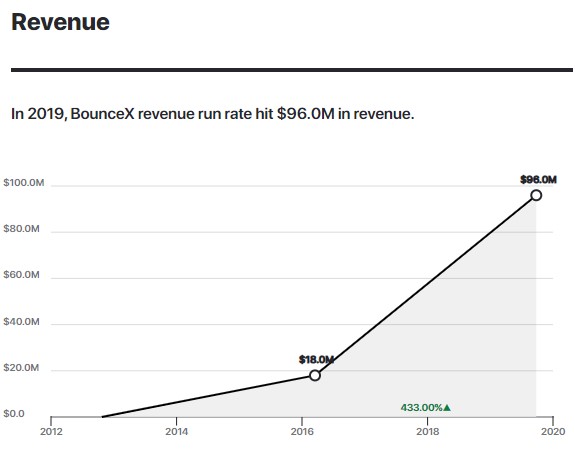

Wunderkind, formerly known as BounceX, helps e-commerce websites bring logged-in experiences to logged-out website visitors across devices using device identity resolution software — ultimately increasing revenue and improving customer experience for clients. Launched in 2011, Wunderkind now serves over 1,000 online businesses and hit $100 million in annual revenue in 2019.

Wunderkind’s pricing system is based on the lift in sales clients experience during a three- to four-month pilot period using Wunderkind — and clients usually see an increase between 5% and 20%, CEO Ryan Urban told Latka in an interview.

Clients pay Wunderkind anywhere from $6,000 to $60,000 a month for its software, and Wunderkind’s sales team signs almost 40 new deals a quarter — adding $20 million dollars to the company’s annual revenue per quarter.

For Wunderkind, the key to unlocking growth has been to create a tight-knit, integrated, and specialized sales team: moving from a traditional sales strategy (with cold emails and hand-off between team members) to a named account strategy (with a single representative assigned to an account) has been transformational for Wunderkind.

“We should have moved to named accounts much quicker,” says Urban. “Clients are now paired on a one-to-one basis with a new business rep… and it’s up to that business development associate to get in there, to move on the organization, be on calls and meetings, take notes, and help facilitate the process.”

Source: GetLatka

Verticalizing has also been important in leveling up Wunderkind’s sales success: whether by location (such as the United Kingdom) or industry (such as online publishers), the sales team now own both their verticals and accounts.

At the time of this interview, Wunderkind was hoping to go public, but wants to have a strong IPO, with a net client growth of $124 million and at least a 50% growth rate. To get there, Urban and the Wunderkind team plan to expand product, keep up their razor-focused sales processes, and move up market.

“You always do that: you always move up market and focus on your product,” Urban says. “Our sweet spot is e-commerce companies that do between $5 million and $1 billion in revenue, so the stuff we’re shipping now is really focused on companies doing a billion to $40 billion in revenue online.”

Over the coming months, that’s the main focus for Wunderkind — and keeping concentrated on that goal is how Urban expects Wunderkind to hit its goals and go public. “We’re super, super narrowly focused on that stuff,” he says. “We typically do things that are new to market, but this has to be best in class.”

Get to Know Ryan Urban, CEO of Wunderkind

Name: Ryan Urban, age 39, single

Where to find him: LinkedIn

Company: Wunderkind

Noteworthy: Urban went to university and got a Master’s degree — but wishes he hadn’t. As someone who loves working, he wishes he’d dropped out of high school and started working much earlier.

Favorite business book: Books by Andy Grove

CEO he respects: Adam Neumann

Favorite online tool for building the business: Oracle

Transcript Excerpts

Don’t get distracted by shiny features

“It turns out it’s really simple: [clients] just need revenue growth and they want to improve customer experience. So everything focuses on that and only that. So you don’t want to do cool stuff: you don’t want to be rolling out features. For us to ship a product or a feature, it has to drive increased revenue — at least 2% to 3%, depending on which product is.”

Buy other businesses strategically

“An acquisition is a hell of a marketing channel.”

