These days, workplace productivity tools are a dime a dozen — and, with quick-growing players in the space like Monday and Asana, they face fierce competition for market share.

One startup, however, has found a way to cut through the noise. For Synapse — a productivity tool hyperfocused on learning and development teams — the key to scaling growth has been to leverage strategic partnerships.

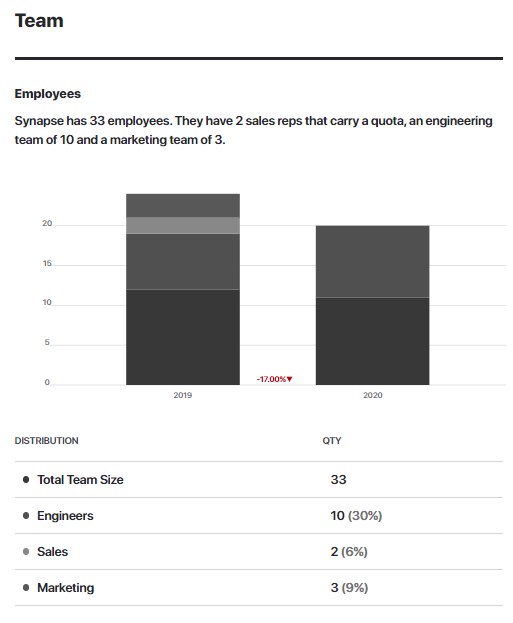

Since launching in 2017, Synapse has raised $4 million in funding and received $500,000 in debt financing. Initially, their funding helped build the product and build out their team, which now sits at a total of about 20 employees, with two account executives and a business development representative on board.

Synapse’s investment into growing its sales team helped the company grow from $400,000 in ARR in 2019 to over $900,000 in late 2020. The company has continued investing that capital in growth, burning around $10,000 a month — but for the next stage of scaling, Synapse plans to focus mainly on partnerships.

Source: GetLatka

“When we raised the majority of our money back in 2019, we started experimenting with partners, and very recently brought on three,” says Synapse CEO and founder Ryan Austin in an interview with Latka. “With the partnership side of things — we call that the scale model — we partner with learning management systems that focus on specific industry verticals. That way, we can service their clients with our technology, and they don’t have to build what we offer.”

Since launching their partnership program, Synapse has landed three major partners: Telus Employer Solutions, IBM Global Business Services, and Relias. As part of one channel partnership, Synapse will be onboarded to 11,000 of a partner’s clients in exchange for a revenue share.

For Synapse, which had around 60 enterprise clients to its name in November 2020, that partnership allows for massive growth.

With a strong focus on partnerships, fixed pricing at $1,500 a seat, and a 95% net retention rate, Synapse plans to hit $2 million in ARR by the end of 2021 before going into its Series A. The team aims to target $10 to $12 million in their next round, and Austin hopes they can land a valuation somewhere between $25 to $40 million.

What is Synapse’s annual revenue?

In 2020, Synapse generated $900,000 in ARR.

What is Synapse’s monthly revenue?

In 2020, Synapse generated $75,000 in MRR.

Who is the CEO of Synapse?

Ryan Austin, age 37, is the CEO of Synapse.

Transcript Excerpts

When to fundraise (rather than borrow)

“I think the equity partners who we’ve taken on have been smart capital. Most of them have large funds and are very CEO-friendly and entrepreneur-friendly — they want to back you. It’s not a spray-and-pray seed fund. With the VCs who we put together, they’re already looking to commit about $5 million going into the next round, combined.”

When to borrow (rather than fundraise)

“We brought on some venture debt through Comerica Bank. It was mainly to build the relationship early, so that when we do our Series A, we can take about 30% of venture debt on top of that next round. This was just to get our feet wet and build credit with the bank, so that we can use it as a future financial partner without giving away equity in the next round.”

Lowering your price to increase your revenue

“We just went through an iteration of our pricing model as a seed stage company. It’s all about learning. Our average price was about $12,000 in the past, and it increased from there, based off a per-seat model. But we actually just flipped the switch during COVID to not having any minimums and pricing at $1,500 a seat, to lower all barriers. And we’re seeing contracts come through at a greater deal value than before.”

Niching down to compete in a crowded space

“Being a productivity software, the trends are really interesting. We’re seeing a lot of similar trends, but our productivity software just focuses on learning and development departments. It’s built specifically for them, not for every single department. Our integrations are with learning management systems, offering tools — similar to how Jira is purpose-built for engineering teams. So it’s a very esoteric problem, but a big market and exciting opportunity.”

