Introduction

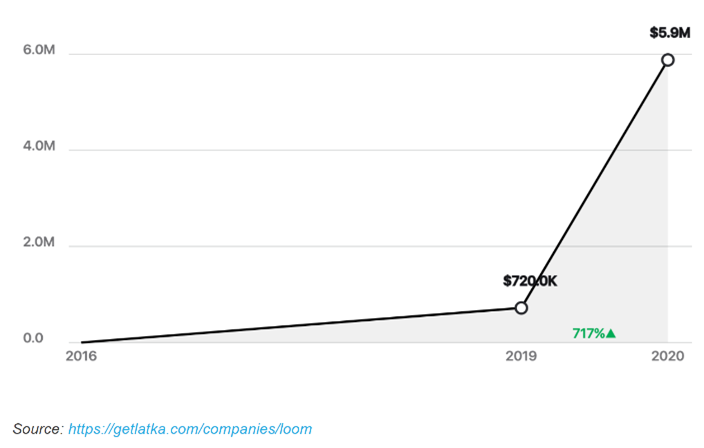

Loom is an asynchronous video sharing platform that allows users to easily record videos of themselves or their screen. Early on Loom was a very individualist product and experience – a chrome extension with a niche feature allowing users to share videos instantly using a link sent over email or messaging. After recording over 717% annual reoccurring revenue (ARR) growth, Loom now tries to mold itself into a business destined for unicorn status. Heavy expectations weight on the company as investors continue to pour capital into the business over such a short period of time bringing the total amount of funding to $73M at a $350M valuation. The path remains an uphill climb to reach a $1B valuation as competitors flood to the B2B video sharing space, and team collaboration software giants such as Zoom, Slack, and Monday take notice.

The Early Days

The cofounders of Loom were sitting in their apartment running out of ideas. They were self-funded with failure on the near horizon – something all startup founders understand. It was June 2016 and their current project, Opentest, was struggling to find traction. After analyzing where the slightest bit of traction was coming from, the cofounding team made a last-ditch effort and decided to double down on the one feature of Opentest that showed promise – a Chrome extension that was part of their user testing product. They launched this Chrome extension under a new brand called Loom.

This feature was rated the #4 Product of the Month on Product Hunt with 2,340 upvotes when launched on the site in June 2016. When described on its very first Product Hunt launch, the product resembled more of a consumer SaaS tool in its early days. Use cases such as “giving a friend feedback on their site” illustrated that the video messaging tool resonated more as a consumer behavior and not one typically seen with the workplace. Video messaging was made popular in the consumer space by Snapchat and Instagram, but the typical knowledge worker was far from conveying ideas over video, and heavily relied on text and voice as the common mediums of communication.

In an interview with Nathan Latka in May 2020, Shahed Khan reflected on this observation in the early days by noting that “consumer behavior tends to lead enterprise behavior by two years” which signaled to his team that they were onto something… something potentially big. He also noticed that synchronous calls were not always the best approach to sharing information but acknowledged the difficulty of building a B2B SaaS business in the video messaging space. To innovate how knowledge is being transferred, Loom’s founding team needed to change a fundamental behavior or rely on an unforeseen event to revolutionize the way communication occurs in the workplace.