Leaning into experiential marketing to gain prospects

“For our top 500 accounts, we want to go in at the CEO level. So how do you create these experiences where a CEO will come out? We spent about $200,000 to rent a private suite at the U.S. Open finals. We choppered all the CEOs in, so they got to meet some other CEOs and CMOs of big companies. … It’s an amazing experience, and a good way to get some of your prospects who were in an active pipeline out and then gain new prospects.”

Leading in a new category

“There’s a point in a SaaS company where you’re the default. I generally think we are default, but we need to make one-to-one device identity resolution a really established channel. And once that channel is a default thing, then we’re going to really see some special growth.”

Full Transcript Speaker 1: … you’re going to love this interview. Just got done editing it. I’m glad I got it live for you. I’ll be in the comments for the next 30 minutes hanging out, answering any questions you have. In fact, leave a comment below about data points or what you think is going to happen to the company. And I will respond to every comment. Additionally, if you’re just loving the content, click the thumbs up and I will go and check out your profile as well and give your videos some love as well. In the meantime, enjoy the interview. Hello everyone. My guest today is Ryan Urban. He’s the co-founder and CEO of BounceX, a marketing technology solution that brings a logged in experience to logged out website visitors across devices. Under the company, BounceX has been ranked number one for employee retention and career development by Computer World and named a best place to work by Cranes and Fortune. Ryan, you ready to take us to the top? Ryan Urban: Yes. Speaker 1: All right. Ryan Urban: Speaker 1: Yeah, right, we’ll see. So first off, thanks for letting us host the CEO forum at your spot. You had a nice big move. So where are you now? You’re in the trade center, correct? Ryan Urban: One World X. Speaker 1: Ryan you got to show people the view real quick. Turn the computer, let them check it out. Ryan Urban: You’re going to come with me. Speaker 1: There you go. Walk us around. Look at this view, guys. If you’re not watching on YouTube, flip over to YouTube and a hell of a view, right? Ryan Urban: Yeah. Speaker 1: Good stuff. So, okay, Ryan. So when pivoted in terms of messaging, I don’t know if the projects actually pivoted over the past couple of years. How do you describe it today in a sentence? Is that right, “A logged in experience to logged out visitors?” Ryan Urban: We evolve the messaging. So we’ve been around about six aND a half years, and we’ve always been focused on two simple things. So I had an e-commerce background. So did the other co-founders of BounceX. And we were just focused on just driving revenue and improving experience. So it’s over time that the product mix evolved. So we started doing email capture and being really good at that. And everyone knows our exits and stuff. Then we’re like, “Hey, we’re collecting all these emails. Let’s let’s do some triggers.” So we rolled out the product abandonment and we start doing some trigger email and doing that at scale. And to scale triggers, you need identification because on e-commerce websites, less than 5% of people logged in, no one creates accounts anymore. So it’s like, “Okay, let’s scale all the triggers with identification.” And so over time as the business [inaudible 00:02:11], our messaging has updated. Basically, we’ve always been doing the same thing. We’re on the side of e-commerce companies, drive a lot of revenue, and we have experience. Speaker 1: What’s a lot of revenue, Ryan? Ryan Urban: Typically, any business we work with, we’re able to increase their revenue by, say, 5% to 20% within 90 days. And it’s usually more in the 10% to 15% range, and that includes multi-billion dollar companies. And the smaller company or a [inaudible 00:02:38] company doing, say, $10 million dollars, we’re usually more [inaudible 00:02:41] 15% to 25% pretty quickly. And normally we’re typically a top three channel in someone’s Google analytics and oftentimes number one. Speaker 1: Do your sales people have to fight for that attribution? Or is it crystal clear that’s because they installed BounceX? Ryan Urban: Well, the attribution is based on our client’s analytics. And also when you find over attribution when your product doesn’t work. When your product works, you feel it, it’s like, “Hey, look, I’m growing here. Wow, what’s happening?” No, it’s like, “Hey, your analytics, last click, we’ll take… Last click is not the best way to measure things, but you should be running control groups. But we’re okay, cool. Just whatever’s in your