In a world where teams are more distributed than ever, making sure everyone is on the same page is beyond critical. Whether it’s preparing for important board meetings or documenting important process within your organization, having a central repository that is easy to access can make a world of difference when scaling up.

Passageways is a software company built to deliver a remarkable collaborative experience

by leveraging technology, talent, and insightful analytics. Their core products, OnBoard and OnSemble, offer a next generation board portal and a loveable employee intranet respectively.

How much is Passageways doing in ARR?

How much is Passageways doing in ARR?

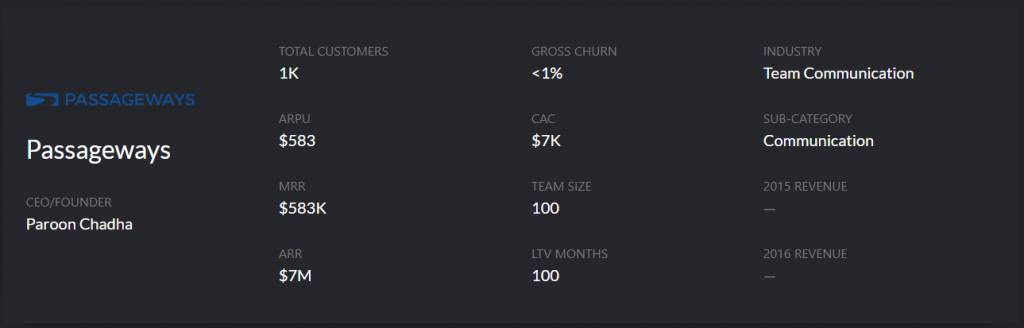

Passageways is a pure-play B2B SaaS business that charges its customers on an annual subscription basis. Customers of their core product, OnBoard, pay them approximately $7k annually for access to their platform.

According to CEO Paroon Chadha, Passageways is currently doing $11M in ARR with $7M coming solely from OnBoard. With 65% growth year over year, OnBoard is up from $4.5M in ARR twelve months ago.

What is Passageways’ churn?

In terms of gross churn, Passageways is currently exhibiting just 3% gross revenue churn annually. With upsells and expansion revenue considered, the company is at 109% net revenue retention annually.

In terms of customer acquisition, the company has seen their CAC inflate due to global expansion in recent months and increased overhead in new markets. Overall, Passageways is willing to spend up to $7k to land a new customer and aims for payback within 12 months.

How much has Passageways raised?

Launched in 2014 our of the founder’s apartment at Purdue University, Passageways has grown to scale with $5M in total outside capital. Going forward, the company is more interested in exploring venture debt and other non-dilutive options to fuel growth as opposed to raising additional capital.

Passageways’ team of 100 full-time employees is based in Indiana, London, and Toronto. a