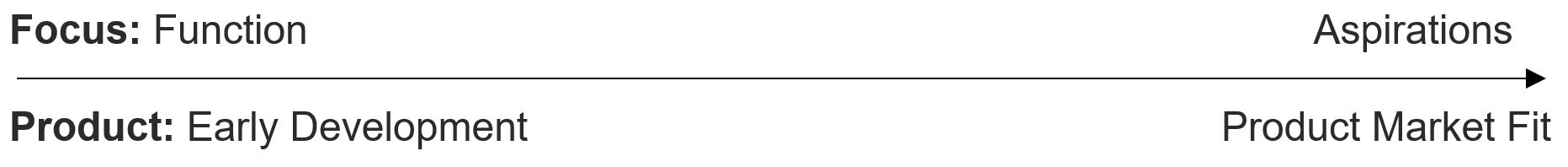

When creating a new behavior in a marketplace, the founding team was very strategic around establishing the functionality of their product. In Loom’s case, the function of the product was instantaneous video sharing. The instantaneous availability is the technical advantage of the product. The messaging here is important, and the founding team was very deliberate when conveying it in their early days. The potential user must understand the functional elements of the software and be able to actually use the product as described. Once this obstacle is accomplished and the users have adopted this new behavior, the messaging can now be adapted to be more aspirational and expand to all the potential use cases such as sending a sales prospect a personalized Loom video.

This may seem intuitive, but it is a commonly overlooked detail many early-stage founders miss. This thoughtful nuance was the framework of Looms early-stage market positioning and bridged the gap between early development and finding product market fit.

What transformed a simple Chrome extension into a $350M businesses?

Product Lead Growth

After establishing how their product would function in the market, the next strategy was to grow their userbase using a product lead growth strategy. The Loom team had no plans to monetize in the early days and set their initial goal to gain as much adoption as possible to become a ubiquitous product among organizations. This bottoms up approach fueled by a series of growth experiments resulted in an early referral system and other product hooks that were inherently viral. The referral system leveraged the same methodology as the famous Dropbox referral campaign to incentivize users to refer based on features. For example, if a user would refer just three people, they would unlock two premium features plus a $15 credit towards more features. Shahed Khan recalls that “individuals were referring the site instead of using the referral link” which signaled that users were started to market Loom for them.

The underlying act of sharing videos created viral hooks that were embedded in the product. When a user would share a video, the recipient would click the link and immediately be inundated with Loom’s branding. A individuals first exposure to this type of asynchronous video collaboration sparked curiosity and was remembered. When they needed to share something quickly without typing an email or scheduling a call, they remembered Loom. These built-in virality mechanisms effectively forced users into the Loom ecosystem. Once enough employees started using the app, Loom became accepted as another key tool in the organization’s communication stack. The use of these growth triggers served as a catalyst to their organic growth in the early stages that soon became word of mouth which allowed for Loom to scale without spending any money on marketing.

Perfect Timing

In early 2020, most of the workforce gave little thought to video in the workplace due to the proximity of teams collaborating and working together in offices. At the time, the need for sharing ideas via video was limited to the consumer setting.

The biggest aid to adopting this new behavior was the fact that the COVID19 pandemic forced individuals to work remote where being in front of the camera and sharing video in the workplace became a commonly accepted standard.