analytics we’re pulled up.” Speaker 1: Do you take a percent of the increase or are you flat kind of SaaS model only? Ryan Urban: We’re a flat SaaS kind of shop, but we will typically do a three or four month initial terms of pilots, which is very unlike most of the [inaudible 00:03:34] companies who require one or two year initial terms. And based on… There’ll be a price, a monthly price there, but we’ll have a tier pricing approach where based on how much increase in revenue, it will automatically go into another 12 month agreement at a certain flat rate SaaS. So based on basically our identification and how we perform during that trial period, it could lock into a higher rate. So that’s how it goes but it’s flat rate SaaS. Speaker 1: So when you look at the cohort right now of all the customers you’re serving. Help me understand sweet spot spot an average customer is going to pay about what per month to use the tech? Or per year? Ryan Urban: There’s a median customer. An average is a funky kind of thing. So the cohorts, I’d say there’s three cohorts. So cohort one is the big ones, the Megalodons, as we call it here. And those are the seven figure ones. So those are the ones that are, they used to pay us between one and ne and a half a million dollars a year. Now we’re getting some that in the two to five million dollar range. So we’re moving the market quite a bit. Speaker 1: But that cohort, you call them your Megalodons, they’re all paying more than a million a year? Ryan Urban: That’s right. And then you have the bottom cohort, which is our minimum is 72K a year. So it goes 6K a month is the companies that we do it five to 10 mil online. And so the cohort between paying us between 6K a month, and I’d say 15K a month, that’s that mid-market cohort. And then we have the enterprise cohort, which is basically the 20K to that 50K, 60 K. Speaker 1: So you kind of have four. The Megalodons, and then enterprise, middle, small. Ryan Urban: I’d say three. Speaker 1: Three. Ryan Urban: There’s strategic and there’s the Megalodons, the big strategic ones. And those really do move a business. Speaker 1: Yeah. Now, if you just add up the revenue from just your Megalodons, does that make up more than, call it 30% of your total revenue? Ryan Urban: It’s probably about that. It’s not heavily weighted, which is good. We sign a high volume of deals. We’re signing almost 40 deals a quarter. So, and maybe we’re doing two of the big ones a quarter. So it’s pretty diverse. Speaker 1: Okay, good. Now, two of those big ones a quarter means your new bookings per quarter then is well north of $2 million dollars at this point. Ryan Urban: Our new books and quarter is approaching $20 million dollars. Speaker 1: Yeah, yeah. Way bigger. Okay. Very good. Now when you look at the segment that’s growing the fastest, are you generally focusing on- Ryan Urban: That’s AR. Speaker 1: Yeah, yeah, yeah. When you’re looking at what segment is growing the fastest, revenue the fastest, is it that top tier or no, you seeing a lot of movement in the bottom tier? Ryan Urban: And and. So we should move to named accounts much quicker. So we mapped out our time and after 4,000 named accounts, we used to have SDRs. Now we kind of have an elevated version of that role. We call it a BDA, Business [inaudible 00:06:19] Associate. So they are paired on a one-to-one basis with a new business rep. And well, they’ll maybe 80% of the time, one rep, to 20% of their time with another rep to spread it out a bit. And they’ll have between 40 and 100 named accounts, depending. Mid-market will be more towards 100, strategic will be more towards 40 or 50. And whether those are clients or not, their goal is to, one, use all the resources we have abouts, which is themselves, the rep, our marketing team, our alliances team, to break into the account at the appropriate level. So we have something called, we don’t do leads, we have something called a sales accepted opportunity. Which is like, it’s the right company, we will map out the work and we’ll have a group, three or four people. Ryan Urban: That if the meeting is with that person and the meeting went a certain way, then that’s an approved opportunity. So we have very high standards on that. So it’s up to that business development associate to get in there. And also post getting in there, then it’s [inaudible 00:07:21] active opportunity, it’s their job to move on the org, be on calls and meetings, take notes, help facilitate the process. So it’s a farming system for our sales team, as opposed to, “Here’s some STRs or cold emailing.” And cold emailing, email templates and hands over sales. It’s not that… It’s a very cohesive unit. So as we did that move to named accounts, we are just, it’s not