studied computer science and physics, and now has immigrated to New Zealand.

“We want to keep capital reserves so we can make smart investments in the future.”

Karma bot Raising $400k?

The partners also have discussed raising capital rather than continuing to bootstrap. The challenge is that the time spent raising capital takes away from time spent building the product, Kulesh said.

In a previous interview, Kulesh indicated that the minimum amount of capital that would be helpful is about $400,000 to $500,000. That amount of investment would have netted about a 10 percent equity share then, although the firm’s sales and profits have grown considerably since. The 10 percent is the largest amount of equity the partners have indicated they might be willing to offer.

If they did raise capital, the company would use it for marketing. Karma bot is in a new Saas industry sector that sells people culture as a service. He says that they want to explain more fully what Karma bot does and how it can help companies build a high-performance team culture.

The company does little marketing currently because it hasn’t found the perfect marketing channel. Its primary customers head companies or teams, and Karma bot hasn’t yet found the best way to target them, Kulesh says.

Partners Turned Down a $1 Million Offer.

Karma bot has become so successful in this age of remote working that a prospective buyer recently offered Kulesh and Kravitz $1 million for the company. The two turned the offer down.

“One million doesn’t do it for us,” said Kulesh. “We can get that much in three years.”

Kulesh doesn’t know whether they would sell if someone offered a larger amount – like $10m.

Karma bot Stays Lean With 4-6 Team Members

A key to Karma bot’s high profitability is its ability to keep its expenses to a minimum.

Despite the company’s large revenue growth since last year, the company hasn’t really grown its employee base. The size of Karma bot’s team is still in the four to six range, with people rotating between Karma bot and projects at Kulesh’s other businesses. The company also uses a few contractors when the company needs extra help.

“We want to stay lean because we are bootstrapping,” says Kulesh.

Churn Rate is About 3% Monthly

The company’s churn rate has gone up and down throughout its three-year history. The company has experienced a churn rate of between 2% and 3 % a month during the pandemic. This rate is considerably higher than pre-pandemic rates.

One reason for the higher-than-usual churn is that some customers have gone out of business during the pandemic.

Another reason for the churn rate is the changes that occur in company leadership. Often after two or three years, the leadership of the company or department will change. When new managers take over, they want to institute a new culture and decide to try something different from what their predecessor used, Kulesh says.

Growing 7% A Month

Karma bot keeps adding customers. Despite the churn rate, the company is growing. In fact, Kulesh says the monthly growth rate is 7 percent.

Will the company keep growing so rapidly once the pandemic ends?

Their ability to arbitrage CAC by getting customers from the Microsoft and Slack app exchanges is enabling them to grow bootstrapped.

Can they build a $10m business on the back of exchanges or is this a one off product only?