Performance monitoring tool intermix.io helps users to capture metadata from their data warehouse and tools that connect to it. Co-Founder and CEO Paul Lappas helped launch the company at the end of 2016, and by December 2018 (when Latka interviewed him), it had nine employees spread out between its headquarters in San Francisco as well as in New York and around Europe.

Prior to intermix.io, Lappas co-founded GoGrid, an early cloud computing company. It grew to over $50 million in ARR, and then in 2011, it was sold to data center/cloud provider Datapipe.

“I had focused on technology at GoGrid and I really wanted to spread my wings and learn more about other sides of the business — marketing and sales,” Lappas says of the turn his career took after the acquisition.

Eventually, he teamed up with intermix.io Co-Founder Lars Kamp. Lappas hired a data scientist to help him create the initial version of the product, which was aimed at helping companies organize all their data in one place. Thus, intermix.io was born — and its first dollar of revenue came six months after a developer created the first line of code for the SaaS.

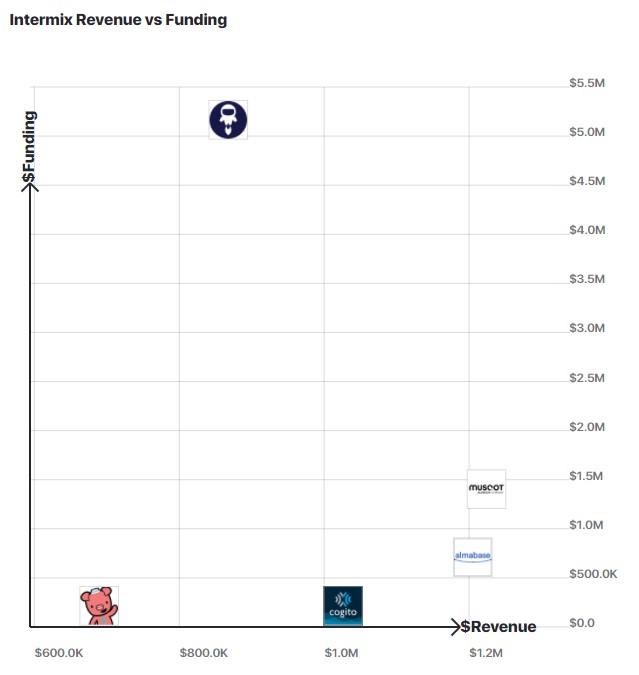

Lappas says the company is subscription-based and sells to enterprise customers that prepay for either one or two years. In 2018, intermix.io was a seed-stage company that had 25 customers, around a $50,000 ACV and was flirting with $1 million ARR (which was up from about $30,000 a month the year prior). The company’s annual revenue churn is under 5% and annual net revenue retention is above 100%.

Source: GetLatka

He also says intermix.io raised a little bit more than $5 million as of December 2018, and that was done in two tranches, the latter of which was a $3 million seed round led by Encore Capital . The decision to raise rather than bootstrap all came down to cost, Lappas says, pointing out that software engineers are expensive, so he and Kamp leaned on their combined decades of working in Silicon Valley to find investors.

The company is still working on product and isn’t yet cash flow positive, but Lappas says he plans to raise more. “We’re investing in R&D, our biggest cost is engineering and software development. And so our goal is to raise another round of funding about this time next year,” he says.

Get to Know intermix.io CEO Paul Lappas

Name: Paul Lappas, age 42, married with one toddler and another kid on the way.

Where to find him: LinkedIn

Company: intermix.io

Noteworthy: Paul was a board member for the nonprofit Arts Education International, an organization that provided community-based arts programs for orphaned children in West Africa, from 2010-2014.

Favorite business book: “Good Strategy Bad Strategy: The Difference and Why It Matters”

CEO he respects: Lew Cirne of New Relic

Favorite online tool for building the business: Heap

Average # of hours of sleep/night: 7

Transcript Excerpts

What a customer who signs up for a $50,000 intermix.io plan would get

“What you get for that is a single dashboard whereby your data teams, the ones that are building out your data lake infrastructure that your data scientists’ plug into, get a single view into all the apps that are connected — all the users that are running queries, the way that data flows through that system. And a very, very easy and quick ability to A, figure out is everybody having a good experience, are apps working, is the data lake working or, if not, why and what the root cause of that, so that you can very quickly pinpoint where data is getting stuck.”