and, or, it’s an and and situation of mid market’s growing, enterprise’s growing, strategic’s growing, Megalodon’s growing. And we’re not at the point where we’re default setting. There’s a point in a SaaS company where, say Salesforce is… Your CRM, there’s the default [inaudible 00:07:59] for email and for an e-commerce company. ExactTarget was the default for a while. DemandWare, which both [inaudible 00:08:04] Salesforce is the default if you’re a mid market and e-commerce company Shopify is your default. Ryan Urban: So for us, we are for… I generally think we are default, but we need to make one-to-one [inaudible 00:08:17] resolution a really established channel. And once that channel is a default thing, then we’re going to really start to see some special growth. Speaker 1: You were serving 250 paid customers back in 2016. What are you at now today? Ryan Urban: We’re probably on about 1,000 websites. Speaker 1: Is that paid customers though? Ryan Urban: Yes, it is. Yeah. We don’t do anything for free. Speaker 1: Yeah. So, okay. So 1,000 paid. I like this approach you’ve taken. So you essentially said, “Okay, I’m going to go look at all the e-commerce brands with more than X amount of GMV based off some…” You probably scraped that data from somewhere, obviously legally, but scraped it, whatever, paid for it. And then you map out the 4,000 accounts and you say, “We want to get all these 4,000 accounts.” You’re at 1,000 right now. Is that accurate? Ryan Urban: Speaker 1: Your publisher business is like Forbes? Ryan Urban: What’s that? Speaker 1: Your publisher business, you mean like- Ryan Urban: Yeah, CNN and stuff like that. We help publish in a lot of ways. So we’ll help them grow their email list, help them drive subscriptions, we’ll help them with creating new ad real estate. So redefining what an ad should be. So we just take an approach of, “Hey, if we’re going to be in the e-commerce world, we’re just going to be a true partner and be on their side and understand what the business needs.” And it turns out it’s really simple. They just need revenue growth and they want to improved customer experience. So everything just really focuses on that and that only. So then you don’t want to do cool stuff. You don’t want it rolling out to features. It has to hit a certain increase in revenue for us to ship a product or a feature. It has to drive increased revenue, at least 2% or 3%, depending on which product it is. And, for example, say re-targeting Criteo’s whole business, which they are a multi-billion dollar company and they only increased revenue by about a half percent. Ryan Urban: So for us even to have a product extension, which is basically a feature, it has to be 4X better than Criteo’s whole business for us to ship something. And it has to improve experience too. It’s not just, “Hey, let’s go run more sales or send more emails.” It’s- Speaker 1: You’re talking about Criteo, C-R-I-T-E-O, correct? Criteo? Ryan Urban: Yeah. Speaker 1: Yeah. Ryan Urban: Yeah. Speaker 1: Yeah. Now you head back. I know you chose not to go the bootstrap route on this thing. How much total capital have you raised today? Ryan Urban: No, I funded it myself at the beginning and then the first year and a half, it was funded by the co-founders. And if you were going to join as a co-founder, I made you put in even 40K. You had to put in 40K if you’re going to go in. Speaker 1: So all the co-founders put in 40K? Ryan Urban: No, some put a lot more. One put in 190. Speaker 1: How many of you are there? Ryan Urban: I probably put in 350 to 500 depending how I look at it. And there’s just- Speaker 1: How many are there? Ryan Urban: There was four. Speaker 1: Okay. Four co-founders. So altogether, how much total do you guys all put in like a million, 2 million? Ryan Urban: No, that’s like 600K. Speaker 1: 600 grand. Now did you- Ryan Urban: And then after we got to about 70K in MR, we got to about the a million dollar AR point. And we had a good pipeline then we raised a bit. We only raised, this was 2013, mid 2013. We only raised a million and a half bucks when we could have easily raised four or five then. And so I know we basically went through the first almost four years on that million and a half venture money raised. We did take a little venture that too, like [inaudible 00:11:52] from WTI. That was great. Now we were in Silicon Valley bank. Speaker 1: What year was that, the WTI deal? Ryan Urban: That was probably the [inaudible 00:11:59] 2014. And we’ve acquired four companies. So some of that’s used to fund some acquisitions. We- Speaker 1: How much leverage can you put into that? Can you go buy a company if the deal price is 10 million cash, can you get away with putting up a million in equity and the rest in