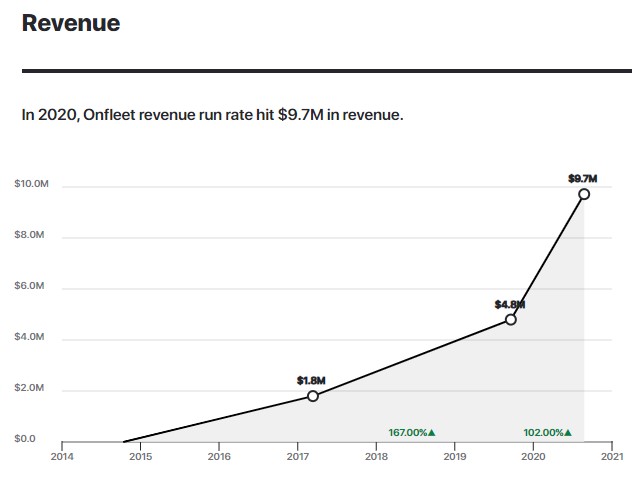

Last mile delivery software company Onfleet capitalized on increased market demand to double its ARR in 2020.

Demand for delivery has been booming since the onset of the coronavirus pandemic, and last-mile delivery coordination software Onfleet has benefited from the transition, CEO Khaled Naim told Latka in an interview. The company’s software coordinates routes and runs analytics for companies that have their own fleets of vehicles for delivery services.

Since CEO Khaled Naim was last on the show in September 2019, the company’s revenue has nearly doubled and it’s pulling in around $800,000 per month. Onfleet has about 900 customers, up from 500 last year.

As restaurants and companies that need goods delivered leverage services like Uber Eats and DoorDash, some also keep their own fleet of vehicles for bigger orders and catering services. That’s where Onfleet comes in with the goal of making those transactions more efficient.

“A lot of restaurants are adopting a hybrid model where they’re just sort of omni-channel,” Naim says. “They need to take orders however they can, especially now.”

Onfleet’s revenue model is unique in the delivery space — the company doesn’t keep a portion of each sale, it charges based on task volume, instead.

Source: GetLatka

“We don’t care if you’re delivering something for $10 or $100,” Naim says. “All we care about is the number of deliveries, the number of transactions.”

Onfleet’s highest volume customers pay about 10 cents per task. Customers on the lower end of the volume scale pay a little more than 20 cents. On average, the company is now pulling about $900 a month per customer, which equates to approximately 4,500 tasks per month, or about 150 per day.

The company has about 40 employees. Between 15 and 17 of those are engineers. In 2021, Naim forecasts the overall team will likely grow to between 65 and 70.

Onfleet has raised about $5 million in equity and raised close to $1 million in debt from Lighter Capital. The money was raised in multiple tranches over several years. “We started with a revenue-based financing vehicle and then now we have a fixed term loan,” Naim explains.

The company is likely to raise some more capital soon – something in the $10 to $15 million range, but Naim said he doesn’t see the company going into high burn mode.

In previous years, Onfleet’s net revenue retention was about 110%. This year, though, it’s reporting about 115% revenue retention thanks to increased demand and a growing customer base.

“We think we are just getting started,” Naim says. “I mean, this space is really growing quickly. We’ve achieved a lot over the years.

Get to Know Khaled Naim, CEO of Onfleet

Name: Khaled Naim, age 35, married with no kids

Where to find him: Twitter, LinkedIn

Company: Onfleet

Noteworthy: Naim got the idea for Onfleet while working on software that would help companies operating in places without an address system make delivery services more efficient.