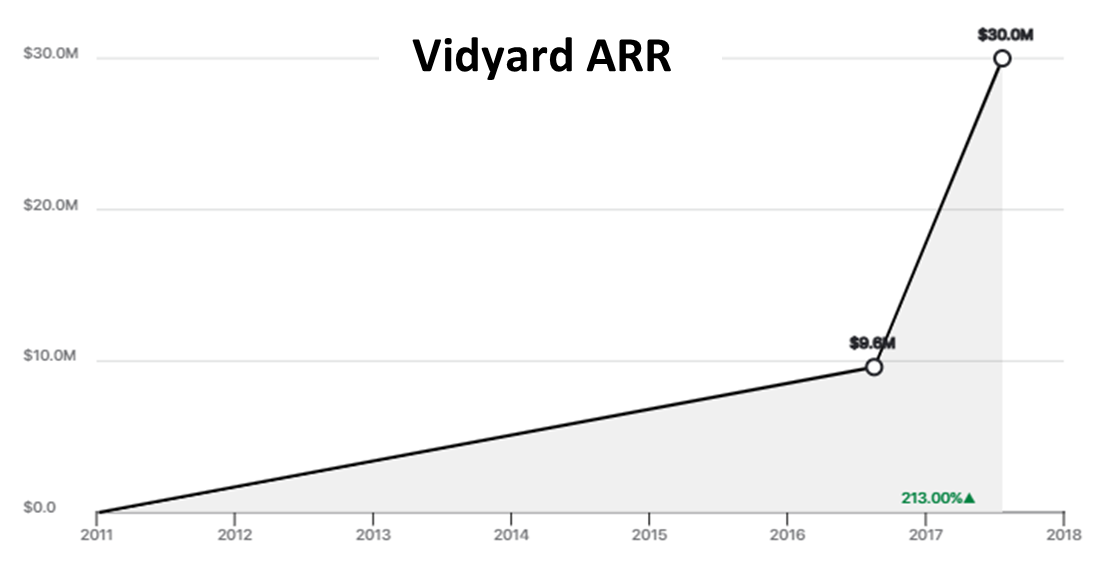

During the heart of the pandemic, Loom’s video views increased by 10x over a short period of time. The team shortly noticed that the inherent virality of the product coupled with incredible market timing sent Loom on an explosive growth trajectory. In the last 12 months, Loom has experience 712% growth bring their ARR to $5.88M in early summer of 2020.

During this time of high velocity growth, the team removed limits on their free-tier and decreased pricing on the pro version of the product to further capture market share while increasing their user base of customers. Since they were experiencing great success while others suffered from the effects of the pandemic, the team decided to make the pro-tier free for individuals in education and non-profit, as well as others who were affected by the pandemic. The effect of this indifference to monetization at the time and

Source: GetLatka

effort at social responsibility fueled the further adoption of their product.

Reflecting on this one year later, the COVID 19 pandemic forever changed the way companies collaborate. Video has now become the norm for knowledge sharing and Loom is a pivotal piece in this change with over 1.2M registered and 200K active users which grows by magnitudes daily.

Leadership

Today, Loom has built a team with all the right pieces by surrounding the scrappy, core visionaries with a talented group of leaders and executives who possess years of early stage, high growth experience.

Founding Team

- Shahed Khan – Co-founder. Former VC at Upfront Ventures and Product Designer in Weebly.

- Joe Thomas – Co-founder, CEO. Joe was the former Director of Product at MyLife.com.

- Vinay Hiremath – Co-founder, CTO. Software Engineer at Backplane and Facebook.

The success of a new venture does not just lie with the founders and their vision. It is only when those founders attract a great team around them by bringing in more experience with a diverse range of skills. Long-term success then becomes possible.

Strategic Leadership Hires

- Nicole Obst – Head of Growth. Nicole was formerly Head of Web Growth at Dropbox.

- Andy Gale – Head of Operations. Prior to Loom, Andy was a tech and consumer investor at Citigroup and Taconic Capital.

- Pete Prowitt – Head of Sales and Success. Former Team Lead at Intercom, Business Development at Quip, and AE at Box.

- Joshua Goldenberg – Head of Design. Joshua is the former Head of Design at Slack and Palantir.

- Jude Flannery – VP of Engineering. Jude is a Google Suite veteran.

The coordination of such great talent brought in to help drive the founders’ vision forward could not have been accomplished without finding strategic partners to help along the way.

The Venture Dream Team

There are a few key reasons why venture investors love Loom. Loom found product market fit in a new space that is the result of a new behavior as many expect video to become the new voice. Loom’s total addressable market is extremely large and identifiable which is a benefit of building in the B2B space. The product allows for virality with the speed at which information can be circulated from one user to the next subsequent user via the instantaneous sharing of video links. As this occurs more users use the tool which drives a cycle of value creation for everyone in the network – a centralized repository of shared knowledge through video documentation. These factors coupled with perfect market timing produced high demand rounds with notable investors lining up to fuel the growth.