debt? Ryan Urban: We can leverage about depending, on the strength of your business, somewhere between 0.8 and 1.2 times your AR and we could flex a little more. Speaker 1: Of your personal AR or company you’re buying? Ryan Urban: Your personal AR. And then they’re going to look at the company buying and how much money you’re losing, et cetera. So you don’t want to be too levered, but it’s really under underrated and you give… The market’s really good for terms you can like- Speaker 1: Ryan, and are you talking like 2% to 6% interest rates somewhere in that range? Ryan Urban: There’s going to be some that are 6%, some that are going to be more in the 10% range, if you’re looking at no interest for a certain period of time or very low warrant coverage. So you might give up like a point about [inaudible 00:12:56]. So the ones that are taking a little equity, they might… Or say there’s no covenants, or there’s minimal covenants. So very friendly terms, you might be paying more than the 10% range, but that’s still super cheap. So then you can raise your paid off where you can keep rolling if you like, if you’re doing well. Speaker 1: So you mentioned another venture round in 2017. What was that round four? Ryan Urban: I don’t think the… The venture questions aren’t really the right questions. It’s when you feel like you have product market fit, or do you have some marketing channels you could really explode on that’s the right time to do it. Speaker 1: By the way Ryan, I asked because there are two very different models. Some people bootstrap the whole time, sometimes you get on a VC track and a VC track is just very different, right? So didn’t you raise in 2018? Didn’t you raised 37 million from Battery? Ryan Urban: A good amount of that went on the balance sheet, but not all of that. So some of that you use to like buy out some early investors. So we put less than 30 on that, but we’ll end the year with- Speaker 1: What do you mean you put less than 30 on that? Well, we put less than 30 into the business. Some bought out some… Or just there’s some liquidity for some earlier, earlier initial- Speaker 1: Yeah. So 8 million went to secondary, early founders, early investors, and less than 30 went to the balance sheet. Ryan Urban: That’s right. And our cash balance is going up now. So we’re close probability, but we’re cashflow positive. So we’ll end the year with a good amount of cash. So not 30 million, but a lot of cash. So now we’re in a position where we don’t need to raise money, but we’re coming up for two best quarters ever. And now we found someplace that we could really hit gas. Speaker 1: Yeah. But you did another $30 million on a Silicon Valley bank a year prior. Correct? That was equity. Ryan Urban: that was a different deadline. It was a little less. So [inaudible 00:14:46] was talking about [inaudible 00:14:47]. And that’s something that we have the option to pull some, we won- Speaker 1: So that wasn’t actual dilutive. That was essentially like a term loan, like revolver or something. Ryan Urban: Some was based on AR. So altogether we probably have about 60 into biz. And then you minus the cash in your balance sheet. And we’ve probably deployed somewhere in the 30. Speaker 1: Got it. So you still have like basically 30 cash in the bank. You’ve raised 60 in equity. And 30 has been spent to grow the business. Ryan Urban: Some within 20% of that stuff. And let’s assume that we’ll end the year. Well, north of 100 million. Speaker 1: Are you past that right now? Or are you still need a three months to break that? Ryan Urban: It depends how you publish your [inaudible 00:15:31]. Speaker 1: How do you measure it? Ryan Urban: If you’re just looking at clean e-commerce SaaS, we’re basically there, but if your publish our business and then we will be [inaudible 00:15:44]. Speaker 1: Why would you not count the publisher business? Ryan Urban: You could, it’s if you look at the net revenue of that, it’s a nuance thing. So it depends the way gap looks at the revenue from that is it changed all the time. So I look at it- Speaker 1: I would say, I would be counting every dollar. If it’s cash come into the bank, I’m counting it. Ryan Urban: This is what we’re looking at. We’re looking to basically to have a strong IPO. Some companies wait until like they’re doing 300, 400 million. Some companies go at like 100 million. What we’ll probably do is we want to get our net revenue retention, which I hate the word. I don’t use the retention just for client growth. But our net client growth, I want that overall to be above 125. Speaker 1: What’s it now? Ryan Urban: One of the issues we had is we’ve ran out of stuff to sell to our clients. We sell for [inaudible 00:16:36] seriously. So it keeps special