Favorite business book: “Meditations”

CEO he’s following: Bill Gates

Favorite online tool for building the business: used to be Gusto; now it’s a good lawyer

Average # of hours of sleep/night: Between 7 and 8

Full Transcript Nathan: Hello everyone. My guest today is Khaled Naim. He’s the CEO and co-founder of a company called Onfleet and the world’s fastest growing provider of last mile delivery management software. All right, Khaled, you ready to take us to the top? Khaled Naim: Let’s do it. Nathan: All right, man. So this is a space people would think and assume has benefited from COVID. People need more help delivering everyone’s ordering online, things are delivered. Are you seeing a spike? Khaled Naim: Definitely, yeah. I mean, as you can imagine, retail is going through a massive sort of transition to online delivery focused models. So yes, we absolutely are. Nathan: So can you help people describe, like what is the use case been, especially over the past three months? How are people using Onfleet, can you name a company? Khaled Naim: Yeah so Drizly, we announced recently they’re an alcohol delivery service. They’ve always been focused on delivery, but many retailers are, basically people use Onfleet to delivered goods locally. So our customers are companies that have some sort of the last mile delivery operation and they use our software to help them manage their fleets of drivers. So routing, dispatching, real-time tracking, analytics, proof of delivery, customer facing communications. So, any retailer that’s looking for new ways to distribute, to get their goods out to their customers can benefit from creating a pool of drivers and using Onfleet to deliver to their customers. So- Nathan: Are the pool of drivers on your payroll full-time or are they contractors on your cut or are they on your customer’s payroll full-time? Khaled Naim: Customers payroll, or they are contracted as a third-party courier. So we also allow for businesses to work with third parties and use Onfleet as kind of a collaboration tool or orchestration layer to interact with that third party. So they can pass the work over the third-party courier company, executes the work and then the retailer gets all of the data, the visibility as if it were their own fleet. Nathan: You launched this company back in 2015. Were you delivering or you were hustling and hustling and delivering yourself and had the idea or what gave you the idea? Khaled Naim: No, that’s not how we got started. We got started… We were actually originally had done a Stanford working on location-based services technologies. So we were targeting emerging markets at the time. This is back in like 2011, helping people that lack functional street addressing systems in their countries to communicate locations with delivery services. That’s how we got started. So, we created a simple web app that allowed anyone in the world to create a URL that represents a physical location. So, that was kind of a… We call it Addy. And Addy was the sort of inception of the [inaudible 00:02:54] it happened. As we were building it, we sort of identified that these companies that we were talking to for Addy just didn’t have any technology on the back-end. They were managing their fleets with a pen and paper, chat apps, phone calls, text messages. And meanwhile, here, we were in Silicon Valley and saw all of these companies emerging around us that were basically just using smart phones to better manage fleets of drivers. And we saw an opportunity to build the infrastructure for that kind of emerging world. Nathan: Mm-hmm (affirmative). And walk us through customer growth. So I remember, I mean, you’ve been on a couple of times back in 2017, you shared, you’d broken 300 customers in late 2019 or September, you said about 500-ish customers. That was about a year, almost a year ago. Now, what do you have today? Khaled Naim: Today we’re close to 900, we’re around 900 right now actually. Nathan: Do they all fit the persona of Drillz? Khaled Naim: Of Drizly? Nathan: Drizly, Sorry. Khaled Naim: No Nathan: That’s close, come on give me credit. Khaled Naim: Definitely Drizly’s kind of a modern, new consumer facing. Like direct to consumer delivery service for alcohol, but we have customers that are more traditional that have brick and mortar locations. Total Wine & More is an example in that. Industry there- Nathan: Total Wine & More. Khaled Naim: Total Wine & More, they’re an alcohol, the largest independent retailer of fine wines and spirits in the country. Gap, more traditional sort of retail. Sweetgreen, so we work with restaurants as well. Nathan: Wait, how does Gap use you? Khaled Naim: So gap in some of their international markets, they actually have fleets of drivers that are doing same day delivery. So they offer same day delivery and some of the international markets and they use that fleet and that fleet that