Full Transcript Nathan Latka: Hello, everyone. My guest today is Ryan Austin. He’s an entrepreneur who has spent over 10 years driving improvements in learning and development. In his current role as CEO of Synapse, Ryan is focused on developing innovative products to help learning teams, increase productivity, and create impactful training at scale. Nathan Latka: Before this company, he served as Senior Vice President for World Trade Group, an organization that that offers live events, online products and training courses. Ryan, you’re ready to take us to the top? Ryan Austin: Sure. Nathan Latka: All right. Just to be clear that the URL is getsynapse.com. Is it a SaaS company, or are you selling services too? Ryan Austin: No, this is a pure SaaS company, 100% software, no service. Nathan Latka: Okay, and your baby. You said you are the founder? Ryan Austin: Yup, one of the co-founders. Nathan Latka: When did you launch? Ryan Austin: We launched it, I guess, officially in 2017, although we worked on the R&D for about a year, year and a half, before that. Nathan Latka: So, launch 2017. I mean, how much did you spend on the R&D and the NDP, before your first paying customer? Do you remember? Ryan Austin: Well, there was a lot of different versions. We don’t have a direct competitor still, in the market right now, there’s indirect incumbents. Ryan Austin: There was a lot of lessons learned, and learning curves to do what we do. We spent probably about 50 grand to get the first iteration out the door, and started to monetize it, but then kept going from there, raised a little bit of money after that. Nathan Latka: How much have you raised? Ryan Austin: About $4 million. Nathan Latka: Four million. Do you regret that? Ryan Austin: Don’t regret it, because we had some good, some great institutional investors, and early on, we had some angel investors, who, without them, we wouldn’t have gotten to where we are today. One of my first SaaS companies that really has taken to a point where we’re really about the scale now, which is exciting. Ryan Austin: Would I take money on early again? Yes. But you would have different limits on, on how you do things. You learn as you execute, so … Nathan Latka: Of course, of course. So, signed your first costumers up in 2017. I imagine how many customers are you serving today? Ryan Austin: We have about 60 on the platform, 60 enterprises directly today. But we’ve just started to experiment with some channel partnerships, one, which we just did a press release on, where over the next two years, they’re going to onboard us to 11,000 clients of theirs, which is exciting. Nathan Latka: What do they get for that? Ryan Austin: Just similar to how you would do a wholesale retail relationship, in a traditional product. It’s similar to that. It’s a revenue split. Nathan Latka: What percent of the revenue are they, do they get to keep? 30%, 50%, more? Ryan Austin: I can’t talk about that, specifically, just because we have certain agreements in place, but it’s a win-win scenario where we’re both happy. It’s very balanced relationship. Nathan Latka: Can you share a range? Is it more or less than 50%? Ryan Austin: It’s around that, yeah. Nathan Latka: Okay, around that, fair enough. Let’s go back to your first 10 customers. How’d you get them? Ryan Austin: Oh, being scrappy. Our first client ever was a Fortune 10 customer, who, basically invests- Nathan Latka: Who was it? Which company? Ryan Austin: … ExxonMobil. Nathan Latka: Okay. Ryan Austin: They basically read about us in the newspaper after coming out of an accelerator, and asked to see the software, where we were, “Well, we don’t have software yet. Here’s our plan.” Ryan Austin: It was a problem for them that, that they said, “Well, we’ll give you a little money to help you develop this.” That was really when we flipped the switch to just really focusing on software as a service. We [crosstalk 00:04:19]- Nathan Latka: How much did they invest? Ryan Austin: … It was in the six figures range. Nathan Latka: Okay. Was it just like a customer payment, or they actually get equity? Ryan Austin: Customer payment. Nathan Latka: Oh, great. That’s that’s the best way to do it. Very cool. So that was your first customer. You got them onboard, or are they still paying today? Ryan Austin: They are. Nathan Latka: That’s great. So what is the average customer paying you per month to use Synapse? Ryan Austin: It’s interesting. We just went through an iteration of, of our pricing model as a seed stage company. It’s all about learning. Our average price was about $12,000 in the past, and it increased- Nathan Latka: Annually? Ryan Austin: … annually, and increased from there, based off a per seat model. But we actually just flipped the switch with COVID, to not having any minimums, and pricing at $1,500 a seat, to lower all barriers. And we’re seeing contracts come through at greater deal value than before. Nathan Latka: And so, can I take 60 customers, times $1,000 a month on average? I mean, you’re doing about $60,000 a month right now, in revenue? Ryan Austin: No, it’s higher than that, actually. Some clients are paying us in the six-figure range. Nathan Latka: Okay. Can you give