products. It takes like a good team. So we’re in alphas with two really, really special products and we’re going to acquire something great. We could put our [D tech 00:16:47] on top of. Speaker 1: But what’s it now. So you want to get 125. What are you at now? Ryan Urban: It’s not that. I think we want to improve by 20%. I’ll put it out. Speaker 1: Okay. So you’re above 100% though right now? Ryan Urban: Some cohorts were much higher than that. And some cohorts were lower. So as you move down market, the numbers are lower. And also depends on the fact we’re say, if we’re partnering with a marketing client and we’re sending our stuff through. If we have our product suites all through. So depending on the cohorts, we know the cohorts where we’re right now, 130, 140. And one, you want to get more of those cohorts and two, ship more products for those cohorts. So in a core strategy perspective. This is the way that I look at it, and this is kind of important. So you could take your same product, move up market. You can take your same product with [inaudible 00:17:38]. You can take the same product with other verticals. You could take your same product and move to other geos. You can do new products to the same market that you’re selling to right now. Or you could do new products, new markets. Anyone who does new products new markets is a complete idiot. So the route that we’ve taken… And all these things are quite product work. Ryan Urban: Actually the most product work is moving down market, and it’s the worst. So we’ve just taken approach that, “Hey, we’re going to keep it simple. We’re going to take our same product, move up market. [inaudible 00:18:06] a little more API approach.” You always do that, you always move up market and you focus your product, move up market. And then we’re shipping new products to the same work. So our sweet spot is e-commerce companies do between 5 million and a billion dollars in revenue. So the stuff we’re shipping now is really focused on companies doing a billion to 40 billion in revenue online and new products that same work and super, super narrowly focused on that stuff. And when we ship our product, it needs to be… We typically do things that are new to market, but it has to be so buttoned up, best in class. Just- Speaker 1: So what other metrics do you want to hit besides 125 net revenue retention before you’ve still got an IPO? Ryan Urban: You want a predictable growth. So there’s this magic number stuff. The difference between growing 40%, 70%, can be huge as a multiple. Right now growth is looked at as everything. But your growth needs to be predictable. So now we’re flat rate SaaS. Flat rate SaaS lowers predictability. The net revenue retention will help with predictability. Because then we know, “Hey, if we’re say had 200 in AR, and our net revenue retention 125, boom, we’re going to be at 240 in the next year.” Speaker 1: With no new customers? Ryan Urban: With no new customers. It depends what’s up for renewal. So yes, with no new customers here. So you want to have that. And then I would recommend only doing usage based pricing or having shipping products that support usage based pricing. So for us, that’s going to be some API service platform as a service stuff, some stuff that’s maybe an active contact here. So a little more of a more [Kettler 00:19:37] approach. You can’t just make that up [inaudible 00:19:39] your interests support that. So make sure when you’re shipping products or you’re going to acquire a product that it’s something that supports usage based pricing. Like [inaudible 00:19:48] that’s almost a 40 billion on markup. They charge a platform fee, but transaction fee. So as businesses grow, they get the benefit of that. Where our core business, our customers get the benefit of locking it at a rate. The rate is really high and it’s backing into a great return on spend number. But if their business doubled, they’re just getting much more ROI from us. Ryan Urban: So it was helpful in the early days for us to grow, but we need other stuff that like, “Hey, as our clients grow, that there’s going to be a step up as well.” Speaker 1: And what’s your overall, so if you’re brick 100 million in AR this year, where were you a year ago? Ryan Urban: Well, let’s talk about where we want to be. We can IPO at like 40% growth, which we’re… Growth is something that you do have a lot of control dictating. So that’s like we’re cashflow positive. So I’m at the point where I feel really comfortable with product market fit on some of the new stuff we have and an acquisition we’re going to make. We’re probably going to make our first, maybe [inaudible 00:20:44] acquisition, but not acquisition in the [inaudible 00:20:46]. Probably somewhere a company