they use to do those deliveries is powered by Onfleet. Nathan: Interesting, okay. So using the Sweetgreen’s example, I mean, I’m just thinking, well, wait, why the heck would Sweetgreen’s use Onfleet when they’ve got Uber Eats and DoorDash and all that. And the only answer is the margin profile using you as much better for them. Khaled Naim: Yeah, great point. So they do also work with Uber Eats and maybe others as well, but I know Uber Eats. So a lot of retailers, a lot of restaurants are adopting a hybrid model where they still, they’re just sort of omni-channel right. They need to take orders from however they can, especially now. And they…but because of the margin profile of having their own drivers, especially if it’s a larger order, like a catering order, then it makes sense to have their own fleet drivers and to use Onfleet to manage those workers. The cost is just a lot lower when you’re talking about a large order. Nathan: So can we just role play for a second? I’m Sweetgreen, I have a new, a hundred dollar order I’m going to use Onfleet. Can you sort of build a little mini P&L for us? Khaled Naim: Well, so the biggest cost is going to be the driver, right? So you have a driver on payroll, depending on how, your location and how you pay them. The driver is going to be the biggest costs. Usually they’re bringing their own vehicle. And in this day and age with kind of the gig economy, drivers show up with their own vehicles. So you’re not leasing or paying for that vehicle or dealing with maintenance. If you look at the P&L for the trucking industry, but those are big line items, there’s fuel costs, there’s vehicle leasing, maintenance, et cetera. And the gig economy sort of local last mile delivery. Typically the largest cost is paying for the drivers. So say 15, 20 bucks an hour Nathan: No I got that, but what does Onfleet take out of a hundred dollar order? Khaled Naim: So we don’t take a margin. So that’s the nice thing about us. We charge you based on the feature set that you need within a software. It’s a SaaS model. So we talked about this last time, but it’s depending on the feature set and the task volume. So we do charge you based on the delivery volume, but we don’t care if you’re delivering something for $10 or a hundred dollars. Nathan: Yep, I wanted to give you a chance to kind of explain that because I think that’s a massive arbitrage play for anyone that needs last mile delivery. Is you do not, maybe your VC’s would argue you should, but you take no percent of sale. It’s based off number of tasks processed through the system and a feature set. Khaled Naim: Correct. Yeah, we’re not driving the sales. So we can’t really command the margin and we don’t even know the value of the items that are going through. All we care about is the volume of deliveries, the number of transactions. And when a driver starts to delivery, completes it. And we say, okay, that’s one task. And that adds to to their task. Nathan: Usage. Khaled Naim: Usage, and then, if they exceed a certain threshold and they start paying on a per usage model. But initially they have up to a certain volume that’s included in their base rate. Nathan: Last September, you told me each customer was paying somewhere around 800 bucks on average per month. Is that still about the sweet spot, that’s the average? Khaled Naim: Yeah, that’s about right. I think we’re closer to 900 now, but in average. Nathan: And paint that picture for us real quick. If I’m paying you 900 bucks a month, how many tasks are you probably processing for me? Khaled Naim: So on average across all of our customers, spending about 20 cents a task. Nathan: Our highest volume customers are all the way down to 10 cents a task and lowest volume is a little higher than 20 cents a task. If you’re below that, like initial tiers threshold, you’re going to be paying a lot for tasks. Nathan: Got it. So 900 bucks a month at 20 cents a task or something like that. I mean, that’s what 4,500 tasks, or about 150 deliveries a day through Onfleet. Something like that. Khaled Naim: Yeah, that sounds about right. Obviously it’s, the distribution is pretty much across the board. I mean, we have customers that are doing hundreds of thousands of deliveries a month and customers are in hundreds of months. So it varies pretty dramatically across customers. But yeah, that sounds more like. Nathan: How many cross all your customers, how many tasks last month across the entire base. Khaled Naim: We are worth at 3 million now. Nathan: Wow. Khaled Naim: A hundred thousand plus a day. Nathan: So, at that scale, you have to have people that want an asset and a space calling you up, asking to buy the company. You’ve obviously chosen not to sell. Why is that? Khaled Naim: We think we’re just getting started. I mean, this space is really growing quickly. We’ve achieved a lot over the years. We had break-even a couple