me a range of where are you’re at? Are you in north of $100,000 a month? Ryan Austin: I guess I’ll say it like this, just because it changes daily right now, Nathan, especially with the partnerships we just onboarded. We have not yet gone to Series A, and when we do, our plan is to start working with Series A partners at around two and a half million ARR. Ryan Austin: So we’re not quite there yet. We’ll be there in about a year’s time, or less. Nathan Latka: I mean, do you think you can break a million dollar run rate by the end of this year, three months left? Ryan Austin: Oh yeah, for sure. Nathan Latka: Okay, got it. Got it. So you’re planning to break a million this year, then double the next 12 months, and then go do a Series A? Ryan Austin: Yeah. I know we’ll have over 100% growth this year. Nathan Latka: Okay, got it. If you’re doing, call it $70-80,000 a month right now in revenue, what were you doing a year ago? Ryan Austin: Well, 100% less than that. I mean- Nathan Latka: Yeah, so what was the number? Ryan Austin: We were at a little over 400K in AR less than a year ago. Nathan Latka: Yup, yup, yeah, that’s great growth. Where’s most of that growth come from? Expanding customers who are already with you, or getting new customers altogether? Ryan Austin: Both. We have a transactional side to the business, just like any other SaaS company. We call that, internally, the growth model. Ryan Austin: With the partnership side of things, we call that the scale model, where we partner with learning management systems that focus on specific industry verticals. That way, we can service their clients with our technology, and they don’t have to build what we offer. Nathan Latka: What do you mean by transactional side of the business? Ryan Austin: Transactional, meaning, we have a BDR and a account executive team who focuses on net new clients. We find them through inbound, and through demand generation, and outbound methods. And then the scale side of the business is just through the partner network. Nathan Latka: I see, I see. How many quota carrying reps are currently on the team? Ryan Austin: We just hired our second AAE as of last week. Nathan Latka: Got it. And your AAEs are the only ones who have quotas, BDRs don’t? Ryan Austin: Yeah. Nathan Latka: I see. Ryan Austin: Yup. BDRs are incentivized on sales, accepted leads, or sales qualified leads, so … Nathan Latka: And how many engineers are on the team? Ryan Austin: About nine right now. Nathan Latka: Okay. And what’s the total team size? Ryan Austin: Little over 20. Nathan Latka: Okay. Nice, good stuff, Ryan. That’s very cool. Nathan Latka: So, driving growth, it sounds like channel partnerships is going to be a key strategy for you guys moving forward. To drive growth. You’ve raised four million currently. Nathan Latka: Are you still investing that capital, to the point where you’re cash flow negative each month? Or are you break even now, or positive? Ryan Austin: There’s a little bit of a loss, still, but we have a lot of runway with the amount that we’ve taken, on as well. Nathan Latka: When you say a little bit of loss, what do you mean? You’re talking 10 grand a month in net burn, or a hundred grand or more? Ryan Austin: No, we’re nowhere close to a hundred grand in that burn, but … Nathan Latka: Okay, got it. Ryan Austin: Yeah. Nathan Latka: Got it. No more than 10? Ryan Austin: Yeah. Nathan Latka: Okay, fair enough, fair enough. When you took, you mentioned a lot of cash that you raise is still in the bank. When was that last raise? How long ago was it? Ryan Austin: Well, we raised the majority of the money back in 2019. We we started experimenting with partners, and very recently brought on three. So the experiment ended up not being an experiment. Ryan Austin: We didn’t want to take the money that we secured from the initial seed round, and fuel it into partnerships, because it wasn’t part of the plan. So we just took on another million dollars in August. Nathan Latka: Okay, got it. Okay, so literally, just recently, you took on 1.5. You also chose to do, I mean, back when you did the round in April, I think it was, of 2019, from generation, I think you had 2.5. Nathan Latka: In between that, in the 1.5, you just took an equity. It looks like you also did a little bit of debt. Is that accurate? If so, help me to understand how to use debt in a SaaS company. Ryan Austin: Yeah, so the debt was really interesting, actually. So we brought on some venture debt through Comerica Bank. It was mainly to really build the relationship early, so that when we do our Series A, we can take about 30% of venture debt on top of that next round. Ryan Austin: This was just to get our feet wet, build credibility, build credit with the bank, that we can use it as a future investment part, or a future financial partner, without taking giving away equity in the next round. Ryan Austin: For this round, we’re not really leveraging the debt right now, although we have access to it. We do plan to leverage it closer to the time that we pull the trigger on our Series A, so we can start scaling the company, and hiring all those people that we need to do that. Nathan Latka: Well, hold on, hold