What does it mean to be a seed-stage company?

“We’re at the point where we’re still figuring out the right go-to market. What is the best way for us to acquire a dollar? Can we make at least $3? Can we make that money back within one year consistently and have enough data points where we can go to an investor and say ‘Hey, if we had a billion of your dollars, we’ll be able to grow at this rate over the next two years.’ We’re close to that at this point, but we’re not quite there yet. So we’re still at that stage of the company.”

Solving problems for enterprise customers

“The thing that is the most exciting is that we’ve recently gotten traction in the enterprise. Very large Fortune 500 companies are now using us as part of their digital transformation. So when large enterprises shift their data services to the cloud, they experience a lot of pain and we’re there to help them make that transition away from the traditional data warehouses like Oracle and Teradata. And so we’ve been really excited to find that niche for ourselves.”

How intermix.io acquires customers

“We’re trying to get the CAC down. The way that we find customers is in two ways. One is, they find us through content. We publish a lot of content about data lakes, performance monitoring, visibility through a blog post or a white paper that we’ve written. And then we’re also reaching out to customers that we know are using Amazon Redshift. … It turns out the word ‘Redshift’ is not common in job descriptions. And so if you scrape Indeed, for example, you can figure out which companies are using it.”

Full Transcript Nathan: Hello everyone. My guest today is Paul Lappas. He is the CEO and co-founder of intermix.io, heeled multiple patents for cloud computing and performance analytics. And in 2007 he co-founded GoGrid, one of the early cloud computing companies, which grew to over $50 million in ARR. Paul, are you ready to take us to the top? Paul: I am. Thanks for having me. Nathan: You bet. Okay, that’s a big cliffhanger. We have to finish up the GoGrid story before, we talk about intermix. What happened to the company? Paul: The company got acquired. Nathan: Who’d you sell to? Paul: In xf. [crosstalk 00:00:34]. Nathan: What was the ecosystem like back then? Yeah, I mean, was it a good exit or soft landing or what? Paul: We had the opportunity to blow it up to be much, much bigger, if we had taken on a lot more capital. It’s very expensive to build cloud services, but we were really, really happy with the outcome. Nathan: That’s great. All right, intermix. So did you go directly into intermix after GoGrid or if not, what was the in between story? Paul: So, I spent a couple of years consulting with a few companies to help them bring their products to market. I had focused on technology at GoGrid and I really wanted to spread my wings and learn more about other sides of the business, marketing and sales. And so, I sort of was helping some other startups. I landed in 2013 and how I got the idea for intermix at a company called Criticism. Criticism, it was later renamed to [Actelligent 00:01:27]. Nathan: Much better name. Paul: What we were doing was a crash reporting tool for companies developing mobile apps. And it was super, super big platform. We had a little library that ran on over one billion devices across Apple and Android. What was really interesting about the company is that, we were sitting on a ton of data. For example, we could tell you, for Android how many activations were done on the AT&T network in Los Angeles in January. Because of the data that we had and it wasn’t part of what we were selling. But, my co-founder Lars that had joined intermix at the same time as me, that’s where we met. Approached me one day and said, “Hey, can we put this data into a place where we could sell it? I have a few companies that would be interested in buying it. Some private equity firms, other consultancies that were just interested in this industry data that was really hard to get.” And so I said, “Sure, how hard could that possibly be?” Paul: And I hired a data scientist to help me to do that. And almost immediately when that person joined, they were like, “Okay, great, where’s the data.” I was like, “Well, it’s here, it’s all these databases, just go out and find it.” and he was like, “No, I need to have it all at one place. It needs to be clean and complete and correct. And I need to be able to run my tools on it, my specialized data science tools.” And I said, “Okay, interesting.” Paul: And then I spent three months doing that and getting the data to a place where it was useful. And really at the time I’m talking to other peers in the industry, realized that a lot of companies were having the same challenge and making data scientists successful. And so, decided to leave