After monitoring the crypto space and recognizing its potential, particularly on Solana, Jack Lu, Co-founder of NFT marketplace exchange Magic Eden, decided to fill a need he saw in the market. Co-Founder Lu recently sat down with the GetLatka team to share the details backing up his claim that his community-focused interactive NFT ecosystem and marketplace Magic Eden is one of the fastest-growing companies in crypto.

The former crypto exchange executive Lu shared how long it took to launch Magic Eden and how they collaborate with high-performance blockchain Solana. Co-founder LU also shared how long it took the company to double its GMV from $200m to $400m and what’s next for the NFT marketplace juggernaut that hasn’t yet reached its first business anniversary.

- Launched in September 2021

- Team of 100 with 40 engineers and 30 former NFT artists/collection creators

- 30,000 unique buyers per month

- Second largest NFT marketplace in the world, launched 7 months ago

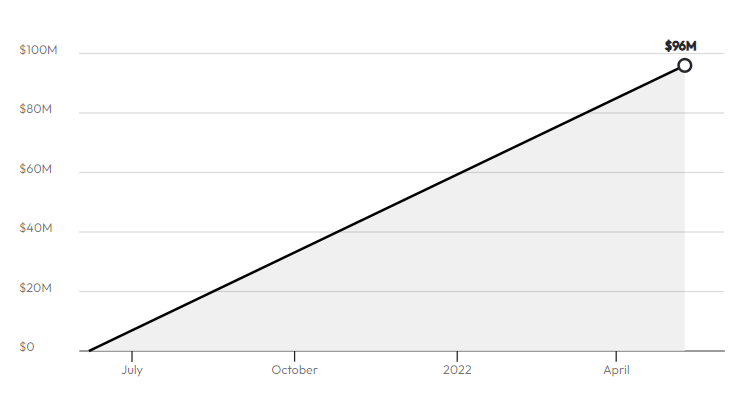

Co-founder Lu got right down to the numbers with Latka, noting that Magic Eden traded $400m in NFTs last month. They’ve already become the fastest ever to reach a cumulative $1b in GMV traded, having completed that feat 4-5 months after launch.

Launched in 14 days

The co-founder startled Latka by revealing that he and his three co-founders launched the marketplace just 14 days after writing the first line of code. “The first one was sticky-taped together. We wanted to launch fast to let the market tell us what we were doing right and wrong.” The approach paid off as the company’s growth skyrocketed.

Two keys to growth

Lu credits market timing and skillset synergies with his founding partners as the two most significant contributors to Magic Eden’s phenomenal growth. “In Q1 and Q2 of last year, Ethereum took off as NFTs because of a cultural zeitgeist,” Lu explained. “Then, in Q3 and Q4, Solana boomed in interest with NFT activity. We caught that tailwind,” he added. But Lu also credits Magic Eden’s success to the synergistic skillsets of his other three founding partners. He believes that together they had a collective intuition about what to build.

25% equal equity split

Co-founder Lu indicated that he, the CTO, COO, and Chief Engineer founders split company equity equally. He attributes their early success to the four having a balance of experience in crypto exchanges and consumer marketplaces. He and his COO founder came from currency exchanges, while his technical founders came from a giant consumer marketplace, UberEats. “Our business model is a crypto exchange, but the features look like a consumer marketplace,” Lu explained.

Nearly 10,000 NFT collections

Magic Eden has already grown to feature over 10,000 NFT collections. The creator of one of their first NFT collections, CyberTrolls, eventually became an employee. “He is integral to our founding story,” quipped Lu. The co-founder passionately reiterated that NFT artists and collection creators are the lifeblood of the company, proudly noting that one-third of their full-time employees are artists or collection creators. Their job is not to create company-owned NFTs, Lu clarified for Latka.