that… Companies were looking at the hub between 75 and 150 people. We were still rolling up a lot more tech. Speaker 1: So you’re talking like 10 and 30 million in ARR ish kind of range? Ryan Urban: Between 10 and 40. Yeah. Speaker 1: Yeah. Ryan Urban: And it’s going to be strategic, tactical, opportunistic stuff. So stuff we put our D tech on top of, and almost use as a marketing channel too. Where we can then go in and go to all their customers and upsell our stuff in. An acquisition is a hell of a marketing channel. Speaker 1: Did you do any acquisitions last year? Ryan Urban: We did one. Want it wasn’t announced. It was- Speaker 1: Are you less than you said you went IPO at 40% year over year growth. Were you less than 40% year over year growth in the past 12 months? Ryan Urban: It depends the way you look at it. We’ll probably finish the year more than that, yeah I guess. But it’s you have quarters, you have different goals, Q4, Q1. That wasn’t all, you’ve got to get the ships in check. For us, it was like having a scalable sales team. You got to have the product market fit your sales team. Now we always had like some real strong athletes, great performers, but like getting that enterprise mid-market team to a place where it’s a machine, where you got the right people in the right process and we got that down now. So we know we can hit the gas there. In a marketing standpoint for our top named accounts. Say our top, even top 500 accounts, we want to go in at the CEO level. So it’s like, “How do you create these experiences where a CEO will come out?” So we just spent about 200K we rented a private suite of the U.S open finals. We choppered the CEO’s into our… Place where our suite was and we also had other CEO’s out. And so they got to meet some other CEOs or CMOs of big companies. Ryan Urban: They got to go to the Nadal final at a private suite [inaudible 00:22:38]. And we only have the top people from our company there. So it’s an amazing experience. And then that way you can get your clients out. That’s a good idea to get some of your prospects who were in an active pipeline out and then new prospects. So doing things like that, it might cost 200K, but [inaudible 00:22:54]. There’s a 500K version of that, where you have John Backer on your booth with you hanging out with you. So we want to do something next year, we call it the Bill Clinton budget. So have these like million dollar experiences. If you want to get the CEO target out, it’s like, “Hey, we’re going to go get Bill Clinton, to hang out with us. But instead of giving a talk, he’s going to play the saxophone. And he’s going to be in a band with like Boyz II Men. And then Mike Tyson, literally rent out a ring and you get punched in the face by Mike Tyson. And then [inaudible 00:23:22] Sylvester Stallone.” Speaker 1: And you’re going to pay us for it. So that’s good. Hey look- Ryan Urban: So it’s like, take what Cameo does. Cameo on 100 dollars, you got a celebrity do this. You go like, create a… We want to create a great experience for the celebrities and presidents, but to hang out with like CEOs. And that’s where we’re going to do marketing next year. Speaker 1: Ryan, we’re running out of time here. Team size today, how many people? Ryan Urban: It’s about 400. Speaker 1: How many engineers? Ryan Urban: What we’ve been doing as a business generally is it’s been a less is more approach where we’re doing small focused teams of much more senior team. So as the business evolved, we were hiring way more senior people and putting them in smaller teams. So our eng team is shipping faster than ever. [crosstalk 00:24:07] 70 people. Speaker 1: Ryan Urban: On ramped quota is much less, that’s probably around 20. So it’s not that much. Speaker 1: What about unramped? Ryan Urban: Around the 40 range. Speaker 1: 40 range, interesting. Okay. Very cool, man. Let’s wrap up here with the famous five. Number one, favorite business book. Ryan Urban: It’s not a business book, the book that’s impacted me the most recently is the… Besides that, Andy Grove. Andy Grove is savage. Andy grove, that’s easily the best book of all time. Speaker 1: Ryan Urban: The [inaudible 00:24:52]. And Daniel [inaudible 00:24:54] book is amazing. It really gets [inaudible 00:24:55]. The book that has the most impact on me in the last year is the Howard Stern interviews. So I’m sure everyone’s watch Howard Stern reading a transcript of these interviews. The one with Madonna especially had some impact on me. It just changed my mindset. Like people thought, being a rebel, she was doing things to get a rise out of people. She was just doing what she thought was right. She was always doing what was right. And just reading, you have the most special people on the planet