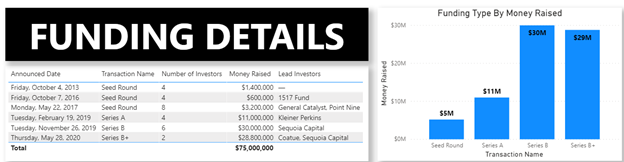

In May 2020 after the explosive period of growth which occurred during the heart of the pandemic, Loom closed a $28.75 million second Series B, led by Sequoia Capital and Coatue to continue the momentum. The deal values the company at an estimated $350 million, doubling the valuation from a previous fundraise seven months ago and bringing the total funds raised to around $75M. Loom has raised from investors including Ashton Kutcher, Instagram’s founders, Atlassian’s Jay Simons and Figma’s Dylan Field. Kleiner Perkins and messaging giant Slack have also invested in multiple rounds.

When building a visual communication platform, you cannot get a better set of highly experienced investors than Kevin Systrom and Mike Krieger, the founders of Instagram. Having a prominent set of investors on the cap table who have already build a visual communication platform (mass market Instagram photos and video stories) in the consumer space is a home run. When discussing the benefits having the founders of Instagram as investors, Joe Thomas, Loom’s CEO, mentioned that their guidance on product development helped explain the key cognitive and psychological mechanisms to generate this new behavior of sharing videos in the workplace.

Path to Becoming A Unicorn

During this period extreme growth as workplace behaviors change, many others realized that collaborating over video is the future. This secular trend caused many competitors to appear, and many others in the video space shifted focus to asynchronous video sharing as an additional feature. These questions commonly appear as the future remains uncertain:

- What is the competitive landscape for video sharing?

- Where is Loom heading next with their business?

- Why doesn’t someone like Zoom or Slack build a similar feature into their product?

Understanding Loom’s competitive landscape and defensibility will help to answer these questions.

Competitive Landscape

The video sharing and collaboration space is large enough where there may be a few winners over time. Being a market creator and market leader is the quickest way to unicorn status yet there are many roadblocks that stand in the way.

According to G2, a peer-to-peer software review site, the most popular alternatives and competitors to Loom are CloudApp, Hippo Video, Snagit, and Camtasia. By quickly referring to Product Hunt, the same platform where Loom first launched, there are 21 alternative products to Loom.

Some of the more notable players in the space that have achieved scale are Vidyard and BombBomb. Vidyard has been selected as part of Deloitte’s Fast 50, the fastest growing companies in technology, over the past 3 years.

BombBomb does approximately $30M in revenue. While monitoring BombBomb website’s pricing page, it was discovered that they just recently took off any indication of enterprise pricing which signals that they are trying to maintain a competitive pricing strategy with their upmarket customers while acknowledging a fast growing, well capitalized competitor (Loom) may be threatening a piece of their market share.