Two business lines, 80/20 revenue

Magic Eden generates revenue from two distinct but connected lines of revenue. First is Launchpad, the business endeavor that helps artists create their first NFT. This portion of the business generates 20% of the total revenue. 80% of revenue is generated by the secondary trading market, where collectors buy and sell NFTs regularly. This collector community drove $400m in GMV in April, of which Magic Eden takes a flat 2% transaction fee.

95% of Solana’s NFT business

The Magic Eden platform is built on the Solana blockchain. Co-founder Lu explained that Magic Eden has worked closely with the Solana Foundation since the beginning, noting that they were one of the company’s series A investors. Today, Magic Eden represents 95% of all of Solana’s NFT business.

2.5m Pre-seed Round

Magic Eden received a small pre-seed round of $2.5m in October 2021 to help with the initial launch. The quick-moving marketplace then signed a term sheet in November at a time when they owned about 30% of Solana’s NFT market share.

Raised $27m in Series A funding in February at a $220m pre-money valuation

By the time the $27m Series A deal closed in February, the company had already grown significantly, but Lu wasn’t interested in renegotiating. “We’ve doubled in revenue every two months since February,” he said, noting that their valuation today would be significantly higher. He and his co-founders sold approximately 10-15% of the company in that round.

$8m in revenue in April on $400m GMV

The revenue-generative business currently takes 2% of all transaction volume, consistent with other marketplaces. Last month’s $400m in GMV delivered $8m in revenue for Magic Eden.

Growth from Creators and Use Cases, not Chain Technology

Pressed about the source of future growth for Magic Eden, Lu quickly noted that NFT market growth would come from creators, not from the technology. NFTs are a new asset class, according to Lu. “The creators create use cases for NFTs. Chains just provide technology for where it lives,” he explained. Lu believes that new categories will be created for NFTs beyond the current digital collectibles. “We are very bullish on gaming going forward,” as Lu noted that in-game assets and purchases are a tried and true industry that’s been around for a decade. “We want to serve game developers,” he added.

Lu explains the popularity of digital collectibles

“Why are (NFT) OK Bears so popular?” queried Latka. The Magic Eden co-founder explained that what makes an NFT take off is branding and a community with fundamental value. The NFT itself, like the OK Bears profile photo, is an example of internet personal branding, like a Rolex or Nike bag. He adds that the successful NFT collections lean in to build their communities over time. “OK Bears built and grew their community over 6 months. They showed up, pounded the pavement, and did the hard work. And it shows,” explained an admiring Lu. Others who shortcut the process by hiring a bunch of influencers and don’t put in the work don’t see their NFTs take off.

2mm NFT transactions per month

The average sale price for an NFT on Magic Eden is $200-$300. Co-Founder Lu shared that they process about 2m transactions per month from at least 30,000 unique daily traders. He noted that NFTs have some whales who buy a ton like other collectible spaces, but most sales are spread among individual traders.

Internet version of an exclusive club

Co-founder Lu explained that NFTs can reward members with different experiences. Each NFT collection, like OK Bears, has a roadmap where the creators use the funds generated to mint a virtual world and create a curated experience for the NFT owners. “It’s the internet version of an exclusive club. You like the people, so you hang out together in the club,” noted Lu.

How would he respond to a $1B offer?

When asked if he would accept a billion-dollar offer from a creative organization like CAA, Lu quickly responded no. Instead, the co-founder is interested in experimenting and seeing where the market goes, noting that this is still the early days. “The DNA for Magic Eden is crypto-native. We want to explore and push the boundaries and would only consider partnering with others who share that vision,” he bluntly noted.

Famous Five

Today, Magic Eden Co-Founder Jack Lu’s favorite book is The Wind-Up Bird Chronicle by Haruki Murakami. He closely follows Crypto exchange FTX CEO Sam Bankman-Fried. Jack’s go-to tool for Magic Eden is Telegraph. “It’s a must-have for crypto communities,” he quipped. Jack sleeps roughly 6 hours per night. He is 32, married with no children. When asked what he wished he had known at 20, Jack replied, “At 20, I was in law school. I should’ve gone into computer science.”