that company. Lars and I joined up to start intermix shortly after that. Nathan: He, Lars was the data scientist? Paul: No, Lars was the head of business development activism. Nathan: Did you bring the data scientists with you or no? Paul: I did not. Nathan: Come on, Paul. Paul: Yeah, well. People that you would hire at a later stage are different from people that you need to start a startup. Nathan: You such a diplomat, smart guy. All right. Talk to me about how people can pay. We understand the product, I think, because you just gave a great story. Tell us how you monetize this, is it a pure play SAS company? Paul: It is, yeah. It’s a SAS company. We sell to enterprises, it’s a subscription and people will either prepay for one year or two years. Nathan: Okay, so on average, I’m sure you have a lot of cohorts, but we’re short on time. What would you say? Like an average company might pay per year to use your tool? Paul: It’s between five fingers moving up to six fingers to like six figures now. Nathan: Okay, got it. And that’s kind of first year ACV, so call it anywhere between 50 and a 100 grand. Paul: Yeah. Nathan: So let’s start role play for a second. If I sign up today for 50 grand, give me a sense, paint a picture here. What would I get for that? Paul: So what you get for that is a single dashboard whereby your data teams, the ones that are building out your data lake infrastructure, that your data scientists’ plug into. You’ll get a single view into all the apps that are connected, all the users that are running queries, the way that data flows through that system. And a very, very easy and quick ability to A, figure out is everybody having a good experience, are apps working, is the data lake working or, if not, why and what the root cause of that, so that you can very quickly pinpoint where data is getting stuck. Nathan: Interesting. Okay. Very good. And put this on a timeline for us. So what was the official year you launched? Paul: So we launched at the end of 2016. One of the interesting things Nathan, is that our first dollar of revenue came only six months after we wrote the first line of code for the business. Nathan: I love that you lead with that. It’s like a technologist who says, “You know what, all techies, don’t just only focus on product. We made money after six months.” Paul: There’s two schools of thought. Nathan: You may not have made money. You had a revenue in six months. Paul: Right. Nathan: That’s where I want to get the story behind that first dollar in a second, but let’s go backwards. So today, how many customers have you scaled to? Paul: So we in that, have over 25 customers. We’re still a seed stage company, Nathan, so we’re still quite small and we’re approaching a million dollars. Nathan: What do you mean when you say you’re still seed stage, how do you define that? Paul: So the way that I define that is, we have a lot of revenue, we have good customers, our churn is really, really low. Nathan: How low? Paul: It’s tiny. We’re over a 100% revenue retention. Because a lot of our customers will expand with us. Nathan: What about gross churn though, if you peel back that onion? Paul: Our platform is focused on Amazon Redshift right now, which is a major cloud data warehouse. As companies shift to other data warehouses where they might churn on us… Nathan: I see. Paul: …Snowflake or BigQuery. Yeah. And so our vision is to support all of those databases going forward, but for right now we’re small. Nathan: So I mean, is that code for like maybe ten-ish annual revenue churn on a gross basis or like what is churn to the annually? Gross. Paul: It’s under 5%. Nathan: Oh, I mean, that’s super healthy. Okay. So you’ll lose less than 5% of your revenue annually. You more than expand that same core by 5%, so you have net revenue retention north of a 100% at this point. Paul: Yes. Nathan: That’s great. Okay. Yeah. Take me back to the backstory. So, you said defined seed stage and I said, how do you define that? Paul: Yeah, well. We’re at the point where we’re still figuring out the right go to market. Right. What is the best way for us to acquire a dollar? Can we make at least $3? Can we make that money back within one year consistently and have enough data points where we can go to an investor and say, “Hey, if we had a billion of your dollars, we’ll be able to grow at this rate over the next two years.” We’re close to that at this point, but we’re not quite there yet. So we’re still at that stage of the company. Nathan: Have you capitalized the company, if so, how much have you raised to date? Paul: We’ve raised a little bit over $5 million. Nathan: Okay. Paul: And plus two rounds of funding. Nathan: And why did you decide to raise instead of bootstrap? It sounds like you were able to get revenue going pretty