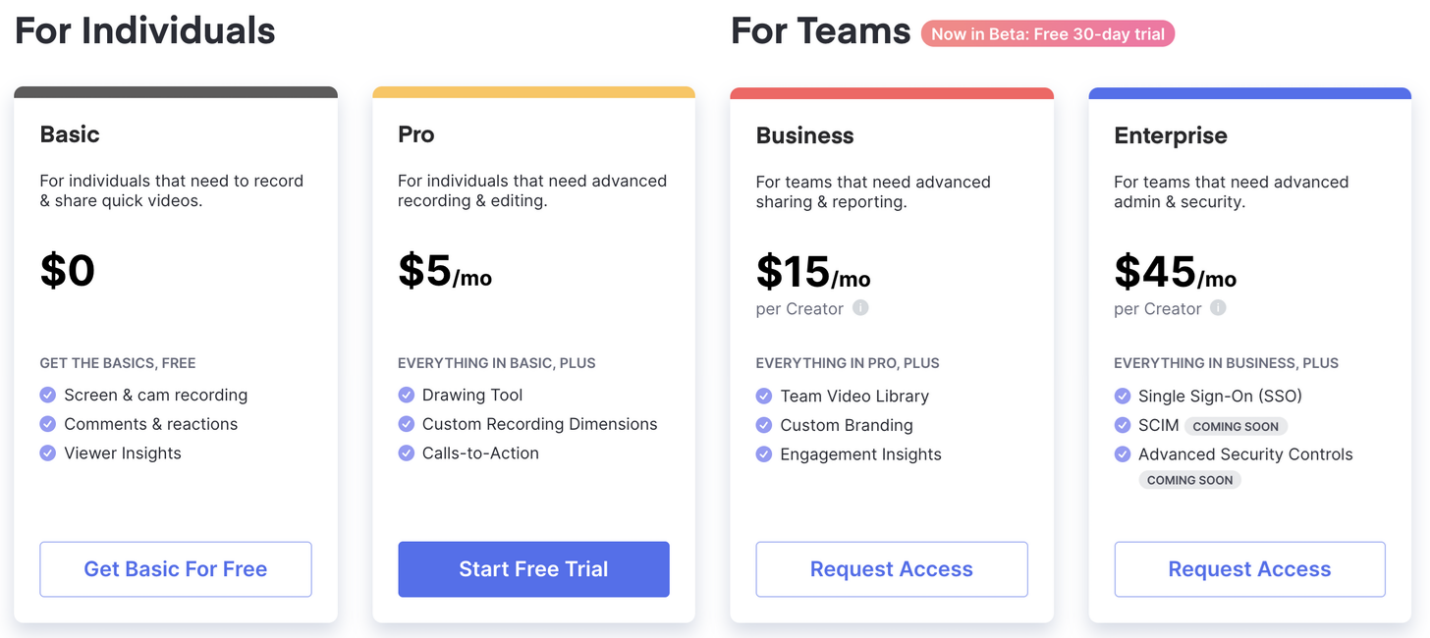

The winners in B2B SaaS are the ones who can serve the larger organizations. Loom’s strategy shifted to attract the biggest customers in the world where the switching costs become too high caused by the internal network effect that is created. Loom already boasts companies such as Hubspot, P&G, and Atlassian as enterprise organizations who use the video sharing software. An individual contributor and a large enterprise who needs 1000 seats have different needs and use cases from simple video sharing to building a knowledge repository to be shared across teams. Loom has started to signal who they are looking to serve by creating team and shared libraries within their product dashboard. Riding the wave, plush with fresh venture capital in such a competitive space, there is only one way to go and that is upmarket.

Enterprise Adoption

Loom may lose out on individual contributors who look for one-off sharing solutions, but they will be able to infiltrate their way into these large enterprises through their existing client base. Due to the virality of the product, they can spread amongst organizations as video links gets shared among colleagues at large organizations. This pulls individuals into the Loom ecosystem at a rapid pace. The virality of the product drives down the cost to acquire a customer (CAC) while going upmarket to target enterprise level clients creates a higher customer lifetime value (LTV). While many other SaaS businesses employ a dedicated sales team to pursue enterprise adoption, Loom’s unit economics make enterprise adoption viable at a lower CAC. It is important to note, video messaging is applicable across all teams with many different workflows with use cases from sharing comments on design edits to sales professionals personalizing their outreach using Loom video. This ubiquitous element to the product fuels the viral loop inside an enterprise.

To align pricing with this shift in strategy, Loom launched Loom “For Teams“, introducing a Business and Enterprise plan (shown below) to strategically move upmarket and focus on contracts that garner higher LTVs.