of years ago. Nathan: But are still break-even? Khaled Naim: Still break-even. Yeah. I mean, with the growth this year, our revenue has a growth has outpaced our ability for us to hire. We are hiring but… We have been approached by a number of folks for M&A, but have decided to continue pushing forward. Nathan: Yeah. I mean, 900 customers paying 900 a month. You guys are somewhere around 800 grand a month in revenue? Khaled Naim: Yeah, that’s right. Nathan: Yeah, which is double where you were 12 months ago about, correct? Khaled Naim: Yeah, this year we’re, we’re definitely on track to double. Probably more than double revenue this year. Nathan: That’s great, Okay. So what about funding situation? I think last time you came on, you said you raised a total of 5 million bucks. Is that in equity? Khaled Naim: Yes in equity. We raised close to a million in debt. So I mentioned that we work with lighter capital. So yeah, that’s still the case. Nathan: And when did you raise the million from later? Khaled Naim: Over the course of the last several years, in multiple tranches, we started with a revenue based financing vehicle and then now we have a fixed term loan and that was, I think, late 2018 maybe. Nathan: Yep, very cool. And so talk to me about capital needs moving forward. I mean, do you see places you can invest to drive growth? Would you raise additional capital if you have that as an option? Khaled Naim: Yeah. So we’re kind of certainly looking at raising now, we wanted to get the business to a point where it could stand on its own two legs and we don’t need outside funding. But we are at the point now where it looks like there’s a huge, exciting market opportunity to go after. And we would raise some capital. We’ll be announcing something in the near future to that effect. Nathan: Oh, that face tells me something’s cooking. We’ll look forward to the announcement. What’s the right amount, do you have an amount you’re targeting? Like if you’re going raise, you might as well have a target and have a plan for it. Is it 5 million, 10 million, 40 million? Khaled Naim: Probably in the 10 to 15 million range? We don’t need a ton of capital [inaudible 00:12:05] for super lean operation. I think we’ve gotten really used to this approach and we don’t plan to go back into like heavy burn mode and spend tons of cash to grow the business we think we can do it probably efficiently. So we don’t need boatloads of capital, but a little bit goes a really long way with us. Nathan: Yep, very good. What’s the team of like today, how many folks? Khaled Naim: We’re 40 people right now. Nathan: 40, and how many engineers. Khaled Naim: Of the 40? About 15. 15 to 17. Nathan: Okay. And do you have any quota carrying sales reps and if so, how many? Khaled Naim: We do, yeah. We have a few STRs where like three STRAs, five AEEs, something in that range. So yeah. Eight to 10. Nathan: sellYep, are you testing anything in terms of your STRA relationship that isn’t already common practice? Khaled Naim: We’re always testing. Right now that is the kind of big questions we grow the team by the end of next year will be probably about 65 or 70 people on the team. And so and a large portion of that will be on sales. And so, we are looking for folks in like revenue ops, which is a new position we’ve never hired for before, but they would help all the plumbing to kind of make our reps more efficient. But then, we’ve only historically had one outbound STR, one inbound STR and then a couple of years. So now we’re thinking about what is the right ratio as we grow the sales team. And there’s still a lot to learn. We haven’t formed and quite figured it out yet, but right now it’s pretty close to two to one, AEE’s to STR’s Nathan: Last question, you’re obviously unit economics rated churn are critical on a SaaS company. Now I think my notes Khaled might be wrong here. Did you tell me last time about a year ago, your gross churn annual on a revenue basis was 72%, but your expansion was 90%. So net revenue retention was 110%. Khaled Naim: So the net revenue retention number sounds right. Right now we’re more than that. Our net revenue retention annually is about 115-116%. Nathan: That’s a great spot. Khaled Naim: We rose, yeah. I mean, a lot of that is obviously May, June this crazy expansion across our existing customers, as you might imagine people staying home, ordering their groceries. We do a lot of food and beverage delivery. So a lot of expansion in our existing customer base. And we did see higher than usual churn. So this year has been just, across the board, anomalous the last few months, but then, more trend than usual, more new customers than usual, more expansion. But yeah, typically, our gross, our gross annual revenue retention is around 85% Nathan: That’s not bad at all, so that 15% gross churn then. Khaled Naim: Yeah, so I must have been, I have- Nathan: Or