early. Paul: Yeah. Well, when you’re building hard tech, like we are, you need software engineers and software engineers are expensive. Nathan: Are you all in San Fran? Paul: I’m sorry? Nathan: Are you guys all in San Francisco? Paul: Not all, HQ is here, but we have engineers in New York and Europe as well. So we’re distributed. Nathan: And how many people total? Paul: Nine people total. Nathan: Nine. Okay. That’s great. And then look, if I take the 25 customers, right, times, we’ll stay on the minimum side, so let’s say $50,000 ACV. I mean, you’ve got to be either flirting or just pass, kind of the million dollar ARR marker. Is that something you’re going to pass in the couple of next, sort of months? Paul: Yeah. We’re going to pass that in about Q2. In about the Q2 time period. Nathan: That’s great. And can you give me a general sense of growth year over year? So if you’re at, call it, 70 grand a month today, where were you a year ago? Paul: So, I mean, we’re growing at over 12% per month at this stage, Nathan, adding new customers. Not only are we adding new customers, but the ACV is also growing and our expansions are approaching over 30% of our monthly growth at this stage. Nathan: You mean your annual revenue growth is coming from expanding old cohorts that signed up? Paul: Yeah. So customers will renew and they’ll double down, they’ll increase their ACV. And also the way that we bill is a function of how much data our customers are processing. And the thing that’s true for everyone is, they’re processing more data, they’re storing it for longer, they’re doing more things with it. And so, our pricing goes up as a function of how much data they’re crunching. Nathan: So Paul, with 12% of monthly growth that’s obviously north of a 100% year over year, fair to say you were doing maybe, call it 25, 30 ish grand a month, a year ago. Something like that? So you’ve more than doubled. Paul: Yeah, yeah, yeah. We’re more than doubling every year, easily. Nathan: That’s great. Talk to me, the last tranche of funding, you said you did it in two tranches. When was the last tranche raised and how much was it for? Paul: We raised around, in May, led by Encore Capital, that was a $3 million seed round. Nathan: Okay. And you had a thesis or a profile built out on how you deploy that capital, we’re now several months into that. Has it panned out how you thought it would, and if not, where’s it different? Paul: So it is panning out. The thing that is the most exciting, is that we’ve recently gotten traction in the enterprise. Very large Fortune 500 companies are now using us as part of their digital transformation. So when large enterprises shift their data services to the cloud, they experience a lot of pain and we’re there to help them make that transition away from the traditional data warehouses, like Oracle and Teradata. And so we’ve been really excited to find that niche for ourselves, because obviously there’s a much higher ACB customers and a much better market segment for us. Nathan: Yeah. Do you have a large enough sample size yet to have a good understanding of what your CAC is, or is it too early? Paul: We do. Our CAC at this point is south of 10 K. The nice thing about our business is that we can sell it over the phone. Typically, customers will make a decision. There’s a free trial, and they’ll make a decision in about two to three weeks, or whether to buy us. So our end-to-end sales cycle is south of two months at this stage, even for the larger customers. Nathan: So, $10,000 CAC on, called it $50,000 ACB account. You guys are what three, four month payback period, something like that. Paul: Yeah. Nathan: Look, obviously that’s healthy. Are you generally getting more aggressive with that or less aggressive? Paul: We constantly want to try to increase prices. We always want to make sure that we’re adding value, but with those economics, we’re really confident that we’re at a good spot for additional venture rounds. And it’s healthy business. My challenge now. [crosstalk 00:11:54]. Nathan: I guess, part of my question is, just to be clear, you have healthy payback, four month is a healthy payback period for your stage. What I’m trying to get at, are you running more and more and more paid marketing experiments to try and figure out how you can get more customers quicker, so that 10 grand, you’re driving that CAC up or are you staying here or going down? Paul: Yeah, we’re trying to get the CAC down. The way that we find customers is in two ways. One is, they find us through content. We publish a lot of content about data lakes, performance monitoring, visibility through a blog post or a white paper that we’ve written. And then we’re also reaching out to customers that we know are using Amazon Redshift. And so we doubling. [crosstalk 00:12:37]