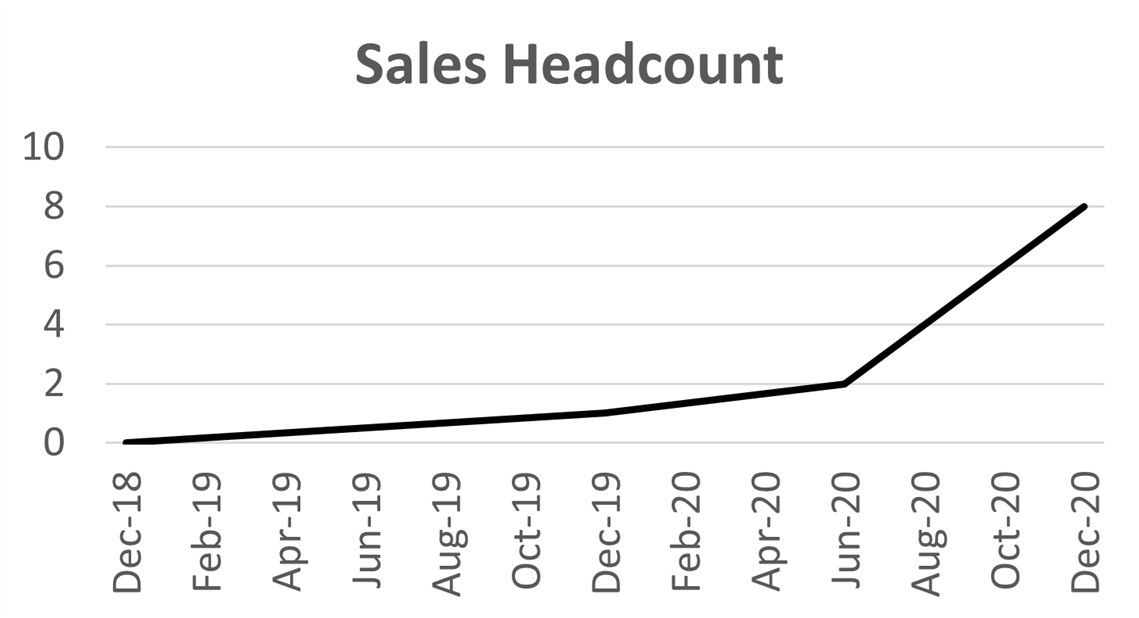

As of January 2020, Loom hired a new sales leader, Pete Prowitt, who has extensive early-stage sales experience from his time at Intercom, Quip and Box. Pete will lead the sales and success team to focus on building the enterprise sales strategy and pipeline, as well as, expanding the independent paying users into the newly created business plans. Loom is constantly monitoring the data behind users’ video sharing tendencies which will become extremely valuable during the sales operation to target net new accounts and expand current customers. By using this data, Loom will be able to easily identify potential prospects and have a warm introduction to key decision makers through their individual power users. Any company who has a small subset of individual employees using Loom automatically becomes a prospect and has higher propensity to convert into their enterprise plan.

By analyzing the employee growth trends, it is obvious that Loom has prioritized the capital from the most recent round to build out the sales team under Pete to execute on this upmarket strategy by going from 2 to 8 sales professionals over the last 6 months.

Shahed confirms that a large portion of VC capital goes to headcount which is one of the largest expenses on the payroll and a large contributor to early-stage companies’ cash burn. Looms cash burn has been anywhere from $100-500K per month through these early-stage rounds. As they invest into their sales team, the next 6 months will be vital to their enterprise adoption strategy. Especially as they aim to organize and produce large scale video sharing in enterprises while adapting the product to serve the needs of these customers. Loom has been taking steps towards increasing the security of the product around the sensitive information shared which is required by enterprise level customers.

Feature vs Product

Most of the new generation SaaS companies are focusing on niches from a product that is easy to use and does one thing exceptionally well to a SaaS that serves one type of customer. Over time these core markets will mature, and growth will slow down as competitors catch up. The next long-term initiative that must constantly be on the product team’s mind is how does Loom make sure they are not just a feature and are built for long term success.