and getting read a transcript of an interview of Howard Stern was like… Getting the mindset of these special people like lady Gaga, Madonna, everybody. Donald Trump was on there [inaudible 00:25:33]. So that was really cool. So that was the best one for me. Speaker 1: Number two. Is there a CEO you’re following or studying? Ryan Urban: Yeah. I’ve been really following the Adam Newman stuff. I’ve I feel bad. He should not have stepped down. Speaker 1: I would have thought. Number three, is their favorite online tool you have for building your company besides your own? Ryan Urban: Yeah. And look, just give the right answer. Elon Musk is the most special person to exist on planet earth over the last 200 years. So hands down and no one should ever talk shit about that guy. Let’s just state the facts here. No one’s doing special things like that. And I’ve really appreciated Larry Ellison’s back in the helm and getting… Trying to build a great product. Larry Ellison’s a special guy too. Speaker 1: You’re talking Oracle. Ryan Urban: Yeah. Larry Ellison. Speaker 1: By the way, if someone offered you a billion dollars to take your company out before you IPO, would you take it? Ryan Urban: Not a chance. Speaker 1: Okay. And when do you think your in IPO? You think it’s next year you file? Ryan Urban: When we have those metrics, we have product market fit on some of the new things where we usage [inaudible 00:26:32]- Speaker 1: But you think you can hit 40% year over year growth next year. And you want to hit that before you [inaudible 00:26:35]. Ryan Urban: Next year I’m going to smoke that. So I really want to be at… My goal, I don’t want to be at less than 50% growth at IPO. And I prefer my EBIT to not be more than negative 10%. I would prefer to be at 65%, 70% growth. I want to be at accelerating growth. Speaker 1: Yeah. Okay. Very good. What’s your situation? Married, single, kiddos? Ryan Urban: Hold on. People read so many books. So stop reading books. Stop listening to podcasts. People listen to too much shit. If you listen to something, if you read something, you got to take action immediately. That’s it. But people read way too much. Stop reading books. Just go do shit. Speaker 1: So Ryan, situation. Married, single, kiddos. Ryan Urban: I’m an independent. Speaker 1: Independent, good. So no kids running around. Ryan Urban: I already have the best kids. I have a lot of them working so. Speaker 1: And how old are you? Ryan Urban: Well, I’m turning 40 in February, but I’ve unsubscribed from aging. So if you see me, [inaudible 00:27:32]. Speaker 1: All right. Last question, what do you wish your 20 year old self knew? Ryan Urban: Well, I wish my six year old self. I really regret not dropping out of high school. I went to college, got a master’s degree. It was one big mistake. Some people were just made to work. I should have been working at… I’ve literally should have been working at six. So if I told my 14 year old self would be, “Drop out of high school immediately, and then probably at the age of 16, go work for DoubleClick.” That was 1996, I would’ve worked for DoubleClick then and would have got a 10 year headstart. Speaker 1: Guys, BounceX launched back many years ago, 2011 ish timeframe, hit that first million in revenue fairly quickly, raised a little bit of money when they hit that million run rate. But since then basically use cash, very advantageous. Used a lot of debt today, about 60 million in equity in the company, 30 million still in the bank. Other portions of that were put towards secondary. But they’re profitable today as we look to scale, helping these large, large companies, again, scale online digital marketing experiences, across many different properties. Over 1,000 customers today, maybe IPO next year, we’ll have to see. Ryan, thanks for taking us to the top. Ryan Urban: Yeah. And also don’t quote me on the 30 million in bank, but we have a good amount of the money in bank and it’s growing. So it’s not a bad thing. Be in control of your destiny and you could see, some of the founders or special founders, they’re not there anymore. So as soon as things aren’t good. So make sure you have good relation to your board, but control your board. Tell them what’s up. Speaker 1: Thanks, Ryan. You guys know I fight like heck to get these data points for you from these CEOs that rarely do these kinds of shows. If you want more shows like this, make sure you subscribe right now. We’re trying to get 10,000 YouTube subscribers by the end of September here 2019. And it would mean the world to me. If you clicked now to subscribe. Additionally, I’ve got two more great interviews for you. If you want more data points from the world’s leading SaaS CEOs, click and watch one of them right now.