I recorded that wrong. Okay. So 15% gross churn annually, 30% expansion puts you at 115% net revenue retention, lot of interesting dynamics at play or anything that you want to touch on that we haven’t already touched on? Khaled Naim: No, thanks for having me back on the show. Yeah, no, it’s some, some exciting updates to come soon. So- Nathan: I was wonder why founders like you decide to, I mean, the show is a lot about data. I do it because I want the audience to learn from real data numbers. I’m thankful that CEOs in front of like you choose to come back on. I have to know what’s in it for you, that why do you come on the show? Khaled Naim: Yeah. Just I’ve learned from a lot of people over the years and it’s always nice to kind of give back. I mean, we don’t really have anything to hide. Our investors aren’t like asking us to be super quiet about our numbers. You can kind of put the pieces of the pieces together and see we’ve been on like the 5,000 and things like that. So we’ve had to disclose our numbers. So, it’s my pleasure and hopefully your audience learns a little bit. Nathan: All right, let’s wrap up here. Rapid fire, famous five. Number one, favorite business book? Khaled Naim: I just started reading, Meditations by Marcus Aurelius. It’s not really a business, but I think a lot of learnings, Nathan: People argue, there’s a lot of people who would say that’s a business book. You have to let me know what you think about it. Number two, is there a CEO you’re following or studying ? Khaled Naim: These days, Bill Gates, I don’t know. I guess he’s still CEO, but yeah. I’ve always been a fan of his and really interested in sort of how he views the world. Nathan: Number three, what’s your favorite online tool? Khaled Naim: Yeah, I remember this from last, the last time I’d actually said Gusto, I think. And we are moving away from Gusto. We just kind of reached a point where we’re outgrowing them. I think favorite tool generally. I mean, these days it’s you know, have a good lawyer. That’s that’s been a really useful tool for us in the last few months. Nathan: Number four, how many hours of sleep do you every night. Khaled Naim: Trying to keep it around seven or eight. Nathan: And situation married, single with kids married. Khaled Naim: I’m married. Nathan: Any kiddos? Khaled Naim: No kids. Nathan: How old are you? Khaled Naim: I’m 35. Nathan: Khaled Naim: When I was 20, that was, yeah. Wow, Invest in Amazon Nathan: Guys there, you have it onfleet.com, helping folks that have some sort of delivery component as part of their business, they help them make that happen. Providing them software. They processed it for 3 million tasks last month. They now over 900 customers that on average 900 bucks a month. So call it 8 million or sorry. 800,000 in MRR up from 400,000, just a year ago. So healthy growth that almost a nine, $10 million run rate right now, $5 million raised looking at potentially raising another 10 to 15 million here shortly. We’ll see what happens with our team of 40. Khaled things pertaining to the top. Khaled Naim: Thanks Nathan, my pleasure. Nathan: One more thing before you go, we have a brand new show, every Thursday at 1:00 PM Central is called Sharktank for SaaS. We call it Deal or Bust. One founder comes on three hungry buyers. They try and do a deal live. And the founder shares back-end dashboards, their expenses, their revenue, ARPU, CAC, LTV, you name it. They share it. And the buyers try and make a deal live. It is fun to watch every Thursday, 1:00 PM Central. Additionally, remember these recorded founder interviews go live. We release them here on YouTube every day at 2:00 PM Central. To make sure you don’t miss any of that, make you click the subscribe button below here on YouTube. The big red button and then click the little bell notification to make sure you get notifications. When we do go live, I wouldn’t want you to miss breaking news in the SaaS world, whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement or something else. Nathan: I don’t want you to miss it. Additionally, if you want to take this conversation deeper and further, we have by far the largest private slack community for B2B SaaS founders, you want to get in there. We’ve probably talked about your tool if you’re running a company or your firm if you’re investing. You can go in there and quickly search and see what people are saying. Sign up for that @nathanlatka.com/slack. In the meantime, I’m hanging out with you here on YouTube. I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. If you enjoyed it, click the thumbs up. We get a lot of haters that are mad at how aggressive I am on these shows, but I do it so that we can all learn. We have to counter those people. We got to push them away, put the thumbs up below to counter them and know that I appreciate you guys your support. All right, I’ll be in the comments. See yah.