Loom strives to build the best-in-class video messenger available on the market that is seamless and easy to use to serve a wide variety of use cases. The inherent threat to the product is the fact that Loom must be shared through mediums such as messaging and email that are not Loom’s own platform. Is the product’s collaborative pull strong enough to force users to spend time on Loom’s application and in their video repository? Many users may just use the product for the video sharing feature without ever truly spending time in the Loom interface. With the lack of a true platform, there may be a threat from large brand names such as Zoom or Slack to build a similar tool into their already omnipresent products that dominate the B2B space.

Slack (publicly traded as NYSE: WORK with a $24.2B Market Cap) is used for internal team communication and is a widely used platform for workplace communication and knowledge transfer, Slack happens to be an investor in Loom that participated in their Series A round. Slack also has built an integration to recognize a Loom link as part of their video viewing functionality only doing the same for YouTube ($1.6B acquisition by Google in 2006) and Vinmeo (200M+ registered users as of December 2020), two of the largest players in the video sharing space. The fact that Loom shares a close relationship with Slack and that Slack has already made it easy for the two parties to coexist on Slack’s platform is a strong signal that Slack will not be building an asynchronous video feature in the near future.

Does Zoom want to get into asynchronous knowledge sharing and documentation as a core part of their communication stack?

Zoom has had great success being the market leader in the synchronous video space. They also have benefited greatly from the remote workforce caused by the pandemic reporting revenue growth of 355% year-over-year in September 2020 and going from 10 million daily meeting participants to 300 million during this time. There is no doubt that Zoom (NASDAQ: ZM with a $103.2B Market Cap) has the resources, capital, and market share to make the leap into asynchronous video and build an asynchronous video sharing feature into their current product. Asynchronous communication is fundamentally different from synchronous communication and does not seem to be in Zoom’s product roadmap. According to Zoom’s latest annual report, their focus and resources seem to be on Zoom Phone, a cloud-based phone system, Zoom Rooms, their software-based conference room system, and their partner ecosystem, App Marketplace, which help enterprises create third-party applications around customized workflows.

What’s Next for Loom

Loom should double down on seamlessly integrating with more high demand platforms and communication tools to create additional use cases through everyday workflows. Every time a SaaS tool integrates into a symbiotic product, the user experience becomes more seamless and functionalities become more interconnected which generates staying power in any user’s workflow. This is a smart strategy for any SaaS founder who is looking to build their case around defensibility.

Loom should also continue to pursue enterprise sales. Heavily funded startups need to yield large outcomes that generate outsized returns for the investors. Either sell more seats until you have saturated your total addressable market or charge a higher price point. Both scenarios are possible by going after large corporations who have larger budgets, can pay higher prices and also have more employees to convert as users. Enterprise customers also have lower risk of churn than SMBs and individual contributors.

If Loom leverage their data effectively and relies heavily on their current user base as entrance points into enterprise accounts, they should continue to see strong growth as they become the default means of communications among enterprise organizations on their way to surpassing the $1 Billion valuation mark.

Conclusion

This is an exciting time to watch software evolve and adapt with the changes going on in the world. Loom has shown the world that the ways professionals collaborate in the workplace are changing. Take note of these behaviors because they are constantly changing and illuminate opportunities. Loom has also demonstrated the importance of timing when pursing an early-stage venture. Loom made it clear that product came first and monetization second as they acquired market square as fast as possible. Finely tuning their pricing strategy along the way. Loom will be studied for their product lead growth strategy and virality elements like how Dropbox is commonly referenced when building a freemium product this way. Loom showed the world how a scrappy founder team can be surrounded by seasoned leadership hires and world class venture investors to create the next big thing in remote work technology.

To have further success, Loom must focus on the underlying mission of what they are building and stay the course with what works. Similar to the team’s approach in the early days. What Loom did right in the beginning was simple. They scaled back then focused on one core feature. The result? Product/market fit. Now with such a large user base that is growing daily, they can shoot for aspirational goals.

From an early Hail Mary pivot to pioneering a product based on changing behavior, the Loom team might just be building something bigger than a simple feature – deeper human connections on the internet.