Launched just over a year ago, SanityDesk aims to help consultants, authors, and other solopreneurs launch and maintain their digital presence — without using an entire suite of software. For $99 to $299 a month, SanityDesk provides individuals with a website, marketing automation, a sales CRM, support desk, and team communication tool, all in one place.

In a digital world that’s overflowing with tools, it’s a great idea. But SanityDesk has still needed to invest to attract the right customers to its platform.

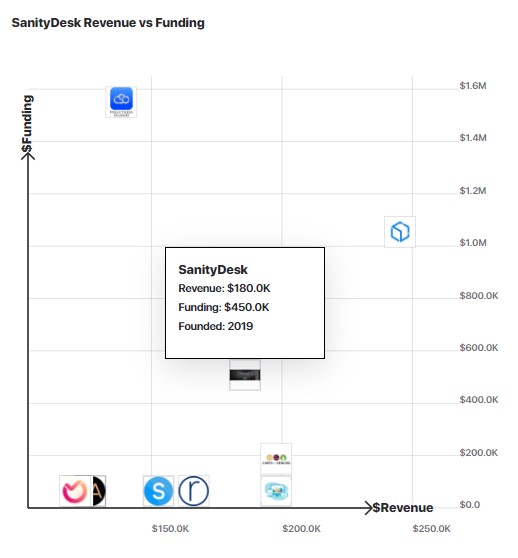

Founder and CEO Samuel Cook first launched SanityDesk in 2019, with $400,000 in angel investments and a $50,000 government loan. His first move was to build out his team, and SanityDesk now employs 14 people, with five engineers and one quota-carrying sales rep on board.

In February 2020, four months after launching, SanityDesk landed its first customer, and the team started selling in earnest in March. SanityDesk’s first few leads came from one of Cook’s previous ventures, digital marketing agency StoryMatters. Cook leveraged the agency’s 100,000-person email list to drum up excitement for SanityDesk. Then, with their first few customers under their belt, the SanityDesk team layered in social media advertising and cold outreach.

“We’re doing Facebook ads to warm audiences, and our new SanityDesk video ads have started to generate leads,” Cook says in a December 2020 interview with Latka. “SanityDesk just launched its own funnel and Facebook ads, and we’re also doing some LinkedIn outreach.”

Source: GetLatka

Between social media ads, outreach, and its sales team, SanityDesk currently has a customer acquisition cost of $1,250, which the startup recoups within three months. That’s a CAC Cook would like to keep as he looks ahead and scales the business using more digital marketing.

Cook recently used Founderpath to get an advance of $6,000, which he invested immediately into online advertising — spending $10,000 for the month rather than SanityDesk’s usual, “more conservative spend of $4,000 or $5,000.”

“We need to spend more money on ads,” Cook says. “I think we could easily go up to $50,000 to $100,000 a month in Facebook ad spend. But I want to make sure as we scale that we’re maintaining that customer acquisition cost. … Because I know that the way we’re operating right now, we can get those customers in.”

What is SanityDesk’s annual revenue?

In 2020, SanityDesk generated $180,000 in ARR.

What is SanityDesk’s monthly revenue?

In 2020, SanityDesk generated $13,000 in MRR.

Who is the CEO of SanityDesk?

Samuel Cook, age 42, is the CEO of SanityDesk.

Transcript Excerpts

Setting up a lower-tier subscription to widen your audience

“We’re systematizing our onboarding so that we can open up a $99 plan to people who can’t afford the $299, and we’ll start selling that without a sales rep. But we really want to make sure these first customers have a great experience so they can be evangelists and case studies. Then I think we’ll be really ready to scale ad spend.”

Going global vs. local for a limitless customer pool

“We’re taking a global approach. We got a customer from Italy in, we got a customer from the United Kingdom in. We’re really not even touching the U.S. market right now, due to the pending elections. We’re used to working with some South African customers; some are from Bangladesh.”

Taking on loans instead of funding

“I view it as just a way to buy additional customers. If you look at the history of startups, even a company like Facebook — that did it all right and had no down rounds — had huge dilution. So I think if a founder like me — who’s got a direct response marketing background — proves that they can buy customers, it just becomes a game of math.”

Don’t skimp on sleep

“I wish I knew when I was 20 the value of exercise and sleep. For 20 years in the Army, we used to say, ‘Sleep when you’re dead,’ and ‘Sleep is for the weak.’ Now I’m focusing on trying to get seven or eight hours of sleep a night, because I’ve found that with fitness and sleep, my productivity is going up.”