on, Ryan. The strategic reason you told me you took the debt is opposite of what you just told me, what you’re actually doing with it. Nathan Latka: You told me is strategically you want to build history. But you just told me functionally, you haven’t actually drawn any down. And you don’t plan to, until the Series A. Having a line, but not using it, doesn’t build credit history with Comerica. Ryan Austin: Six months before our Series A will draw it down. Nathan Latka: There’s a lot of firms looking at SaaS companies, looking at debt like this. A Silicon Valley bank will do things like this, in the five to six percent interest range. Nathan Latka: It’s sort of a warehouse line or a term loan. Can you hear me understand the structure you put on your 500,000? Ryan Austin: Yeah. It was an unsecured line of credit. We were given favorable terms, because of some of the investors that came into the last round, and who Comerica had a relationship with. Nathan Latka: When you say favorable terms, I mean, are we talking, when was the interest rate on the line? Are you talking five or 6%, or something higher? Ryan Austin: It’s less than that. Nathan Latka: Okay, less than five to six percent? Got it. Usually, banks like this do require warrants, so there’s still a little equity kicker. Ryan Austin: And no warrants. Nathan Latka: Okay, no warrants. And so, no nasty covenants, origination fees, anything like that? Ryan Austin: No. The way they protected themselves is, is it’s not an open line. We have to use it by a certain date, otherwise, it can claw back. Ryan Austin: It’s really based off of cash out dates, and things like that. So they de-risk it that way, but we were executing so closely to our model right now, that we’ll be able to leverage the cash, versus not being able to leverage it. Ryan Austin: We actually did an extension on it, because we’re off a little bit of our plan the first time around. We had to go back to them, and ask them to extend it, so that we can actually- Nathan Latka: What do you mean? I thought you said you haven’t drawn it down yet. Ryan Austin: No, but the term of the line of credit would have expired, if we didn’t use it. Nathan Latka: I see. So you asked them to give you more time? Ryan Austin: That’s it. More time, yup. Nathan Latka: Yeah, I see. Why not just use that line? I mean, you took a bunch of extra dilution raising 1.5 million, in addition to 500K from equity investors. Why do any equity at all? Ryan Austin: I’ll tell you, I think the equity partners who we’ve taken on, is smart capital. Outside of participating this round, these weren’t spray and pray funds, they were, two of them- Nathan Latka: Yeah, this is BDC venture capital generation ventures, ripple ventures, and differential ventures. Ryan Austin: Yeah. Most of them have large funds, and the other ones are very CEO-friendly and entrepreneur friendly, they want to back you. Ryan Austin: It’s not a spray and pray seed fund. With the VCs who we put together, they’re already looking to commit about five, a little over five million, going into the next round, combined. Nathan Latka: How do much you think you’ll raise in your Series A, what are you targeting? Ryan Austin: About 10 to 12. Nathan Latka: What valuation would you love to get? Obviously you have to negotiate this, but what would you like to get? Ryan Austin: Yeah, I mean, it’s up in the air right now. I’ve seen Series A companies in our space, as low as 25 pre-money and all the way up to 40 million pre-money, so somewhere in between there. I don’t want to shoot myself in the foot without actually realizing the value creation that we know we can create, so, somewhere in the line of- Nathan Latka: Yeah. I mean, right now, you’re at a million bucks, or in terms of run rate, obviously getting a 25 million pre right now, and then, raising 10 or 12? Nathan Latka: I mean, that would be pretty incredible at a million dollar run rate and growing, even though you are growing 100, year over year, if you have the 2.2 million, and grow 100% year over year, two years in a row, makes more sense. Ryan Austin: Yeah, it’s really interesting. There’s some things we’re doing this year with IP, around some of the analytic features that we’re rolling out shortly, as well as investing a lot into product-led growth. Ryan Austin: Being a productivity software, the trends are really interesting. When you look up Crunchbase, with companies like Asana, or monday.com or Jira on how long it took them to get to their Series A, it’s a similar trend to what we’ve experienced, but then, they start seeing crazy growth after that, right? Ryan Austin: We’re seeing a lot of the similar trends, and our productivity software just focuses on learning and development departments. It’s built specifically for them, not for every single department. Ryan Austin: Our integrations are with learning management systems, offering tools, similar to how Jira is purpose built for engineering teams. So it’s a very esoteric problem, but big market, and exciting opportunity. Nathan Latka: Ryan, we’re running out of time here. Quick answers, if you can. Gross revenue churn monthly is about what? Ryan Austin: Can you repeat that? Nathan Latka: Gross