Nathan: How do you know that, is there something like JavaScript scrape you do, or how do you get that list? Paul: That’s a really good question, Nathan. It turns out the word Redshift is not common in job descriptions. And so if you scrape Indeed, for example, you can figure out which companies are using it. Nathan: Really smart. Paul: So we have scrapers that go out to job boards and then they collect company names. And then we just get lists of people that work in those companies with the right titles, get their phone numbers and just basically do call outreach. [crosstalk 00:13:06]. Nathan: Really smart. Is that how you got your first dollar when you were six months in? Paul: A little bit, we also used our network at that stage, because Lars and I have been in the Valley for 20 years. So we know that signing up early alpha users to a not fully baked product super early on. And so the first few customers were largely founders network. Nathan: That’s great. And I assume today, since you just raised that capital, you’re obviously not breakeven or cashflow positive, you’re still investing in burning capital right now. Paul: True. Yeah. We’re investing in R&D, our biggest cost is engineering and software development. And so our goal is to raise another round of funding about this time next year. Nathan: Would you ever, Paul, consider, I don’t know if this is popular in the Valley or not, because there’s so much VC money out there. But I mean, have you looked at venture debt at all to basically fuel growth without having to take dilution? Paul: Yeah, we are not able to do that yet because the banks that we work with only give you venture debt if you’re after series A. Nathan: You taking, like SVB or a square one. Paul: Yeah. Yeah, exactly. Nathan: I’m talking about people that play lower down the ecosystems, so for example, Lighter Capital will go like pre VC, as long as you’re north, like 15 grand a month in revenue. I mean, have you talked to folks like that or no? Paul: Not yet. Yeah. We haven’t had a need to, but I think venture debt is a great idea. And I’m going to look at seriously doing it next year, just because it’s another financing option without giving away equity. Nathan: Oh, totally, man, I love it. I mean, obviously capital, it can be a little expensive, but again, if you understand your growth levers, I’d rather keep the equity. Paul: Exactly. Nathan: Yeah. All right, cool man. Let’s wrap up here with the famous five. Number one, what’s your favorite business book? Paul: Good strategy bad strategy by Richard Rumelt. Nathan: Number two, is there a CEO you’re following or studying? Paul: I really love Lew Cirne at New Relic. Nathan: Number three, what’s your favorite online tool for building your company? Paul: Gosh, I log into a Heap Analytics a lot, to keep times with our metrics. Nathan: Yeah, good one. Number four, how many hours of sleep do you get Paul? Paul: Seven. Paul: That’s good. And what’s your situation, married, single, kiddos? Nathan: I’m married with a small toddler and one on the way. And so it’s shocking that I get seven hours of sleep, but our kid thankfully sleeps through the night for now. Nathan: That’s good. You married, one kid, another on the way and how old are ya? Paul: Yep. I’m 42. Nathan: Paul: To have kids sooner. It’s awesome having kids. Now that you have some, you kind of want it. I wish I had them a lot sooner than now, but yeah. Nathan: Guys have kids sooner. Launched intermix back in 25, again giving visibility to data pipelines. Working now with really an enterprise segment as they’re growing. Working at 25 customers, call it a 50,000 ish ACV. But anyways, they’re flirting with, in the next couple of months, about a million bucks in terms of ARR. That’s up from about 30,000 bucks a month, just a year ago. So healthy, more than doubling year over year, burning capital they’ve raised five million bucks, nine people in San Fran, New York and Europe. Less than 5% annual revenue churn, but more than 5% expansion as well. So a 100% net revenue retention annually, spending up to 10 grand to get a new customer. So healthy payback period as they look to scale. Paul, thanks so much for taking it to the top. Paul: Thank you, Nathan.