Full Transcript Nathan: Hello everyone my guest today is Sam Cook. He’s a former U.S Army officer and Russian history teacher who founded SanityDesk to help experts, authors and coaches build their entire businesses online. He lives in Kiev Ukraine and his tech team is based in Poland and Ukraine. Sam you ready to take this to the top? Sam: Ready to go Nathan. Nathan: All right. So talk to me real quick. What kinds of customers are you selling SanityDesk to? Sam: We’re specifically targeting experts, authors, consultants, solopreneur. People just starting their business and are overwhelmed by the tech because the tech monster is really… it stops a lot of people from ever getting started. Especially now with Covid you can’t rely on in-person networking. You really have to have your IT set up. Nathan: Yap. That’s absolutely true. Can you name a customer or two that people might know? Sam: Yeah. Peter Sage just signed up. He’s got about a 60,000 person audience. He was actually user number one of SanityDesk five years ago. He just signed up for the SAS version of it. That was when we were developing our agency. And Marilee Williams who wrote the book, Change Your Questions, Change Your Life and David Baboulene, who wrote the book Primary Colors of Story PhD and film script story consultant. So not everyone have written a book but everyone wants to write a book. I think generally we we’re working within their individual experts, coaches, consultants on their way [inaudible 00:01:34]. Nathan: When do you launch the company Sam? Sam: Launched October 31st of 2019. Literally I think that was the first day we were in business supporting the state of Delaware. Nathan: And how many customers are you working with today? Sam: We have just over 50 customers. I think we have about five subscriptions ending their trial today, tomorrow. So we’ll just cross the North of 50 customer mark right now. Nathan: That’s great. What are some of these customers paying you per month on average to use the full tech? Sam: Well, we have two plans. We have one that’s $99 a month, which I think we have nine or 10 users on that, but we’re actually mainly only working with people who are willing to pay for the enterprise version, which is 2.99 a month. It’s up to 10,000 users. It has the smart page technology where you can create thousands, tens of thousand variations of every page based on user data. And also they get a dedicated tech support rep with that plan because we’re using this guided onboarding model concierge level support to really work out the onboarding process, education and kinks in the tool as we go through the first hundred users. Nathan: So can we multiply 2.99 a month, times 50? You’re doing like call it 13, $15,000 a month in revenue? Sam: Yeah, I think we’re at 12 and a half when you average it out between the 10 or so lower plan users and most of them on the 2.99 plan. So you have 12 and a half 13,000 a month. Nathan: And where were a year ago, do you remember? Sam: A year ago we had no revenue. We started selling in… I think we got our first customer end of February and March was really when we started selling in earnest. Nathan: Where are you driving this growth from? I mean, how are you getting 10, 20, 30 new customers each month? Sam: Well, two places. I had a marketing agency that I built up that had about a 100,000 people on its list. We had the StoryMatters brand, StoryMatters Academy. We’re getting people coming over from there who were old customers. We’re also doing Facebook ads to warm audiences. Who’ve never signed up but half a million plus people have seen me on video marketing for the past three, four years online- Nathan: Face for TV baby. Sam: Yeah. And then cold traffic through our new SanityDesk video ads has started generate some leads. So basically old agency marketing, new product, they have an affiliate permission as any agency or reseller can get. And then SanityDesk just launched its own funnel and Facebook ads. And we’re also doing some LinkedIn outreach. Nathan: Now, have you bootstrapped the company today or did you raise capital? Sam: No, we’ve raised 450,000 in outside funds. The company bootstrapped the first 700,000 as an agency. The agency sold the IP in October of last year. The agency’s got about 725,000 invested into the company. It has one of the angels that transferred the IP and then 450 of outside money has come in since then. Nathan: So what percent of SanityDesk does the agency own? Sam: I think at a 4.5 million post-money valuation on a safe, that’s going to put it- Nathan: 20%. Sam: Yeah. Nathan: Yeah. Now did you own a hundred percent of the agency? Sam: Yeah. Nathan: So why deal with that at all? If it’s the same owner on both things, why not just say Sam Cook owns that 17% in SanityDesk? Sam: Well the one reason was the team at the agency. I am actually putting two managers in the Cap table, plus we’re going to set aside some of the Cap table for the team. So that part of it is to incentivize the team to do work for SanityDesk at way below market rates. Because the team, their shareholders. The team also had some past invoices to pay off. So even if I wanted to shut down that company and roll it into SanityDesk. They’re actually handling obligations, which they’re winding down on a monthly basis that they owe and the new company has no IP or debt, no debt. So that was the cleanest