revenue churn. Churn is critical in a SaaS company. What’s your gross rate of return look like? Ryan Austin: Yeah, yeah, yeah. We’re retaining about 89% of clients right now. Nathan Latka: On an annual basis? Ryan Austin: Yeah. Nathan Latka: Okay, so 11% gross revenue churn, and then I assume you have probably some good expansion revenue, right? Ryan Austin: Just getting into expansion now, really. Nathan Latka: Okay, got it. So net retention is something like 90, 95% annually, currently? Ryan Austin: Yup, yeah. Nathan Latka: Okay. D you have a model for customer attrition? Nailed down, you’re testing the channel partners, but I mean, what will it cost you on average in terms of CAC, to get a new customer paying 12,000 bucks a year? Ryan Austin: Yeah, we think that payback will be five to six months, once we roll out the product-led growth strategy. Nathan Latka: Okay, but what is it currently? Ryan Austin: It’s higher, which is why we raised some money. It’s about 10 grand. Nathan Latka: Okay, got it. 10 grand to get a $11,000 or $12,000 a year customer, so payback’s more like 12 months. Ryan Austin: Yeah. Nathan Latka: Okay, interesting. Very good. I mean, look, super interesting space. Nathan Latka: You saw ClickUp, just raised a pretty large round, going from nothing to $35 million, monday’s obviously in this space. Curious to see how many big winners we can have in this space, but we’ll be rooting for you. Ryan Austin: Ah, thank you. Nathan Latka: All right, let’s wrap up with the Famous Five. Number one, favorite business book? Ryan Austin: Oh, Tell To Win. Nathan Latka: Number two. That’s one that very few people know about, I love that you know that. Tell To Win is a really good one. Number two, is there a CEO you’re following or studying? Ryan Austin: Not any that anybody would really know. I’ve had a lot of great mentors. One, Jay Steinfeld, who is the owner of blinds.com, who sold to the Home Depot. Nathan Latka: Number- Ryan Austin: He was very instrumental in helping us. Nathan Latka: Number three. What’s your favorite online tool for building your company besides your own? Ryan Austin: Outreach. Nathan Latka: Number four. How many hours of sleep do you get every night? Ryan Austin: Five. Nathan Latka: And situation, married, single, kids? Ryan Austin: Single. I’m sorry, married with a dog. Nathan Latka: Okay, fair enough. And how old are you? Ryan Austin: I’m 37. Nathan Latka: Ryan Austin: To listen to people. Nathan Latka: Guys, get to signups.com. They’ve scaled from, call it $400,000 a month, or sorry, a year, in revenue in 2019, to over $900,000. In terms of run annual run rate today, 60 customers pay around an average of $12,000 per year. Nathan Latka: They’re burning a little bit of capital, way less than a hundred grand per month, but more than, call it 10 grand a month. They raised four million bucks to build the product, 20 people on the team, nine engineers, small sales team they’re growing right now, two people on it currently. Nathan Latka: Got a 95% net revenue retention, as they look to scale in a very competitive productivity tool space, but they are hyperfocusing on learning and development teams. Ryan, thanks for taking us to the top. Ryan Austin: Thanks, Nathan. Nathan Latka: One more thing before you go. We have a brand new show every Thursday at 1:00 p.m. Central. It’s called Shark Tank For SaaS. We call it Deal Or Bust. Nathan Latka: One founder comes on, three hungry buyers, they try and do a deal live. And the founder shares backend dashboards, their expenses, their revenue, ARPU, CAC, LTV. Nathan Latka: You name it, they share it, and the buyers try and make a deal live. It is fun to watch every Thursday, 1:00 p.m. Central. Nathan Latka: Additionally, remember, these recorded founder interviews go live. We release them here on YouTube every day at 2:00 p.m. Central, so make sure you don’t miss any of that. Nathan Latka: Make sure you click the Subscribe button below here on YouTube, the big red button. Then click the little bell notification to make sure you get notifications when we do go live. Nathan Latka: I wouldn’t want you to miss breaking news in the SaaS world, whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement, or something else. I don’t want you to miss it. Nathan Latka: Additionally, if you want to take this conversation deeper and further, we have by far the largest private Slack community for B2B SaaS founders. You want to get in there. Nathan Latka: We’ve probably talked about your tool if you’re running a company, or your firm, if you’re investing. You can go in there and quickly search and see what people are saying. Sign up for that at nathanlatka.com/slack. Nathan Latka: In the meantime, I’m hanging out with you here on YouTube. I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. And if you enjoyed it, click the thumbs up. Nathan Latka: We get a lot of haters that are mad at how aggressive I am on these shows, but I do it so that we can all learn. Nathan Latka: We have to counter those people, we got to push them away. Click the thumbs up below to counter them, and know that I appreciate your guys’s support. Nathan Latka: All right, I’ll be in the comments. See you.