way to make the transition. Brand new company, IP transfers. Nathan: Yep. That all makes sense. Got it. So 450 raised outside, agency’s put in 750K. When did you raise the 450 from outside angels? Sam: It’s been since August of last year, we got our first outside angel who put in a hundred, five or six more in for 25, sorry, five more in for 25, one in for another a hundred, his brother in for 50. And then I think we got a couple loans. Well we got a SBA loan, which I call outside capital but that’s not equity. So I think 400,000 in angel money to be precise plus about 50 from the government. Nathan: And you’ve used this obviously reinvest in the team. How many folks on the team today? Sam: 14, we have nine in the products. My partner’s chief product officer/CTO. Even though he’s not a developer by trade he’s- Nathan: How many pure developers, pure engineers? Sam: Five pure engineers, one QA to design. Nathan: Any quota carrying folks? Sam: Quota-carrying? Nathan: Do you have any salespeople with quota? Sam: Oh yeah. I got one sales rep, one customer support rep, one hiring officer, one finance person. Nathan: But they don’t all have quota, just a sales person. Sam: So sales person and I’m the other sales person. Nathan: So besides you, the other sales person with quota, what do you set their quota at annually? Sam: Well, he’s on a base plus commission. So basically he’s on a base of a thousand dollar base plus 150 per new signup, inbound leads and then 250 if he finds them himself. Nathan: What do you want him though, to be closing monthly in terms of the new month recurring revenue, what’s his quota target Sam: 20 per customer 20 per sales rep. That’s one deal a working day. We’re also looking for new sales reps to increase that. Nathan: Got it so 20 per day at whatever $300- Sam: I’ve got 20 per month, one deal a day as right now per rep if they speak to three of the [crosstalk 00:07:58]. Nathan: I understand. So 20 new customers. This one guy who’s doing sales for you now you want him to close 20 new deals per month at about $300 per month, which is 6,000 in a monthly recurring revenue, about $72,000 in ARR. Sam: Yeah. Nathan: How do you get that to scale? You need your sales people to be closing more than that. If you’re going to go hire and build an army of salespeople. Sam: Yeah. That’s where we’re initially at. We need to spend more money on ads. I think realistically, if we were to get… right now we’re spending about a thousand dollars to party customer, if we were to have a budget to spend on ads and some float for that. One sales rep I think I… that’s what I think he can close based on what we’re bringing in on ads. But one sales rep is really good. If his phone’s filled all day could probably close four deals a day. So I could hold with one sales rep and then have another one so were having about a 30 to 50% close rate of people we speak to. And it’s [inaudible 00:09:04] going to call. Nathan: That’s great. And so when you take your fully weighted CAC today, Facebook ads, commission and salesperson, all your expenses, what’s it cost you to $300 a month customer? Sam: Well, they pay a 4.99 upfront onboarding fee and then 2.99 a month. We’re paying right now about 1250 to acquire a customer. Nathan: Sam: Mm-hmm Nathan: How much marketing invest in these channels? They seem to be working. Sam: It really just depends on optimizing our Facebook ads and getting the money in. So I think Facebook ads could definitely scale up. We’re taking a global approach. We got a customer from Italy in, we got a customer from the UK in. We’re really not even touching the U.S market right now to the election spending. We have a large global audience we’re used to working with some South African customers but some are from Bangladesh. I think easily we could probably go 50 to a 100,000 a month in Facebook ad spend. I want to scale it up as we make sure as we scale that we’re maintaining that customer acquisition cost. Nathan: I launched Founderpath specifically to help founders like you. Early stage SaaS companies get capital they need without having to sell equity. You chose to do a little deal on there the other day. I saw the approval go through. Explain to me how it works and why you did it and what you hope you can do with Founderpath in the future. Sam: Yeah. Well look, I know with the 6,000, I think I did, I sold two of my customer… I got an advance for two customers, other ARR, annual revenue. That’s $6,000. I know that I just upped my ad budget so this month we’re going to spend 10,000 on ads versus a more conservative spend of four five. Because I know that the way we’re operating right now, we can get those customers in. We get 4.99 right away, 2.99 another seven days later. So really within 30 days actually, if I have two payments of 2.99, we’re almost 150 shy break even. So I view it as just a way to buy additional customers. I know our onboarding process, very low churn because it’s guided right now. We’re systematizing our onboarding so we can open up a $99 plan to people who don’t afford the 2.99, start selling that without a sales rep. But we really want to make sure these first customers have a great experience so they can be evangelists case studies. And then I think we’re really ready to scale ad spend. Nathan: Yeah, you took two customers paying 300 bucks a month. So 600 bucks a a month in MRR, you said Founderpath give me six grand for those folks up front, we said, boom approved. And now if you can take that six grand and spend it and hold your CAC at 1250 which means you get five, six new customers with the six grand that you got from Founderpath, it becomes basically arbitrage for you. You go back in Founderpath, I watch your credit score. Your credit score will go up, you’ll unlock cheaper capital and more capital over time. Hopefully IPO is still owning 90% of your company, right? Sam: Yeah. You look at the history of startups, even a company like Facebook that did it all right and had no down rounds as huge dilution. So I think what you’re doing once a founder like me, who’s got a direct response marketing background proves that they can buy customers and I’ve spent a lot of money on ads for clients and have that experience. Yeah, It just becomes a game of math. Nathan: Yeah. Sam, on that note now, let’s wrap up here with the famous five number one favorite business book. Sam: Favorite business book, I would say Good to Great by Jim Collins and the reason why is simply he talks about leadership and how he wanted to have only quantifiable facts in there but his team almost quit because he wouldn’t allow him to put leadership in there, which you couldn’t quantify. So I think that’s my favorite. Nathan: Number two, is there a CEO you’re following or studying? Sam: Yeah. I got to admit I’m an Elon Musk fan boy because of his big vision and purpose behind what he’s doing. I think life’s not worth playing small on and that’s definitely, we’re doing the same I guess. Nathan: Number four. What’s your favorite online tool for building the company? Sam: You’ve missed three. Nathan: Number three. Same question. Sam: Online tool for building the company. Well look, I got to be partial, I use really my own tool, SanityDesk- Nathan: Besides your own. Sam: Online tool to build a company, honestly, I would say I’ve just been a huge fan of … man that’s a really tough question. I’ll say right now, Slack. That’s probably going to be one of the last things we try and replace. My team’s done a great job building the culture in there. Nathan: Great. [crosstalk 00:14:08] Number four. How many hours of sleep are you getting every night Sam? Sam: You know what? I’m focusing on trying to get seven or eight because I’ve found with fitness and sleep that my productivity is going up. So I used to thrash myself and sleep a lot less but I think seven or eight is a good number. Nathan: What’s your situation? Married, single, kids? Sam: I am single. Nathan: No kids? Sam: No kids. Nathan: All right Sam and how old are you? Sam: I’m 42. Nathan: Last question. What’s something you wish you knew when you were 20. Sam: I wish I knew when I was 20 the value of I think exercise and sleep. For 20 years in army we used to say sleep when you’re dead and sleep is for the weak. And I really learned that lesson last, three, four months time on fitness coach and seeing the power of actually focus on your sleep and your fitness for productivity. Nathan: Guys, SanityDesk got Tom just passed 50 customers, about $180,000 in terms of ARR, they raised $450,000 to do this also used Founderpath money to start scaling some of their ad spend. Hopefully grow the company over time without taking a bunch of delusion. 14 people on the team, five engineers, one quota carrying sales rep. Again, helping brands like Peter Sage, grow their businesses without having to go put and staple a bunch of online tools here. SanityDesk does it all. Sam thanks for taking us to the top. Sam: Thanks Nathan. Nathan: One more thing before you go, we have a brand new show. every Thursday at 1:00 PM central. It’s called Shark Tank for SaaS. We call it Deal or Bust. One founder comes on three hungry buyers. They try and do a deal live. The founder shares backend dashboards, their expenses, their revenue, ARPU, CAC, LTV. You name it, they share it. And the buyers try and make a deal live. It is fun to watch every Thursday, 1:00 PM central. Additionally, remember these recorded founder interviews go live. We release them here on YouTube every day at 2:00 PM central, to make sure you don’t miss any of that makes you click the subscribe button below here on YouTube. The big red button and then click the little bell notification to make sure you get notifications when we do go live. I wouldn’t want you to miss breaking news in the SaaS world. Whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement or something else. Nathan: I don’t want you to miss it. Additionally, if you want to take this conversation deeper and further, we have by far the largest private Slack community for B2B SAS founders, you want to get in there. We’ve probably talked about your tool if you’re running a company or your firm, if you’re investing. You can go in there and quickly search and see what people are saying. Sign up for that at nathanlacquer.com forward slash Slack. In the meantime, I’m hanging out with you here on YouTube. I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. If you enjoyed it, click the thumbs up. We get a lot of haters that are mad at how aggressive I am on these shows but I do it so that we can all learn. We have to counter those people. We got to push them away. Put the thumbs up below to counter them and know that I appreciate your guys support. All right, I’ll be in the comments. See you.